A much-repeated mantra says that investing is about time in the market, not timing the market – which gets repeated over and over again to encourage people to remain invested instead of waiting for the right moment to buy or sell.

But like any good advice, it is hard to stick to it and doing the opposite can be tempting, especially after looking at how much – theoretically – one could save by avoiding the worst days in the market.

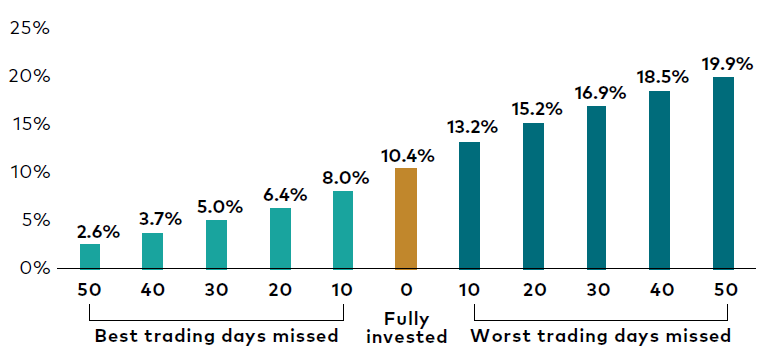

The brown column at the centre of the chart below shows the return of the S&P 500 for investors who stayed fully invested throughout the period highlighted – 10.4%, which was “pretty good”, according to Michael DiJoseph, CFA at the Vanguard Investment Advisory Research Center.

S&P 500 Index total returns 1988 through December 31, 2022

Source: Vanguard Investment Advisory Research Center.

But what if one missed the 10 best trading days? Move one column to the left to find out that the return would have been only 8%.

“And if you missed the 10 worst trading days? Look to the other side and that’s 13.2%,” he said. “So it may sound easy to gain more than 2% of total returns over 30 years annualised just by missing the 10 worst days.”

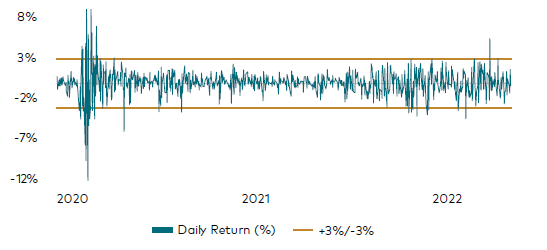

But navigating the best and worst days of the stock market isn’t that easy, as the second chart emphasizes below.

S&P 500 Index daily price returns January 1, 2020 through December 31, 2022

Source: Vanguard Investment Advisory Research Center.

For the three-year period from 2020 to 2022 there was around a 2% chance of a plus or minus 3% day in the stock market versus an 80% chance that after it happened once, it'll happen again in the following 30 days, DiJoseph explained.

“The problem is that there's no predictive power of whether there is going to be an up day or a down day, so going back to the first chart, if you think that it might sound easy to miss just the 10 worst trading days, the reality is that it's not, because those good days tend to occur in close succession,” he said.

“This makes it really hard to time the market and it emphasises that time in the market is much more impactful and easier than the difficulty of timing the market.”

What the first charts illustrate, according to Vanguard, is the importance of staying invested even during volatile times, even when it’s unnerving to see the stock market plummeting.

Because some of the best days in the market often follow bad ones, what the data might be showing is that it can make sense to stay the course in order to not miss out on net gains over the long term.