Aerospace engineering firm Rolls-Royce, cruise company Carnival and retailer Marks & Spencer made investors the biggest gains in 2023, according to data from AJ Bell, as investors looked favourably on previously unloved names.

All three have been volatile holdings for investors in recent years, tanking in 2020 before recovering in 2021. They all nosedived again in 2022, but rebounded strongly last year, making the three highest returns in 2023, as the below table shows.

Rolls-Royce topped the charts after delivering consistent good news throughout the year. In July shares rose after it doubled its profit guidance, while in September the firm was approved to build engines for business jets and in November it announced up to £1.5b worth of disposals and cost-cutting measures.

In total, investors would have more than tripled their money had they bought shares at the start of 2023, data from AJ Bell shows.

AJ Bell investment director Russ Mould said: “Low expectations can mean it is easy to beat those expectations, so wilful contrarians may have been able to dig out Rolls-Royce as a possible value play, especially once nuclear power started to move back into fashion and global air traffic took flight. Both trends play to Rolls-Royce’s technological prowess, in small modular reactors and jet engines respectively.”

Rolls-Royce was almost 100 percentage points ahead of the next best performer, Carnival, which made 127% over the course of the year.

Source: AJ Bell

Shares in the owner of P&O cruises were bumpy last year, but ended on a high as the company revealed its annual losses had narrowed on the back of a surge in bookings. The firm is also concentrating on reducing its debt, which was taken out during the pandemic.

Fashion and food retailer Marks & Spencer was just behind in third place, with a total return of 122%. Shares climbed steadily over the course of the year as the firm consistent beat expectations and uplifted profit expectations in 2023

Mould said: “The presence of Marks & Spencer and AB Foods, the owner of Primark, [up 54% last year] among the stronger stocks of the year may have seemed unlikely at the beginning of 2023 in the wake of the chaos caused by Trussonomics and a collapse in consumer confidence.

“But, again, the bad news was largely in the price, as it turned out, and the UK consumer proved more resilient than thought, despite interest rate hikes, thanks to robust wage growth, a cooling in inflation and a drop in oil and gas prices. These stocks are already anticipating interest rate cuts from the Bank of England in 2024.”

Overall the FTSE 100 made a total return of 7.9% on the year, while the FTSE 250 made 8%, with the overall FTSE 350 splitting the difference.

Mould said: “Although the FTSE 100 eked out just a mid-single digit percentage gain, it was still possible to make money from UK equities, and beat inflation, government bond yields and cash in the bank, with some judicious stock picking.”

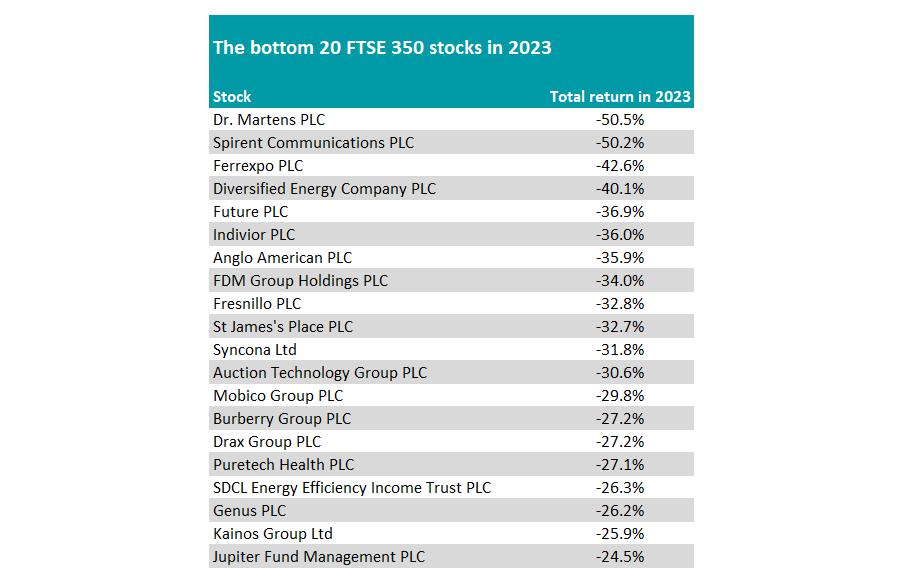

However, it was not all plain sailing. Shoemaker Dr Martens – a relative newcomer on the UK stock exchange having listed in 2021 – made the biggest loss for investors, down 51%.

It was a tough year overall, culminating in a profit warning in November. At the time, Adam Vettese, analyst at trading and investment platform eToro, said it was “concerning” that the firm’s main issue was a “difficult US trading outlook”.

“Although we’re now moving into winter, it would seem likely that the firm will have ongoing trouble encouraging consumers to shell out for its leather boots and shoes. What were once a staple of workwear are now quasi-luxury items in style and pricing, something that troubling economic conditions aren’t going to improve any time soon,” he added.

Source: AJ Bell

Mould noted that a major theme among the fallers was their proximity to China, which was a major laggard last year.

“The world’s second-biggest economy did not bounce back three years of lockdowns anywhere near as quickly as many expected,” he said.

“That weighed on sentiment toward luxury goods plays such as Burberry, miners such as Anglo American and also financial services giant Prudential, whose major overhaul of its corporate structure in the past few years makes it a play on the growing middle class in Asia and China in particular.”

The UK’s largest wealth manager St James’s Place also tanked in 2023, making a loss of 33% on the back of a regulatory crackdown. The firm removed its punitive exit fees for all new investment bond and pensions following the introduction of the Consumer Duty by the Financial Conduct Authority (FCA) earlier this year.

It was also a tough year for dividend payers, with the likes of British American Tobacco (down 23%) struggling due to regulatory pressures around smoking.

Croda and Diageo, also dropped 22% and 20% respectively “despite keeping alive long-running dividend growth streaks,” Mould noted.

“These stocks were loved as dividend compounders (and thus potentially expensive, from a valuation point of view). Their lofty valuations left no room for any unexpected slip and earnings disappointments took their toll.”