Investment trusts on discounts offer opportunities for investors to gain exposure to assets at less than their book value.

This may sound like an attractive bargain, but there is no guarantee that the gap between the share price and the net asset value per share will close. In fact, it could widen even further.

Whether a discount presents an opportunity is entirely idiosyncratic to each trust, which means it can be hard to sort the chaff from the wheat.

Mick Gilligan, head of managed portfolio services and partner at Killik & Co, said that opportunities are, generally speaking, where underlying assets are liquid.

He added: “This may be due to overall market direction or to a specific investment style being out of favour. Performance rarely remains poor for long periods (years) as markets and styles tend to be mean reverting.”

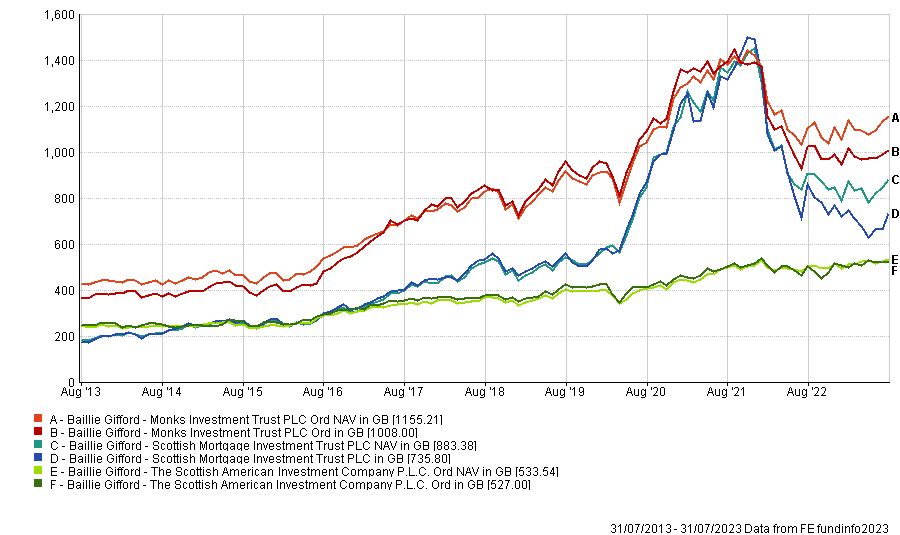

For instance, growth-orientated strategies, such as those run by Baillie Gifford, were trading on persistent premiums while value-oriented strategies often languished on wide discounts back in 2020. Yet now, the shoe is on the other foot, as the discounts of various value strategies have narrowed, while growth-biased trusts were shifted onto ever widening discounts.

Price and NAV of trusts over 10yrs

David Johnson, analyst at QuotedData said: “This kind of cyclicality should not be viewed as a value trap in my opinion, as the possible catalyst for a discount narrowing (or widening) is clear. However, investors need to have the patience to wait for a style of investing to come into vogue.

“For example, the breakout of the war in the Ukraine was, with hindsight, a clear catalyst for the reversal in the discount of energy stocks, but the amount of patience required to wait for such a catalyst can make trusts feel like value traps.”

He noted that UK and European strategies are in this predicament as the market outlook for these regions has been so negative that it has pushed investment trusts in those sectors into persistent discounts. Darius McDermott, managing director of Chelsea Financial Services, added that it is also true for trusts investing in China due to the global malaise towards Chinese equities.

In that regard, historical trends can be useful indications to figure out whether a trust has the potential to bounce back.

Emma Bird, head of investment trust research at Winterflood, said: “If the rating is an outlier, potentially due to idiosyncratic events (such as an overreaction to a regulatory development or a large shareholder exit), this could signify an opportunity, especially in the absence of any fundamental change to the trust’s investment proposition.

“The discount to peers is also important – if an investment trust is trading at a notably wider discount that its peers for no discernible reason, and if this has not historically been the case, this could indicate an attractive entry point.”

Where a discount can be a value trap is when a trust is facing structural issues rather than needing a reversion in market sentiment. Structural issues can be, for example, a lack of liquidity, concerns around governance or the structure of a trust.

Johnson said: “These issues can be so pervasive that only the bravest investors would dare hold them. Even then, we note that, in some circumstances, boards may be able to get their act together and rectify the issues affecting these trusts, leading to impressive short-term share price returns.

“Alternatively, change may be forced upon them by a third party, but opportunistic bids are still quite rare in the sector, and in addition, you get situations like Hansa Trust which seems stuck on a 40% discount but positive change cannot be imposed as the trust operates with voting and non-voting shares, with a majority of the voting shares controlled by two individuals.”

Price and NAV of trust over 10yrs

Source: FE Analytics

Gilligan added that value traps are often those that hold hard-to-value assets, such as overseas property or emerging market private equity. In addition, interest rates can also play a role.

McDermott said: “When I think of traps I also think about the impact of interest rates. We’ve seen a rapid rise in rates in the past 18 months, and that has meant we’ve had to re-price certain assets in that environment.”

To avoid value trap, Bird suggested investors consider whether a discount control policy is in place or if the fund has previously repurchased shares to limit the discount, as it can help limiting downside share price risk, while maintaining exposure to any potentially re-rating from a change in sentiment towards the fund.

Johnson noted that a recent positive example of this has been Seraphim Space, whose board has recently initiated a share buyback programme to help rectify its stubborn discount. This has resulted in a 70% one-month share price return at the time of writing.