Last year was a record year for initial public offerings (IPOs) in the UK, but it was a mixed bag for investors that bought into companies early.

In 2021, 120 companies listed on the London Stock Exchange (LSE), the highest number of new companies in a calendar year since 2014. Between them they raised £16.8bn, the highest amount since 2007.

According to the London Stock Exchange (LSE) the UK was the third-largest centre for IPOs globally after the US and Greater China last year.

The Alternative Investment Market (AIM) also had a very strong year, beating the number of new IPOs in 2020 as early as June.

Part of this was a large number of IPOs proposed in 2020 coming through after the most Covid heavy periods had passed, but it also indicated the strong appetite businesses had for the UK, choosing to domicile there.

Ben Russon, manager of several UK equity funds at Franklin Templeton, previously told Trustnet that the record number of companies listing also indicated an increased desire from investors to invest back into the UK after years of Brexit, growth rallies in other markets and Covid, had kept them away.

Russon was optimistic about the UK IPO market in his 2022 outlook and expected this momentum to continue over the coming 12 months.

Looking at what captured investors’ attention the most, there was a range of sectors and offering sizes, but performance was patchy.

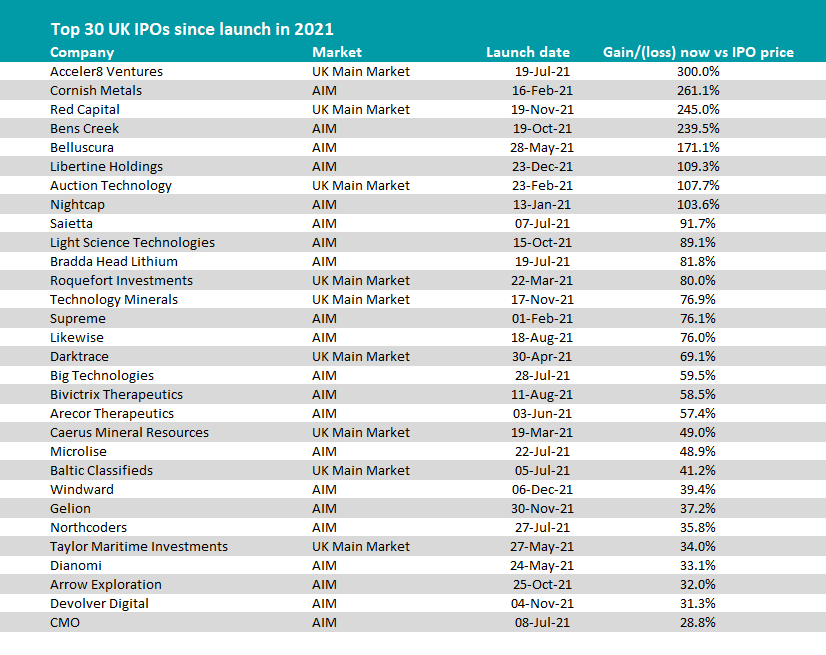

Source: AJ Bell

While the UK market is associated with old economy sectors such as banks, manufacturing, energy, telecom, and financial services, one of the big themes was technology.

“We now have more tech & consumer internet companies in the FTSE 350 than we’ve had at any point since the year 2000,” LSE analysts said.

Tech and consumer internet companies accounted for 54% of IPO proceeds raised in London in the first half of 2021, LSE data showed.

Indeed, just four tech names: Trustpilot, Darktrace, Wise and Tinybuild accounted for 40% of total IPO proceeds last year.

But the six best-performing IPOs overall were a collection of smaller companies, all raising under £100m each, according to data from AJ Bell.

The best performer overall was Acceler8 Ventures, an impact fund investing in solutions to accelerate the reduction and removal of greenhouse gases. It proved very popular, growing its share price by 300% since IPO.

Following behind were metal mining businesses Cornish Metals and Bens Creek along with medical device company Bellscura and Libertine Holdings, which develops technology for heavy duty powertrains.

There were several large IPOs as well, including Auction Technology, which raised £247.4m from its IPO. The business provides the technology for carrying out online auctions, a crucial tool for many businesses during the various lockdowns in 2020 and last year. The company was very well received, with shares up 107.7% since it launched.

Not every IPO had such a positive response however, with several high-profile falls from grace, most memorably Deliveroo.

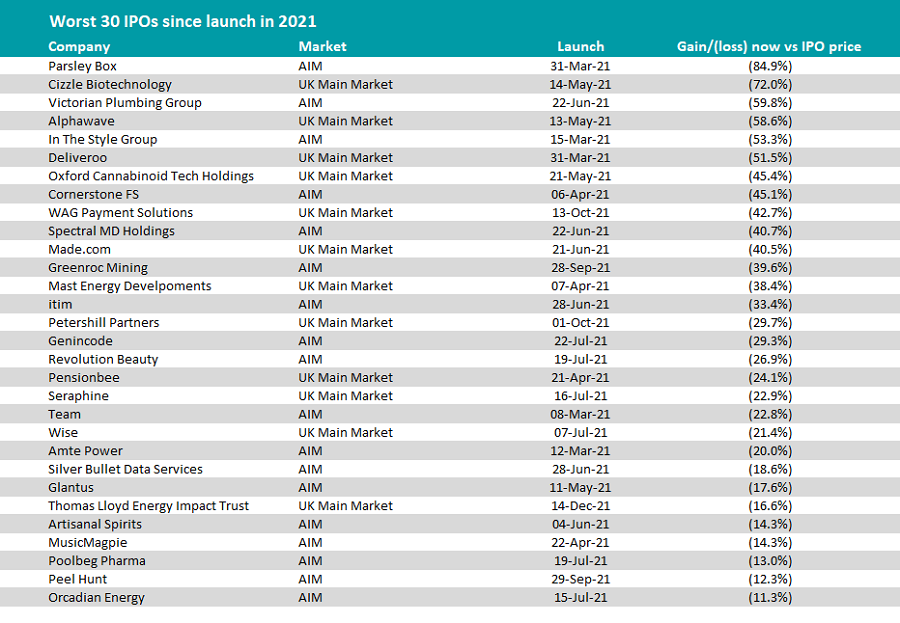

Source: AJ Bell

The door-to-door delivery company fell by 30% on its debut after a lot of hype prior to its listing. Its shares were issues at 390p and immediately fell to 271p before recovering slightly. To-date shares are down 51.5% on the initial IPO price.

At the time many analysts were concerned that this would put off other higher growth, tech -focused companies from listing in the UK, although this proved not to be the case.

Other well-known IPOs that ended the year down included shoe brand Dr Martens (down 3.2%), furniture company Made.com (a 40.5% loss), Victorian Plumbing Group (59.8% lower) and AlphaWave (-58.6%).

The worst performer was Parsley Box, the food business that delivers cupboard-stored meals to the door. Shares are down 84.9% since the company launched.