A change of manager and renewed interest from shareholders have propelled Majedie Investments from a discount in the high twenties in 2022 to just 11% today.

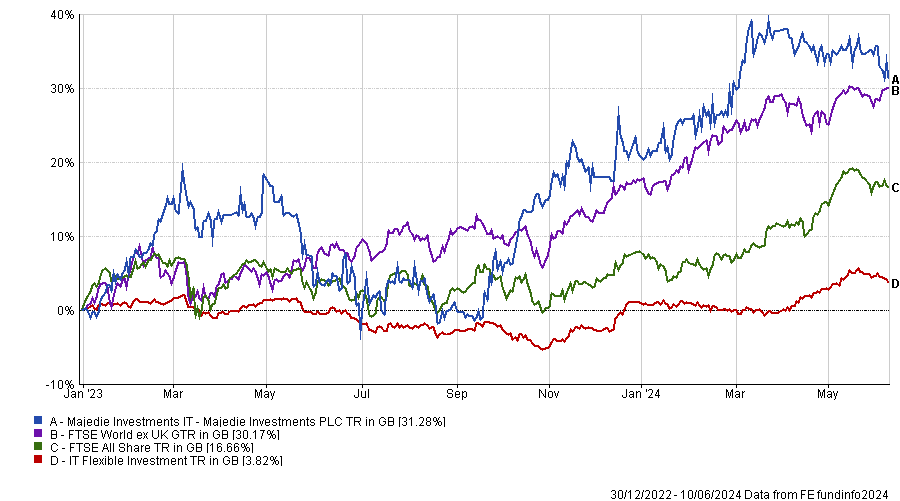

Since the start of last year, the investment trust has made 31.3% on a total return basis, propelled by its discount narrowing, making it the top performer in the IT Flexible Sector.

The trust appointed Marylebone Partners as its investment manager in January 2023 and switched to a ‘liquid endowment’ investment strategy, with a return target of inflation plus 4%. The portfolio is split between external managers (56% of the trust), direct investments (24%), hard-to-access special investments (10%) and finally, bonds and cash (10%).

Performance of fund vs sector and indices since January 2023

Source: FE Analytics

Majedie recently announced its results for the six months to 31 March 2024, during which time its discount narrowed from 18.7% to 7.6%, although it has widened since then. The trust achieved a net asset value total return of 13.3% and a shareholder total return of 28.1% during the six-month period. Its total assets rose to £165m.

Given the discount has already come in substantially, Trustnet asked experts whether investors have missed the boat or if the trust still represents good value, and if there are any other similar multi-asset trusts that investors should consider instead.

Juliet Schooling Latter, research director at FundCalibre, said Majedie is now trading “at the slightly more expensive end relative to its long-term history” but for investors with a long time horizon, it is “likely to still represent a strong opportunity”. She also believes there are catalysts for the discount to continue narrowing.

“The whole investment trust sector has been considerably affected by worsening financial conditions and technical issues over the past few years, resulting in an almost synchronous widening of discounts. If factors that helped cause this decline, such as higher rates, inflation and less investor confidence, were to improve, and assuming the trust's underlying holdings continued to perform, there is no reason there might not still be a healthy upside for investors,” she said.

“Should wider financial conditions improve, coupled with the implementation of a promising new strategy, we believe there is still plenty to play for at Majedie.”

William Heathcoat Amory, managing partner at Kepler Partners, concurred. “We think the first year of the manager’s tenure represents a solid foundation for showcasing the potential of a liquid endowment-style model. If the managers deliver in line with their objectives, there’s scope for the current 11.4% discount to narrow further.”

Heathcoat Amory views Majedie as a “return-seeking diversifier” because it is correlated to stock markets, but aims to have lower volatility than equities. “Majedie has the potential to provide exposure to genuinely differentiated sources of returns,” he said.

Another differentiating factor is its fee arrangements. Marylebone Partners receives a flat fee based on the trust’s market capitalisation, not its net asset value, so it’s interests are aligned with shareholders.

James Carthew, head of investment companies at QuotedData, was less enthusiastic. “Majedie was struggling a bit before Marylebone Partners was appointed. It had created a great deal of value by establishing Majedie Asset Management (MAM), but its sale to Liontrust Asset Management did not end well (it exchanged its stake in MAM for Liontrust shares that then fell in value) and the funds that it was invested in were underperforming their benchmarks,” he recalled.

When asked to suggest alternatives, Carthew and Schooling Latter both pointed to RIT Capital Partners, which invests third-party funds and direct equities like Majedie, and has some private market holdings to boot.

Carthew said: “RIT Capital is trading on a discount of 27.2%, which reflects some investors’ (irrational in my view) dislike of its private equity holdings. RIT is committed to reducing the exposure to this part of the portfolio and is keen to narrow its discount.

“As a trade, to me RIT Capital might be a better bet. Majedie has had a good run over 2024, but RIT could catch up as it achieves some disposals from its private equity portfolio at premiums to carrying value (past disposals have followed this pattern).”

Schooling Latter pointed out, however, that “RIT’s performance has been less impressive with the trust on one of its widest discounts in its history. Poor sentiment and share price weakness have arguably gone too far, and it does certainly look cheap.”

Meanwhile, Majedie’s chairman Christopher Getley was bullish about the trust’s ability to continue its strong run, noting the “breadth of ideas” that have contributed to recent outperformance.

“Returns have been generated from positions in areas as varied as biotech, software, Chinese and copper stocks, as well as credit opportunities,” he said.

External managers made the biggest contribution to performance in the six months to 31 March, returning 9.1%, led by the Helikon Long/Short Equity fund. Other external managers include biotech specialist Paradigm BioCapital, Praesidium Strategic Software Opportunities, deep value manager CastleKnight, and several managers with expertise in stressed or distressed credit, including the Millstreet Credit fund.

Dan Higgins, chief investment officer of Marylebone Partners, described the trust’s investment philosophy as long-term fundamental investing, taking advantage of market inefficiencies and embracing alternative return sources.

“I don’t think I’ve ever used the word ‘differentiated’ as much as in the past 18 months,” he admitted. The trust “frankly only has the right to exist if it is offering something truly differentiated that shareholders can’t get elsewhere.”