The stellar performance that chipmaker Nvidia has achieved over the past two years, with its share price growing by 500%, has favoured investors who jumped on the artificial intelligence (AI) bandwagon and left everyone else wondering whether they are too late to the party.

Earlier this week, it surpassed Microsoft and Apple to become the world’s most valuable company, with a $3.34trn market capitalisation, making the question even more present in investors' minds.

But there are a number of unknowns around Nvidia according to Markus Hansen, portfolio manager at Vontobel’s quality growth boutique, who said that historically in the technology sector, it has been much more beneficial to sit back and wait for the fog to clear around a stock.

“We don't own Nvidia. It’s great business that’s doing great and it might become a quality business one day, once it figures out what its long-term growth is. But there's an element where the predictability is unknown,” he said.

“Today, I just can't predict what the earnings numbers are going to be, so how can I understand how it's going to be valued in the future?”

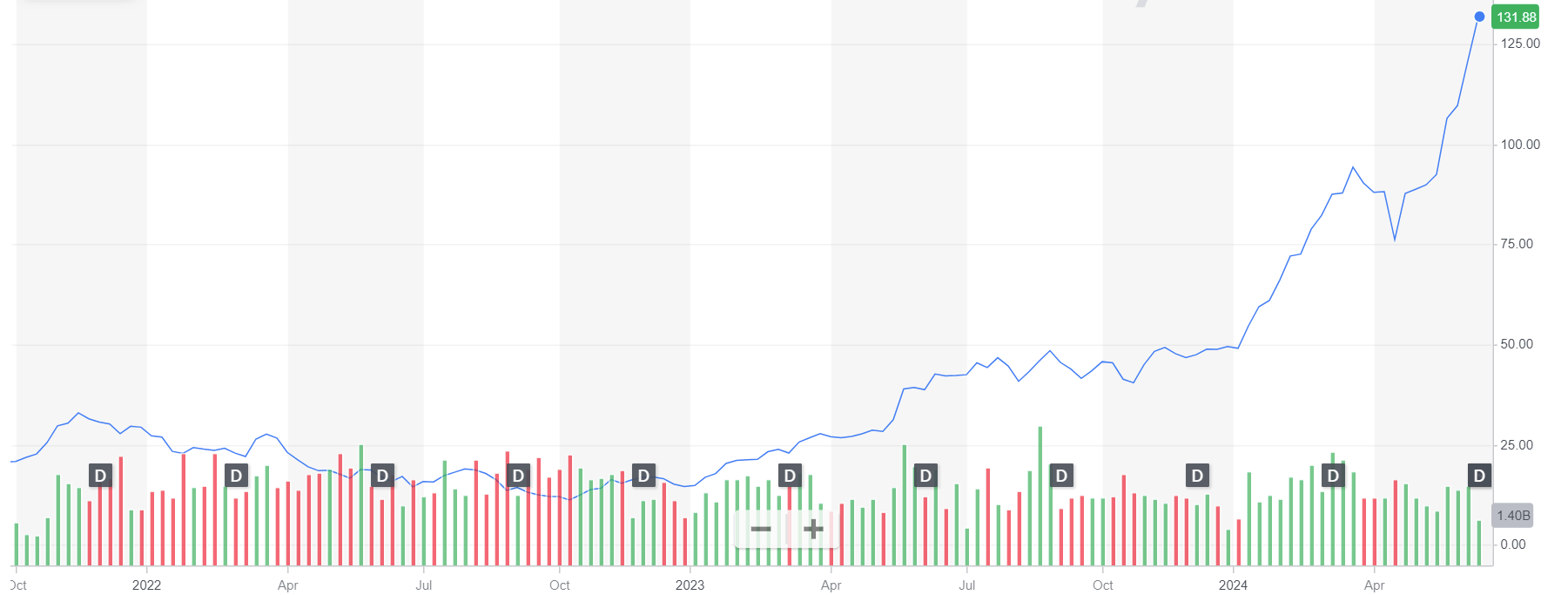

Performance of stock over 2yrs

Source: Yahoo! Finance

Nvidia’s track record has been erratic. In the early 2000s, its graphics processing units (GPU) chips were needed in gaming consoles, then when consoles started selling off because gaming was moving online, it lost money for a couple of years.

Nvidia’s fortunes improved with the rise of Bitcoin mining, which required its high-end GPUs. When that faded out, Nvidia hit a new driver – artificial intelligence (AI).

“Now, could you have predicted that? The simple answer is no. Three years ago, people thought that sales would be in the $30bn range for 2025, now they're predicting $110bn. That's a massive difference. That's unpredictable,” Hansen said.

“And that’s where the risk is. As we get into 2026, competition might come out, or we might understand what AI is. We're still too early to understand what is real from AI and what isn't.”

The biggest buyers of Nvidia's products currently are hyperscalers, who "hate relying on just one supplier and much prefer having two or three or developing their own chips", he said.

For instance, Apple did not want to be tied to chipmaker Qualcomm, so it started creating its own chips.

Demand for semiconductors, which has risen due to the boom in large language models, could fall if small language models prove more successful instead.

“You don’t need a language model that’s capable of crunching 10 million bits of data to get your calendar appointments sorted. If that’s what people will be using language models for – or for other similar, smaller tasks – we might not see as large a demand for computing power as people are predicting today,” he said.

That is why generally in technology, “being late doesn't mean you've missed the boat”, said Hansen. This has happened before, with Amazon and Cisco Systems, he said.

Amazon came to the market in 1997 as an online bookseller. Anyone who bought it at or around its initial public offering (IPO) would have initially made five times their money, but then it fell below the IPO price, not recovering until 2007.

Performance of stock between 1997 and 2008

Source: Yahoo! Finance

“The bulk of Amazon's returns came if you bought it 13 years after it came to the market,” noted the manager.

Similarly, Cisco Systems, which makes routing equipment, was a darling of the stock market from 1997 to 2000 as the internet was being built.

“The stock went up, came back down, then went sideways for forever because it wasn't clear whether everyone could make money from doing that,” he said.

“So we're not rushing to chase these fad names, even though they have great growth. My gut is, Nvidia will be a similar story.”

Hansen owns other stocks where he thinks the AI applications are much clearer today and which have predictable earnings streams that Nvidia, such as Microsoft, Google and to some extent, Amazon.

What convinced the manager about Microsoft is its small language model Copilot, which integrates with the Office package and helps users summarise, produce slides or use formulas on Excel.

“What you maybe spent half an hour on, Copilot can do in a few minutes. For me, that's great, that's productivity, there’s nothing to predict. As for Google, it has Gemini in development,” he said.

“Other companies are developing in the same direction too, such as Wolters Kluwer and RELX, whose legal AI assistant can quicken the job of teams of paralegals.”