The spread between the cheapest and most expensive UK stocks is at its widest level in 50 years, according to Merchants Trust manager Simon Gergel.

Companies at the bottom part of the market are trading at historic lows whilst those at the upper end are at similar valuations to expensive US companies.

Gergel said: “You've got a very cheap market with a huge valuation dispersion, which means many stocks are trading on really low valuations versus history – that's a great market for stock pickers.

“There should be great opportunities in that. Of course it also means that there's some stocks that are very highly rated, but it's really polarised.”

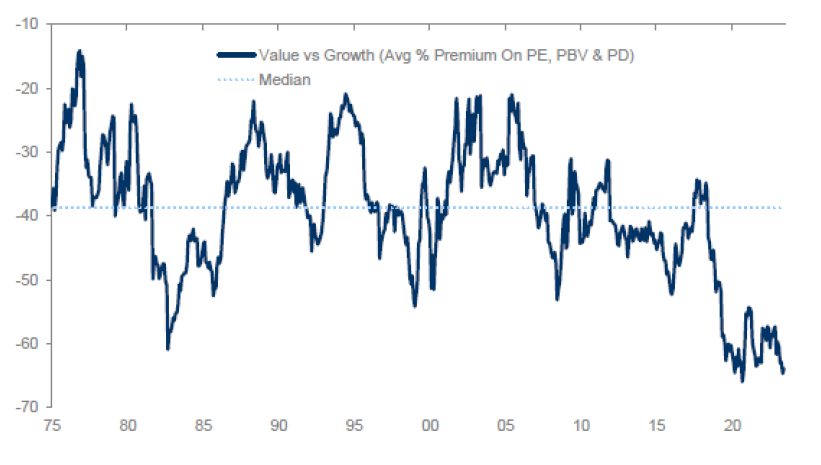

UK value vs growth average valuation premium

Source: Allianz Global Investors

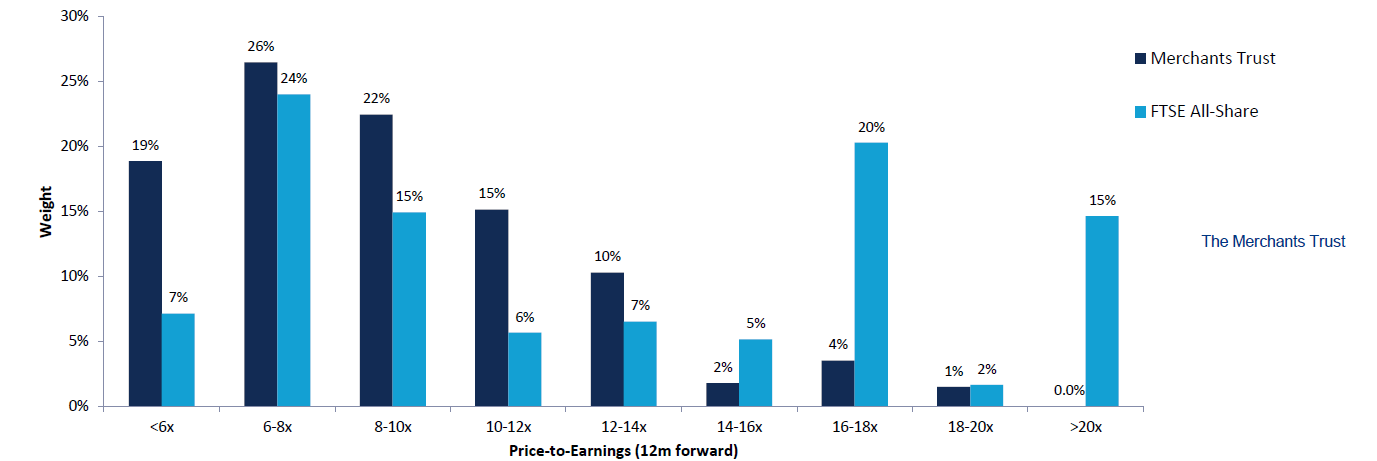

Co-manager Richard Knight noted the sizable gap dividing the two starkly different ends of the market. Overall, the UK stock market has an average price-to-earnings (P/E) ratio of 10x but 46% of companies fall below that.

Similarly, over a third (37%) of UK companies have P/E ratios of over 16x, revealing a clear split of valuations across the market.

“There is almost nothing in the middle,” Knight said. “There's this huge polarisation between the winners and losers and that area has a lot of opportunity. A lot of things that are cheap look far too cheap but the middle ground is very interesting to me.”

P/E ratios of Merchants Trust vs UK market

Source: Allianz Global Investors

Knight explained that expensive large-cap companies were shielded from downgrades thanks to the interest of international investors, who have inflated their share prices whilst most of the mid- and small-cap end of the market remains unloved

“There is a very small handful of stocks that international investors know and love, which will be in international portfolios all the time,” Knight added. “They're the few UK stocks that are on the radar of the average fund manager in the US and they’ve owned them forever.”

However, there are better opportunities for capital growth at the cheaper end of the spectrum, according to Knight, who said, although some deserve high ratings “many don't”.

“The point is there's little to be gained from mining in the area as far as we’re concerned. We prefer the added margin of safety from not overpaying, where the stock can afford to put a foot wrong without permanently losing capital. This market has shaken that belief because even very cheap things have gotten cheaper, but the value will be recognised over the long term – it's just difficult to say when,” he said.

The gap between the cheapest and most expensive stocks may be vast in the UK, but price dispersion is equally as polarised across the globe, according to Callum Abbot, manager of the JPM UK Equity Core fund.

“Global valuation spreads are extreme and about as wide as they were during the tech bubble,” he said. “The only period in the past 30 years when spreads have been wider was during the pandemic.”

This has allowed value investors to outperform for the first time in years, but growth continues to thrive in markets such as the US where excitement around artificial intelligence (AI) supercharged prices.

However, Abbott pointed out that when markets faced conditions such as these previously, it was followed by a period in which UK stocks outperformed the US.

“The last time the UK materially outperformed the US equity market was in the years after the tech bubble burst, up to the global financial crisis,” he explained. “This period had a similar set up to what we see today; extreme valuation spreads, positive real interest rates and hype over a new technology (AI).”

Indeed, Schroders’ value investment director Andrew Williams was also enthusiastic about the “highly compelling” opportunities that underpriced UK companies have over the US.

While 46% of UK companies trade on valuations below the 10x earnings average of the market, just 5% of US stocks fall into that valuation bucket.

“The comparison could hardly be more stark,” Willaims said. “There is a lot of bad news priced into broad swathes of the UK stock market, which tends to bode well for value managers looking to build and benefit from diversified portfolios of undervalued businesses.”