Felise Agranoff of the JPMorgan American Investment Trust is already switching back to growth after two years in value, saying the current uncertainty is allowing investors to pick up some of the most exciting names in the market on reasonable multiples.

Agranoff comes from a growth background and has 17 years’ experience in searching for companies with underappreciated opportunities in large addressable markets. Her co-manager Jonathan Simon is more of a value specialist, looking for companies that are cheap relative to the cashflows they are producing.

Whichever camp stocks fall into, to merit inclusion in the trust they need to be durable franchises, meaning they have at least one sustainable competitive advantage and a strong management team. Agranoff, Simon and their other co-manager Timothy Parton agree that after a two-year period in which they ramped up their value exposure to escape from the de-rating in the most expensive areas of the market, there are now better opportunities in growth stocks.

As an example, Agranoff pointed to technology. While it remains an underweight position in the trust relative to the benchmark, the managers recently increased exposure to the sector.

“We have been cautious on technology for some time, as valuations got to extreme levels relative to history about two years ago and we reduced our exposure to the highest-growth parts,” she said.

“We felt that not only were valuations high, but that our view on fundamentals and the growth potential was less differentiated [from other investors] than it had been.

“But as we sit here today, there has been a significant drawdown and we have seen valuations pull back quite significantly. So we're starting to find opportunities to add back exposure.”

One tech stock the managers recently added to the portfolio is chip-designer Nvidia. They originally bought it in 2016, with Agranoff saying its GPU technology will play a pivotal role in the artificial intelligence boom. However, the stock was caught up in what is now being referred to as a bubble and the managers sold out when they began de-risking their portfolio two years ago. Nvidia fell by more than 65% between its peak in November 2021 and its trough in October 2022.

Performance of Nvidia stock over 5yrs

Source: Google Finance

Agranoff said this fall opened up a buying opportunity and she bought back in in December last year. However, this decision wasn’t just made on valuation grounds.

“We recently went to Silicon Valley and met with a variety of different public and private companies,” said the manager.

“What we learned is that we’re reaching a point where artificial intelligence spending is about to inflect, and Nvidia has never been positioned more strongly from a competitive standpoint, as its dominance in GPUs has extended even further.

“What is also interesting is that in a period when venture capitalists haven't been funding as many new companies, dozens of new artificial intelligence firms have been funded over the last 18 months. These have practical uses for artificial intelligence and they're spending a lot on GPUs.”

Another area that Agranoff is excited about is industrials. This is usually regarded as a value sector, but the manager pointed out that all of the trust’s holdings here are in growth names.

“This reflects the fact that these companies have many multi-year growth drivers,” she said.

“We're excited about the investment going into renewable energy, electric vehicles and the grid. These are multi-year spending cycles that are being further accelerated by stimulus packages such as the Inflation Reduction Act, which provides us with a lot of visibility on the duration of the growth opportunity.”

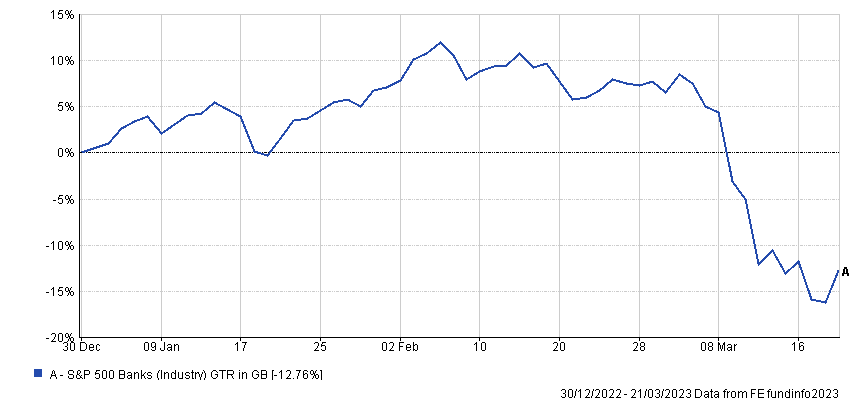

There are still some value areas that the trust’s managers are optimistic about, one of which is banking. The S&P 500 Banks index is down by more than 20% from this year’s peak, tumbling on the news of SVB’s collapse and fears of contagion across the sector. However, Agranoff said that while these fears are to some extent justified, the banks in JPMorgan American Investment Trust’s portfolio are unlikely to be affected.

Performance of index in 2023

Source: FE Analytics

“We focused on the highest-quality companies such as Bank of America and M&T Bank, which have the stickiest deposit bases,” she explained.

“The way the market reacted is all banks sold off. And I think that's fair for some of the regional banks, which will continue to face some pressures.

“But at the same time, we saw a sell-off in some of the larger banks as well, even in Bank of America. And that was interesting as the big banks are ultimately going to come out of this consolidating market share, with companies like JP Morgan, Bank of America and Wells Fargo already starting to do that.”

“We’re going to be cautious in the way we navigate this environment,” she added. “But there will be winners and losers and as stock pickers we feel we’re well positioned to benefit from that.”