A lot has been written on the IA Targeted Absolute Return sector and whether it still offers value for investors, a debate prompted by the closure of the once-great abrdn Global Absolute Return Strategies fund.

Some experts believe that some funds from the sector still have a reason to exist and highlighted three in particular in a Trustnet article from last week.

But most strategies in the sector have disappointed for a long time, including the popular £3.1bn BNY Mellon Real Return fund, the largest in the peer group, which failed to beat inflation (CPI index) over one, three, five and 10 years.

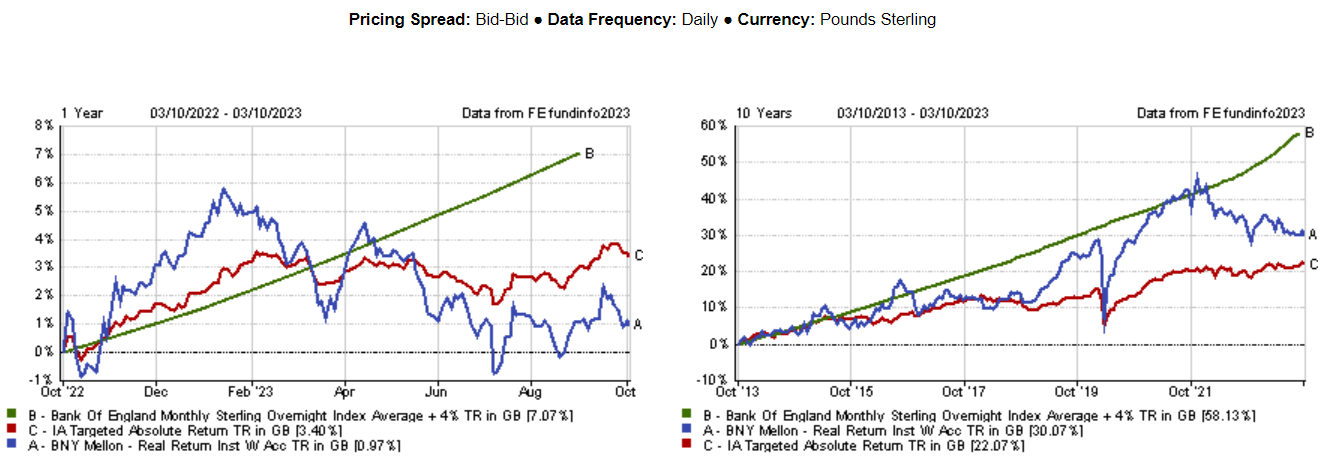

Performance of fund vs sector and index over 1 and 10yrs Source: FE Analytics

Source: FE Analytics

Approached for comment on this performance, BNY Mellon IM highlighted the long-term experience and the “broad, deep and invaluable resources” that the managing team draw on, as well as the “strong track record” that the strategy has in minimising downside participation. This is “an important part of the portfolio’s success in achieving good risk-adjusted returns”, it said.

For investors who own the fund and are wondering whether it’s time to walk, 7IM senior portfolio manager Peter Sleep has another question.

“What were you thinking when you bought it? Your expectations are unrealistic and you should probably have a rethink before you do anything and maybe speak to a financial planner,” he said.

“I have long thought that the return objectives of the absolute return sector were unachievable. Ultimately any fund can only give the returns of the market, plus or minus a little bit. The promise to achieve returns of inflation plus 4% over five years, and positive returns over any three years are unrealistic in a bearish market environment.”

But the BNY Mellon fund went further.

“This fund suggested high returns if inflation is high. If inflation is high, it is very probable that the returns from the market will be low or negative and the target is likely to be out of the question,” Sleep concluded.

Darius McDermott, managing director at Chelsea Financial Services, also expressed some disappointment: “The fund has a target of Sonia plus 4% which they are currently behind on a 10-year basis. This is a little disappointing given the long time frame the fund has had to deliver outperformance.”

One reason for this might be that the strong market performance over the last year has been driven primarily by the very narrow leadership of the ‘Magnificent Seven’ stocks (Apple, Microsoft, Amazon, Google, Nvidia, Tesla and Meta), he explained.

“The sector as a whole has disappointed, but these funds are there to add defensive ballast to a portfolio and some obvious diversification,” he concluded.

But for Ben Yearsley, director at Fairview Investing, diversification isn’t enough.

“The biggest problem these funds face is how do they fit into a portfolio when a cash fund can deliver almost 5%. That’s a legitimate question to raise – diversification isn’t a good enough reason. Quite simply, it has to outperform cash as well as providing diversification from equities and bonds,” he said.

“On BNY Mellon Real Return I am a hold. There are other funds in the sector I’ve given up on due to massive and unexpected change in volatility, but BNY is sufficiently different to stick with it. I think the team behind it has the wherewithal to do this, but clearly only time will tell.”