Private equity is a “secret weapon” rather than an “Achilles’ heel”, according to Scottish Mortgage deputy manager Lawrence Burns. So much so, that the manager has discouraged some companies from listing publicly over the past few years.

This may sound counterintuitive to those who remember the collapse of former star manager Neil Woodford’s eponymous fund house in 2019. His penchant for unlisted or hard-to-trade companies eventually left him in a predicament where he could no longer pay back investors who were withdrawing money in their droves, while remaining under the Financial Conduct Authority’s 10% maximum limit for unquoted stocks.

Although this was a problem for his open-ended portfolios, his investment trust – named Woodford Patient Capital at the time – also suffered, with the share price tanking.

Since then, the inclusion of privately-owned companies as part of a larger equity portfolio has been a controversial talking point for fund managers who employ the strategy.

This has been the case for Scottish Mortgage, with Lawrence Burns admitting that he and lead manager Tom Slater have “spent a bit of time in past couple of years trying to demonstrate that actually private companies are in some ways a secret weapon for Scottish Mortgage rather than an Achilles heel”.

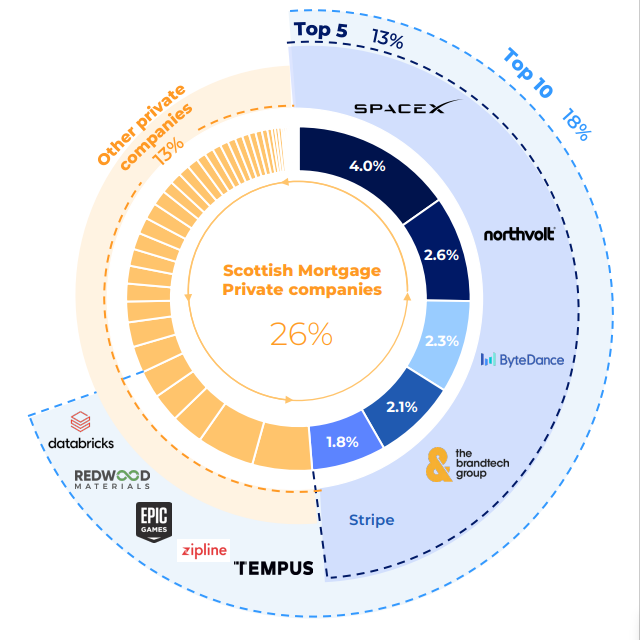

The trust has a self-imposed 30% limit on private companies and currently has around 26% invested in unlisted names. However, Burns is unconcerned by the large weighting and has actually discouraged some companies from conducting an initial public offering (IPO).

The IPO market has, essentially, been closed for the past couple of years with very few new listings and against that backdrop, Burns is concerned that companies would not be rewarded for going public.

“Have we occasionally encouraged companies to not IPO? Yes,” Burns admitted.

“Apart from anything else we think these are very valuable companies, so we want them to list in a market that is going to appreciate that value.”

He pointed out that companies listing would bring down the trust’s unquoted exposure, but said he is not “going around to our private companies and encouraging them to do this”, adding “we want to do what is in the best long-term interest of that company”.

Things could be turning a corner, however. Burns added that there are “early indications that the market might be more receptive to them [IPOs] than in the past”, which could lead to a rise in the number of Scottish Mortgage’s holdings coming to market.

Indeed, last year wellness technology company Oddity listed on the US Nasdaq exchange, although shares are down 19.5% since its launch. Others in the portfolio, such as Horizon Robotics in Hong Kong and Tempus in the US, have also filed to IPO in their respective markets.

Burns emphasized the quality and resilience of the trust’s private holdings, with the majority of these businesses “growing strongly” and being “well capitalised”.

He highlighted Elon Musk’s SpaceX – the largest name in the unlisted section – and Swedish battery developer Northvolt as examples of big companies the trust invests in that happen to sit in the private sphere.

Scottish Mortgage’s private equity weightings

Source: FE Analytics

“The nature of our private companies on average is they are quite large companies and profitable ones relative to what people think. If you look at our private companies, around 40% by exposure are cash generative already, 18% have a cash runway of more than four years, another 18% have a cash runway of two-to-four years and around 5% have a cash runway of less than one year,” said Burns.

The other differentiator for the trust is the number of valuations it conducts. Using an outsourced independent valuator – S&P Global – the trust has been notified of 427 revaluations in the past 12 months on its unlisted holdings.

This means the trust is not using “stale valuations”, but rather, its data is reflective of “fair value if we sold a company today”, Burns explained.

These valuations reflect the worth of public peers but also take into account any illiquidity premium that is required for unlisted stocks, he said.