As UK value managers, Man Group’s Henry Dixon and Jack Barrat have been pursuing an out of favour investment style in an unpopular region for the best part of a decade and yet they have managed to hold their own. As Barrat said: “We sometimes think of ourselves as the last value investors left standing.”

With the Man GLG Undervalued Assets fund, Barrat and Dixon have developed an investment process that works in today’s market conditions and is a far cry from traditional value investing.

“We've tried to build a process that we think is value for 2024, not value for 1980 – which was buying low price-to-book or low price-to-earnings (P/E) or buying things that were falling. That’s not what we do,” Barrat said.

“We hope that our process, through analysis of proper tangible assets, sensible cash generation and the real value you're paying for a company – the all-in enterprise value – attempts to circumnavigate a lot of the pitfalls of historical value investing. We try to be a modern value fund and I think that’s how we’ve managed to stay alive.”

It hasn’t been easy. Barrat said that he and Dixon designed their investment process during “an era where value hasn't worked”.

For instance, Man GLG Undervalued Assets’ portfolio has a tangible asset value three times greater than the wider market. “There was a moment when rates were zero that felt like we just weren't getting rewarded, because an extension of zero rates was that you could replicate anything you wanted, virtually for free,” Barrat recalled.

When central banks started hiking interest rates in 2022, “a slight compensation” was that higher rates focused attention on asset value.

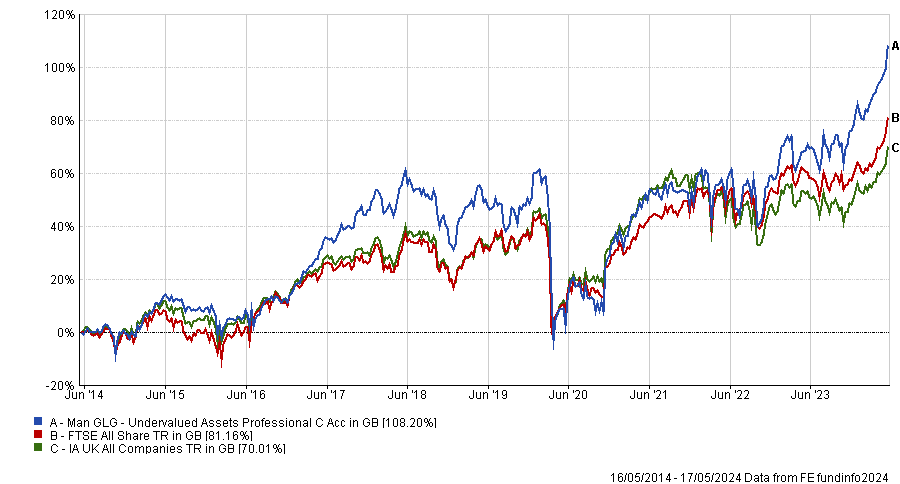

Amidst that environment, Man GLG Undervalued Assets was one of the few funds to make a positive return in 2022, up 2.9%. The FTSE All Share was flat for 2022 but the average fund in the IA UK All Companies sector lost 9.1% that year.

Last year, Man GLG Undervalued Assets more than doubled its benchmark’s return, up 16.2% versus 7.9% for the FTSE All Share and 7.4% for the IA UK All Companies sector.

In recognition of their track record, Barrat and Dixon have won the FE fundinfo Alpha Manager of the Year award for UK equities, for the second year running.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

A breakdown of the investment process

Barrat and Dixon analyse three key things: core tangible assets, the enterprise value of a business and one-year forward cash generation.

They calculate a ‘conservative baseline’ tangible book value – in other words, what it would cost to replicate the business and its assets.

Then they assess what returns a business is making from its assets and compare that to the enterprise value, i.e. the multiple of book value that investors are being asked to pay for those returns.

Third, they check the business is generating cash flow. “Not only is there a record amount of adjustment to earnings in the UK market right now, the conversion of those earnings to cash flow is, in places, very poor. Indeed, there are businesses out there that may appear ostensibly cheap, but we believe they produce almost no cash at all,” Barrat pointed out.

Having put stocks through their three tests, Barrat and Dixon invest in two types of company, which they classify as ‘undervalued assets’ and ‘undervalued returns’.

‘Undervalued assets’ are companies trading below their tangible book value, in other words the share price is less than the replacement cost for the company’s assets.

“These are businesses that are typically in quite a distressed period of their own capital cycle. The market is almost explicitly calling into question the value of their assets. Ryanair at the height of the Covid pandemic was trading below the value of its planes, right on its balance sheet, because people thought they were never going to fly again,” Barrat explained.

“Now brick manufacturers in the UK are trading below the value of their factories, let alone the value of the clay in the ground. House builders have had a very difficult two years given the rise in interest rates and that has a knock-on effect on brick deliveries.”

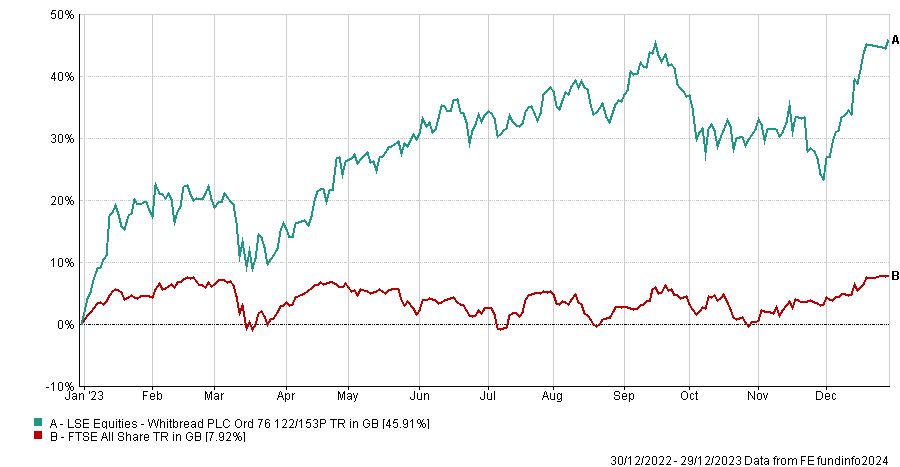

An example of this is Whitbread, in which Man GLG Undervalued Assets invested in late 2022 and sold out at the end of 2023. Dixon said he bought the stock at a share price of £25 but the cost of replicating its assets was £34 per share; a target that the share price reached in December 2023.

Performance of Whitbread shares vs FTSE All Share in 2023

Source: FE Analytics

Whitbread has a hotel footprint of 85,000 rooms and Dixon said it would cost just over £100,000 per room to build a hotel. The replacement cost was 40% higher than the share price 18 months or so ago.

There were concerns about the cost of labour and utility bills, and worries about Covid variants and the possibility of further lockdowns. However, Whitbread was well positioned to take market share.

Whitbread did a rights issue after Covid so it had very little debt and was well financed. Its share price has recovered as travel trends have normalised.

“That's a poster child of a well-financed company with a competitive landscape getting easier,” Dixon concluded.

The second type of company, ‘undervalued returns’, generate a return on their assets that is not being appreciated by the wider market. The return stream is undervalued and the market is calling into question whether those returns are sustainable.

“Take a business that is trading on two times its tangible asset base, but we think it is generating say three or four times its return on capital employed,” Barrat explained.

Barrat and Dixon only invest in these businesses if they are delivering positive operating momentum, such as earnings upgrades, beating expectations and things getting better.

Earlier this year, the fund exited from CRH, a US and global aggregates business that performed strongly last year with its shares up 60%. Of that, 20 percentage points came from operational delivery and 40 percentage points represented the value disconnect from being listed in the UK then moving to the US.

Barrat said: “We believed, coming out of Covid, that this business could make a significant multiple of its cost of capital on its tangible asset base and that [its prospects] would be much, much better in an inflationary environment. CRH was trading at two times its tangible asset base and it was our contention that it could make three or four times the cost of capital.”

Consensus expectations were gloomy due to negative headwinds for the construction industry. However, aggregates businesses typically operate in a concentrated local market because infrastructure operators want to work with local suppliers. That gives them pricing power. CRH bid up its prices north of 30% cumulatively over two and a half years which fed into earnings.