Many pension savers may see their chances for a comfortable retirement slip away as they too often ignore their pension portfolio until it’s too late.

If you leave your pension to work on its own in the background, it’s likely that it will default to “life-styling”, whereby risks and potential returns are curbed as you approach retirement age.

That doesn’t suit everybody, however, as Lumin Wealth senior chartered financial adviser James Corcoran told Trustnet last week.

In order not to be disappointed with your pension, it’s key to double check that your portfolio is invested in the best funds for you.

Below, we highlight the best pension funds of the decade from Prudential. Previously in this series, we looked at those offered by Legal and General, Standard Life, Aegon/Scottish Equitable, Scottish Widows, Aviva and Royal London.

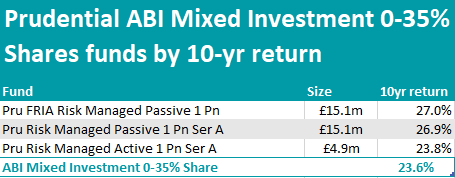

On the low-risk side of the spectrum, Prudential offers two funds, one passively managed (the Prudential Risk Managed Passive fund) and one active – LF Prudential Risk Managed Active. Both have outperformed the average peer from the ABI Mixed Investment 0-35% Share sector and returned more than 23.6% since 2013.

Source: FE Analytics

These vehicles have moved in tandem 97% of the time, but this high correlation is paired with the active fund having lagged the passive by 3 percentage points since 2013, while also charging 0.4 percentage points more.

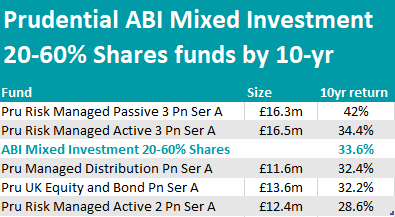

The corresponding funds in the higher-risk ABI Mixed Investment 20-60% Shares sector also achieved above-average results. Again, it was the passive vehicle to come out on top, beating the active fund by close to eight percentage points.

Source: FE Analytics

All remaining strategies underperformed in a similar way to each other – in particular, Pru UK Equity and Bond Pn and Pru Managed Distribution Pn have a correlation of 99%, meaning that when one makes a positive return, the other will do the same 99% of the time.

That is the result of similar underlying portfolios, with the main variation between the two being in their exposure to property, which is at 1.5% for the former fund and 11.5% for the latter. This difference translates in larger positions in fixed interest for the Equity and Bond fund.

On the other hand, Pru Risk Managed Active has more significant weightings to alternative investment strategies, global fixed interest and global equities (against the preference for UK companies for the previously mentioned funds) as well as the money market.

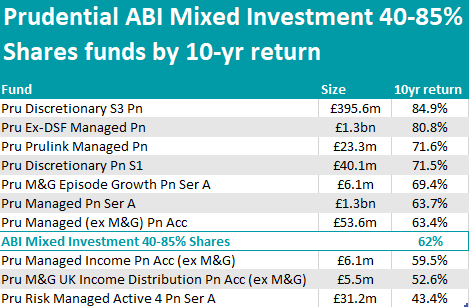

The majority of Prudential’s funds (and the largest) belong to the ABI Mixed Investment 40-85% Shares sector.

Here, most have beat the 62% average 10-year return apart from three income-focused strategies, which reside at the bottom of the table.

Source: FE Analytics

The top performer was Pru Discretionary S3, a large-cap UK-biased strategy that made 84.9% and is managed by the former Prudential Portfolio Management Group, now M&G Treasury & Investment Office.

Many of those who save with Prudential are likely to have investments in the £1.3bn Pru Ex-DSF Managed Pn, the largest fund in the table and the second-best performer.

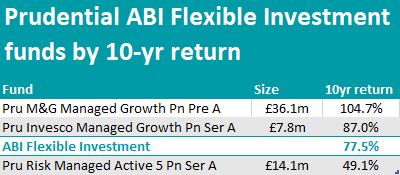

Lastly, all of Prudential ABI Flexible Investment funds beat their benchmark return in the past 10 years except for Pru Risk Managed Active 5 Pn, which made 49.1% compared to the average 77.5%.

The rest of the list is taken up by two growth solutions managed by M&G or Invesco. Of the two, Pru M&G Managed Growth Pn, which is managed by M&G’s Craig Simpson, stood out for its FE fundinfo 5-Crown rating and its 104.7% return.

Source: FE Analytics