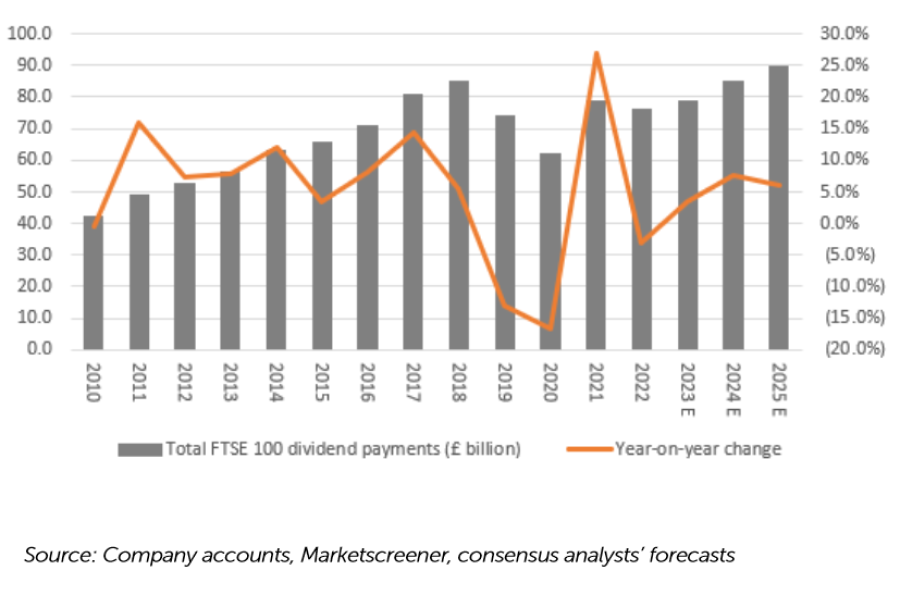

UK large-caps are expected to pay less out in dividends both in 2023 and 2024 than had previously been hoped, according to the latest AJ Bell’s Dividend Dashboard.

The amount paid by FTSE 100 companies in dividends is expected to reach £78.7bn this year, down from the £83.8bn consensus forecast at the end of the second quarter. This figure, however, still exceeds the £76.1bn paid out in 2022, excluding special dividends.

Russ Mould, investment director at AJ Bell, said: “The increase in the number of options available to those looking to build a diversified portfolio of assets and combat the evils of inflation is one possible explanation for why the FTSE 100 continues to paddle sideways, even if the long-feared recession is still yet to materialise.”

With higher interest rates, investors are looking at cash and sovereign bonds as a source of income, as the UK 10-year gilt offers a 4.47% yield, which competes against the FTSE 100’s forecast equity yield of 3.9%.

Mould added that another reason for the “turgid display” of UK equities may be down to the scepticism around FTSE 100 earnings and dividend forecasts for 2023 and 2024, as a result of inflationary and input cost concerns, higher interest bills, tax increases and the negative economic outlook.

Year-on-year change in total FTSE 100 dividend payments

The growth of pre-tax profits for 2023 has also been downgraded from 19% three months ago to 10%, although analysts are still expecting a new all-time high of £254bn.

Those revised forecasts are due to reduced profit forecasts at miners, which have been impacted by China’s economic woes as well as oil companies that have been facing lower oil prices.

Current growth forecasts of pre-tax profits for 2024 and 2025 are 3% and 2% respectively. While those figures might not excite too many investors, Mould said that the economic outlook remains unclear, with disinflation, deflation, inflation and stagflation remaining possible outcomes, each with different implications for growth.

Mould added: “There are many other variables besides and oil analysts could yet find themselves upgrading their estimates for 2023 and beyond if crude stays above $90 a barrel for long.”

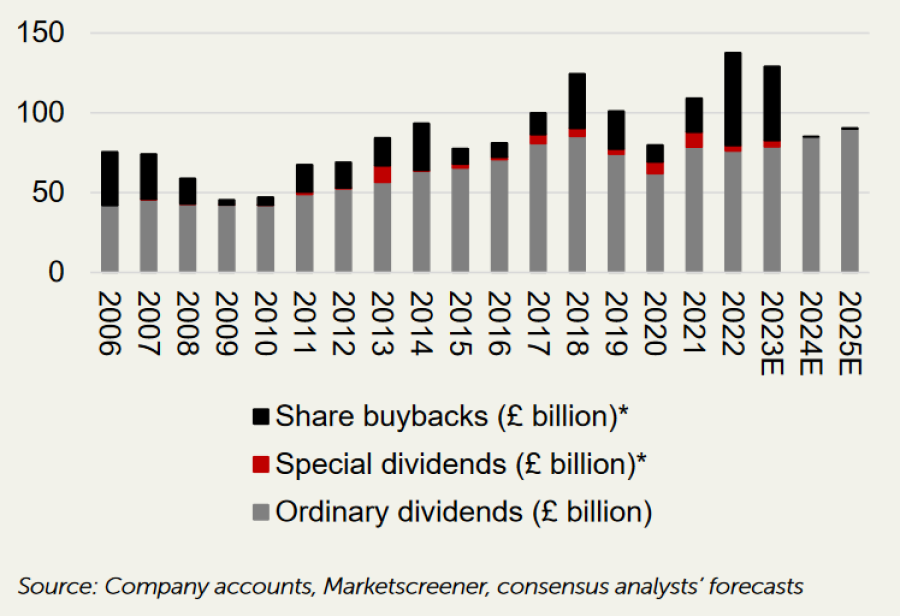

Yet, several FTSE 100 constituents have pledged to return excessive cash to shareholders via share buyback programmes. Some 37 firms have announced plans or already begun to do so.

To date, FTSE 100 firms have announced £46.6bn of share buybacks in 2023, which is the second best year for cash returns from the FTSE 100, only trailing 2022.

Share buybacks since 2006

Mould said: “These bumper cash returns supplement dividends. The FTSE 100’s members are on track to return £129bn to investors via ordinary dividends, special dividends and buybacks in 2023, again with the possibility of more buybacks in the final quarter. That compares to 2022’s all-time peak of £137.6bn.

“It also takes the total cash yield from the FTSE 100 to 6.2%, a figure which nicely exceeds both the two- and 10-year gilt yields and even gives the prevailing rate of consumer price inflation of 6.7% a run for its money, at the time of writing.”

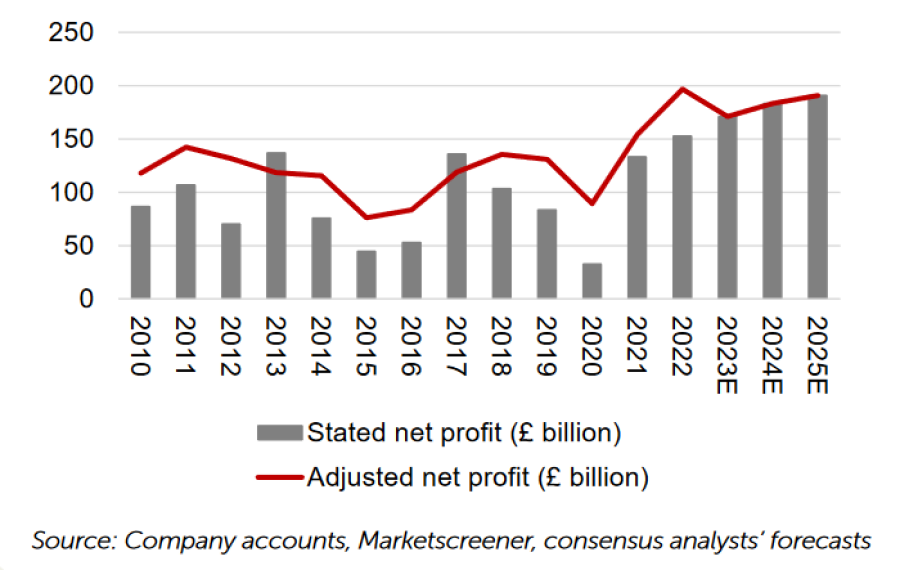

Net income on an adjusted basis is expected to hit £171bn in 2023, which is 13% less than the all-time high of £197bn reached last year.

Mould said: “The stated net income number is seen rising sharply, thanks again to the presumed absence of inventory and asset write-downs and mark-to-market losses at oils, insurers, real estate firms and investment trusts.”

Analysts have forecasted growth of 7% and 4% in 2024 and 2025 respectively, which indicates forecasts for ordinary dividend growth of 8% in 2024 and 6% in 2025.

Stated net profit vs adjusted net profit since 2010

Mould added: “Profits growth estimates rely heavily on banks and insurers, while drawing on health care and consumer discretionary for further support. Oils and miners are expected to have a negative impact on the overall total in 2023, thanks to lower commodity prices and sluggish economic growth.

“That said, an unexpected economic rebound, and one that sparks a sustained increase in commodity prices as inflation takes a grip, could leave oils, miners and – by extension – the FTSE 100’s earning power firmly underpinned.”