Sometimes good managers have a bad year that can derail their performance figures for years to come. For Siddarth Chand Lall, manager of the £465m IFSL Marlborough Multi Cap Income fund, that time was 2022.

The year was so poor that it has impacted the fund’s medium and long-term figures, with the portfolio sitting in the fourth quartile of the IA UK Equity Income sector over three, five and 10 years. It remains ahead of the sector average since launch in July 2011, however.

In the decade prior to 2022, the fund was the fourth-best among its 60 peers, smashing its average rival by more than 70 percentage points, as the below chart shows.

Performance of fund vs sector from 2012-2022

Source: FE Analytics

“The performance was top quartile over one, three five and 10 years up until the end of 2021; 2022 was the year that we struggled,” said Chand Lall.

“That is what has spoiled the three and five-year numbers. It isn’t that we have had bad performance every year.”

His fund tends to invest mainly in mid- and small-caps, with some 83.6% of the portfolio invested in this area of the market, while just 10.3% is in larger stocks.

As a result, the fund was buffeted from all sides, including the UK macroeconomic picture worsening due to rampant inflation, which had a particularly big impact on the more domestically-focused mid-cap stocks.

Couple this with a weaker pound (making imports more expensive) and the situation for the lower end of the market was difficult.

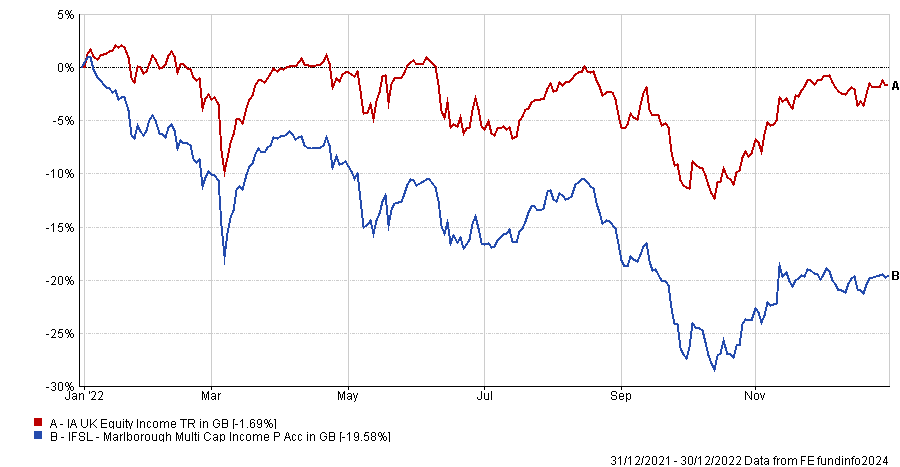

As such, his fund lost some 19.6% in 2022 alone – the worst year on record for the fund since its launch in 2011 – with the manager also noting there were some stock-specific issues as well.

Performance of fund vs sector in 2022

Source: FE Analytics

Yet the name of his fund is multi-cap, suggesting he has the option to move up the scale where appropriate – something Chand Lall admits was a lesson he learned during the course of that difficult year.

“How would we have positioned if we had known now what we knew then? We would have made much more use of the large-cap allocation. Whereas it’s almost always been between 5% and 15% to the FTSE 100 we would probably have moved up the scale,” he said.

However, it was not as easy, he noted, due to the makeup of the investors in the fund. “At the time there were specific clients who wanted us to keep the small-cap and mid-cap bias the way it was because we made up a portion of their allocation across many portfolios,” Chand Lall said.

“We were told ‘if you do underperform at least we know why you are, what we don’t want is for you to double up on where we already have exposure through other funds’.”

This is no longer an issue for the manager as these clients are no longer invested in the fund and so he has “much more flexibility” in the future should the environment change as dramatically as it did in 2022 when inflation and interest rates rose steeply.

“We will move much larger without changing the investment process,” he said, which includes looking for good companies with strong balance sheets indicated by metrics such as net debt to net assets of sub 50% (or preferably net cash) and free cashflow covering the dividends.

Chand Lall added: “In the event we get a scenario where there is potentially high inflation and interest rates, we would take advantage of the flexibility the strategy allows. That is the learning. I don’t mean 60% of the fund would be invested in the FTSE 100, but instead of 10-15% it might be 30-35%.”

Yet to change the portfolio now would be “silly”, he argued as mid- and small-caps are coming into their own. Indeed, the fund has been one of the top performers of the IA UK Equity Income sector so far in 2024 and since its nadir in October 2023 it is up some 28%.

Performance of fund vs sector over 1yr

Source: FE Analytics

“At this current juncture it would, to a certain extent, be almost silly to do it [move into large-caps]. We are getting so much alpha at this moment so I wouldn’t want to move away from that just to buy large-cap for the sake of it,” he said.

This recovery is in-keeping with previous periods, he noted, such as following the Brexit referendum in 2016 and the Covid pandemic collapse of 2020.

“What’s driving that is the aspect of beaten up valuations and also stocks trading better. We have gone past that element of caution and worries over a recession in the UK GDP figures. In the latest quarter it was 0.6% which was better than expected,” he said.

“That macro aspect does have some correlation with your micro. Also companies are trading better – we have had more good updates than bad. The multiple expansion will come.”