Retired investors usually have a bond ballast in their portfolios to deliver income, stable returns, capital preservation and diversification against more volatile assets.

Conventional wisdom used to be that investors should shift gradually from equities into bonds as they approached retirement age, but the experience of 2022 when both equities and bonds were hurt by rapidly rising interest rates and inflation has left many investors and advisers with a sense of trepidation.

Chris Metcalfe, chief investment officer at IBOSS Asset Management, warned that “one of the key dangers in investing is trying to fight the last war”. “The extremely volatile and largely negative bond period between the end of 2021 and October 2023 has led many advisers and retail clients to question the validity of holding bonds in their ‘at retirement’ portfolios.

“However, we believe the backdrop for bonds, especially for active managers, is more positive than it has been for the best part of two decades,” he said.

Edward Allen, private client investment director at Tyndall Investment Management, was more circumspect. “Perhaps we are past interest rate rises, but history would teach us not to be complacent. As such, for those investors looking for income and security, short-dated bonds and/or floating rate exposure would seem more appropriate. Returns will likely be low, but they should be predictable,” he said.

When selecting funds, Metcalfe recommended focusing on total returns rather than prioritising yield to the detriment of the overall risk/return profile – even for retired investors who rely on the income generated by their portfolios.

“We saw many managers suffer extreme drawdowns in the pandemic sell-off and the market lows of early October 2022. It was often the managers who either had explicitly high target yields or that gravitated to those bonds offering what, on paper, looked like attractive outcomes,” he recalled.

“We recommend a broad church of fixed-income investments offering an acceptable mix of capital appreciation as well as capital preservation, and an attractive but not excessively risky income yield. Whilst we expect inflation to stay elevated, higher volatility brings opportunities for active managers to harvest alpha even if interest rates don’t move down quickly.”

With yields for gilts and US treasuries still above 4%, the risk/return profile of sovereign bonds looks attractive, he continued. “Given these starting points in yields, there is also significantly less risk of capital losses.”

Metcalfe also thinks that corporate bonds, high yield and emerging market debt have a role to play within a diversified portfolio. “Emerging market debt, particularly the blended currency sector, can help reduce overall correlations by adding an additional diverse source of potential alpha,” he explained.

Below, fund selectors suggest six bond funds for retired investors.

TwentyFour Dynamic Bond

The £1.5bn TwentyFour Dynamic Bond fund “suffered in the bust”, Allen said, “but this left some of the assets where TwentyFour has particular expertise, specifically asset-backed and collateralised bonds, at screamingly cheap prices”.

“The fund has roughly 25% of its assets in US treasuries and has a suitably glass half-full attitude to portfolio allocation; they take risk where they see suitable rewards and avoid it where they do not,” he explained.

“This is therefore not the fund for retirees focussed on short-term capital preservation, but is worthy of consideration for those willing to absorb volatility and pay up for active navigation of shark-infested waters. It has a healthy mark-to-market yield of 7.8% so a running return expectation of perhaps 7% after fees.”

L&G Strategic Bond and M&G Optimal Income

Metcalfe tipped the £592m L&G Strategic Bond fund, managed by FE fundinfo Alpha Managers Colin Reedie and Matthew Rees since 2019. “It takes a very active stance on both duration and credit quality and has made several important strategic moves which have added value to clients whilst being mindful not to take excessive risks,” he said. For instance, the fund is relatively overweight high yield on a tactical basis.

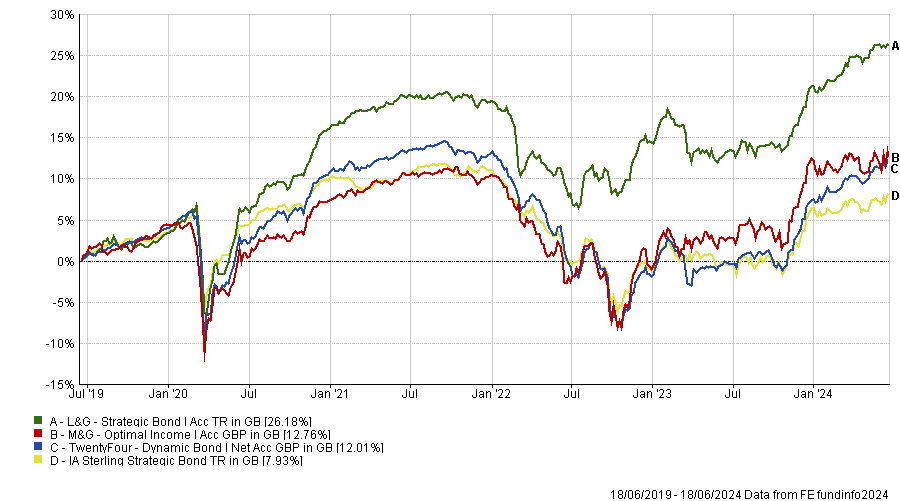

L&G Strategic Bond is the fourth-best performing fund in the IA Sterling Strategic Bond sector over five years to 18 June 2024 and has also delivered top-quartile performance over one and three years.

M&G Optimal Income, managed by Alpha Manager Richard Woolnough, is also nimble in its approach, Metcalfe said.

“For several years, we considered this fund too large to invest in, whilst maintaining our belief in the M&G team. At its current size of £1.4bn and with the superb track record the team possesses, we feel that it offers an excellent cornerstone investment for a client looking for solid fixed-income credentials,” he concluded.

The strategy has retained the large assets it had previously funnelled into the UK-based fund, but moved much of the money overseas following the Brexit vote in 2016.

Performance of funds vs sector over 5yrs

Source: FE Analytics

T. Rowe Price Global Impact Short Duration

In an environment where interest rates could stay higher for longer, short-dated bonds have a key role in providing a strong yield of 5-6% while minimising credit and interest rates risks, said Ben Faulkner, director of marketing and communications at EQ Investors.

As such, EQ has invested in the T. Rowe Price Global Impact Short Duration fund, which was launched earlier this year and is helmed by Matt Lawton, who developed T. Rowe Price’s impact bond franchise.

“T. Rowe Price impressed us with the expertise they have built in selecting businesses and projects that are making measurable positive social and environmental impact. This recently-launched fund is bridging a gap for investors than want to marry impact and short-dated bonds,” Faulkner said.

“We also like the fact that the fund invests across all regions and has a wider reach than most peers restricted to bonds issued in sterling.”

Passive fixed income funds

For investors who prefer index trackers, Henry Cobbe, head of research at Elston Consulting, said there is “plenty of solid yield available in high-quality, low-cost index bond funds” such as the Fidelity Index UK Gilt and BlackRock Corporate Bond funds. “Higher yields now make for a more interesting entry point,” he added.

Cobbe warned, however, that “bonds alone are not enough”.

“For someone aged 65 with average life expectancy, a bond fund isn’t enough to ensure portfolio durability. Over that term, the biggest risk is inflation and it’s harder for nominal bonds to keep pace with inflation. Most retirees will need a multi-asset retirement portfolio to last the course.”