Record selling of mixed-asset funds and property funds were paired with the largest outflows from equity funds in over a year this October, the latest Calastone fund flows report has highlighted.

The picture emerging from the data is one of uncertainty, with investors fleeing to security. They withdrew their money from the more volatile parts of the market and redirected it to money market funds, which are more profitable in a high interest rate environment and enjoyed their third-best month on record.

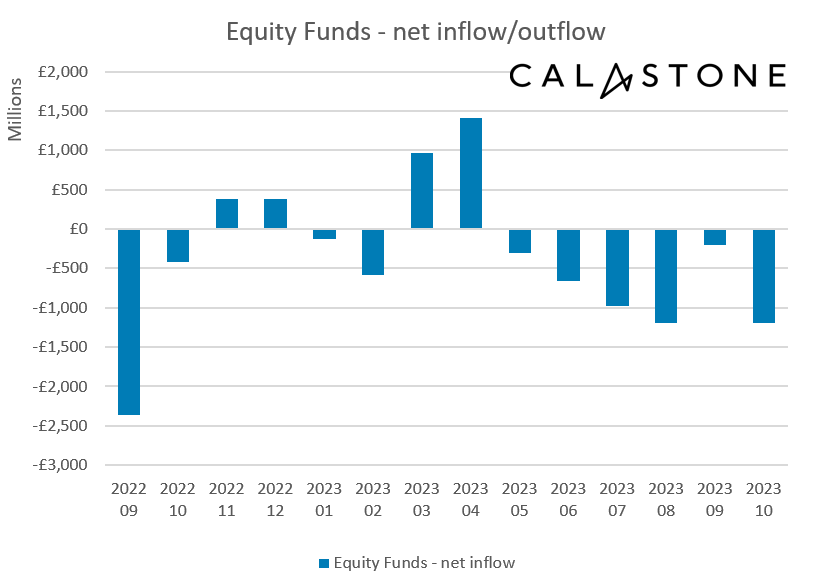

Equity funds experienced their sixth consecutive month of net selling, with a total of £2.9bn of capital leaving the sector the over the year to date. In October £1.2bn was removed from the asset class, as the chart below shows.

Source: Calastone

UK equities were particularly hit, as the domestic market continues to be unloved. Some £739m left funds investing in the region, which registered its highest outflow since April. Europe didn’t fare much better, with £318m in withdrawals its worst month of the year.

Funds focused on environmental, sustainability and governance (ESG) principles had their second worst month on record with outflows of £700m, taking its six-month figure to £3.1bn.

Income funds suffered significant outflows too (the £475m in October marked the 16th consecutive month of net selling), as Edward Glyn, head of global markets at Calastone, explained.

“Despite dividend income in the UK and around the world looking healthy, income funds are suffering by comparison to the interest income investors can earn on bonds, money markets and cash,” he said.

“The valuation of dividend stocks is actually less sensitive to bond yields than high growth companies, but investors looking for income now have alternatives that come with lower risk. Similar factors are at play in closed-ended funds – income-focused investment trusts have seen discounts widen significantly recently.”

However, there are signs of buying interest following the dramatic bond-market repricing of recent months, read the report.

This year is also likely to be the first in Calastone’s data history in which mixed asset funds register net outflows. So far, they have hit a record £1.6bn in outflows, with the money leaving the sector being up 50% month-on-month.

According to Glyn, this reflects a growing investor perception that “their strong record for a favourable balance of risk and rewards is breaking down as asset markets become increasingly correlated”.

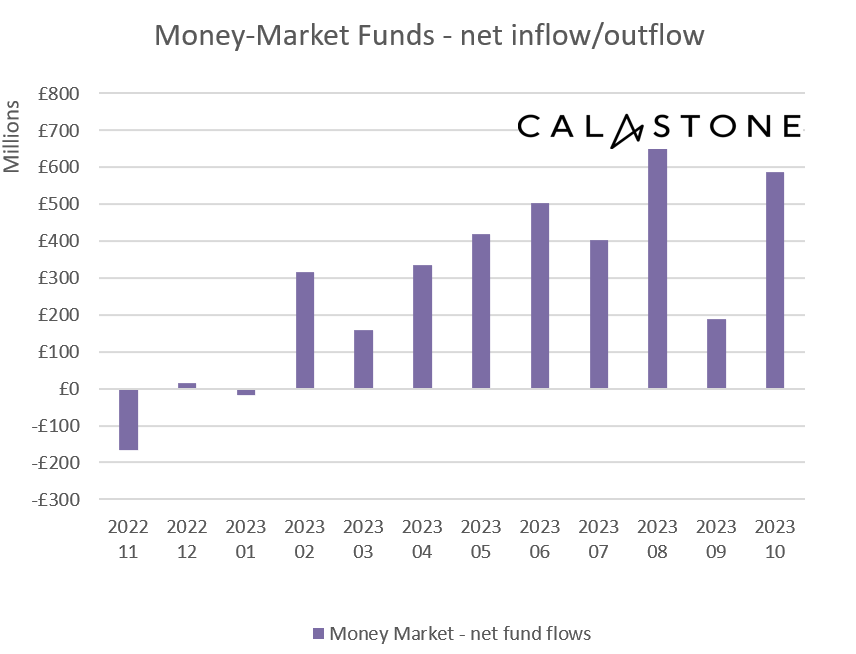

The only parts of the equity market to attract money were global and emerging market funds, with the latter adding a further £311m in October and being on track to have its best year on Calastone’s record. But the true winners of the month were money-market funds, as shown in the graph below.

Source: Calastone

The biggest beneficiaries of investor cash so far, these funds are often considered a ‘safe haven’ for their perceived lower risks and therefore added £586m of new capital in the sector’s their third-best month in Calastone’s record.

“The bond-market crunch has brought a deepening sense of crisis to capital markets. Investors demanding higher risk premiums are pushing bond yields up and prices down, and when longer-term market interest rates rise like this, asset prices of all kinds come under pressure,” said Glyn.

“Equity fund outflows are inevitable when bond markets are experiencing this wrenching repricing.”