A change in government next month could be the impetus investors need to return to the UK equity market, reversing the outflows of recent years and driving the UK stock market higher, according to James Penny, chief investment officer of TAM Asset Management.

“A change of the political guard breathing fresh life and vigour into Whitehall might just prove the catalyst this UK stock market needs for both international and domestic investors to get off the sidelines and start investing into one of the cheapest UK markets we have seen in recent times,” he said.

“A new government with a real bit between their teeth to get cracking and implement change could be what brings life into the stock market.”

The FTSE All Share tends to perform better during the 12 months after a general election if the keys to 10 Downing Street change hands, according to a study by AJ Bell of all 16 general elections since 1962.

The FTSE All Share rose by an average of 12.8% in the year after an election when the government changed hands, but inched up only 0.9% when an incumbent won, as the chart below shows.

Capital return from the FTSE All Share (%)

Sources: AJ Bell, LSEG Datastream

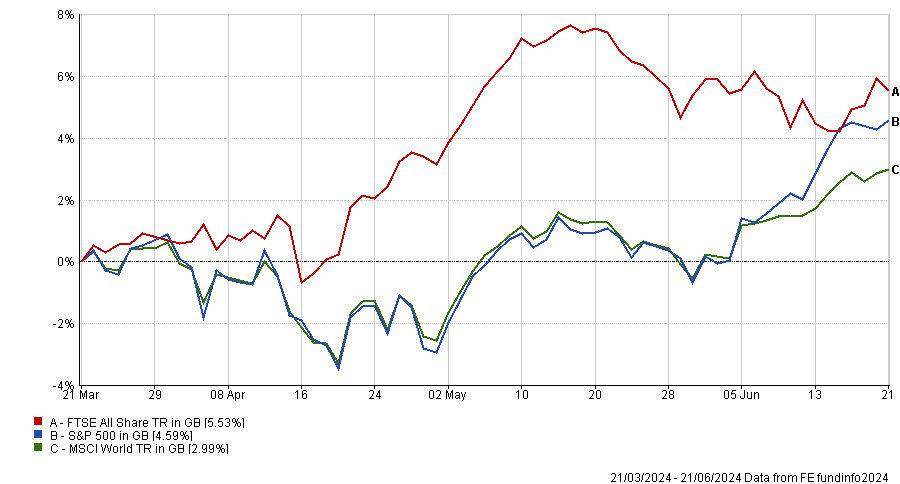

UK equities have already performed strongly this year, even beating the mighty S&P 500 in the past three months, as the chart below shows. Yet Penny thinks valuations are still cheap and the market has much more upside.

Performance of UK vs US and global equities over 3 months

Source: FE Analytics

Penny said: “We expect Labour’s potential victory to be met with a strengthening market. Bolt on the potential for rate cuts from the Bank of England, which would add further fuel to the rally, and even a rally back to our view of fair value would present a real opportunity for outperformance and alpha against increasingly US-heavy benchmarks.”

TAM has a 5-6% allocation to UK equities, slightly above global benchmarks. “We like the quality of the companies in the UK. We like the prices that we're paying for those companies. It's got a good income narrative and in a world of inflation, income is becoming important. Advisors need a decumulation piece to their proposition and the UK is a good market for that,” Penny explained.

He prefers to use active managers in the UK who can find high quality companies with strong management teams at attractive valuations. Some of the best managers in the industry are running UK equity funds, he added.

Redwheel UK Income is a core holding. Penny described the fund’s managers, Ian Lance and Nick Purves, as “an experienced team delivering a sound strategy, focusing on income and capital growth”.

It was the fifth-best performing fund in the IA UK Equity Income sector over five years and the second-best over one year to 21 June 2024. (Incidentally Redwheel UK Value, which is managed by the same people, performed even better.)

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

TAM also holds CRUX UK Special Situations, which invests in undervalued companies whose growth prospects are underappreciated by the market or which are in distressed situations where the market has lost confidence and overreacted on the downside.

The fund’s manager, Richard Penny, is “a competent and experienced active manager in a complicated market”. He previously ran a similar strategy at Legal & General Investment Management and has built a long-standing track record.

“Redwheel’s income and UK large-cap tilt dovetails nicely with the CRUX fund, which is a higher volatility vehicle designed to invest further down the cap scale. Owning them together gives us a better blended approach to the UK all-cap market,” TAM’s Penny said.

There is consensus among active UK equity managers that valuations are at record low levels and, as such, “there are opportunities everywhere for alpha to buy good companies trading on pence in the pound”, Penny continued.

“It's been painful to be a UK manager, really painful. You've got to love the UK market to want to stick with it. But a lot of these guys have been through boom and bust in the UK and are really positive about the direction for the UK going forwards,” he concluded.