Premier Miton has hired Alex Knox, a US small and mid-cap (SMID) specialist at Federated Hermes, to co-manage its Premier Miton US Opportunities and US Smaller Companies funds.

She replaces Nick Ford, who will retire at the end of September after almost 40 years in the investment industry. He joined Premier Miton in 2012 from Scottish Widows Investment Partnership.

Hugh Grieves, who has co-managed the US Opportunities fund with Ford since 2013 and the Smaller Companies strategy since 2018, is staying on and will work alongside Knox when she joins next month.

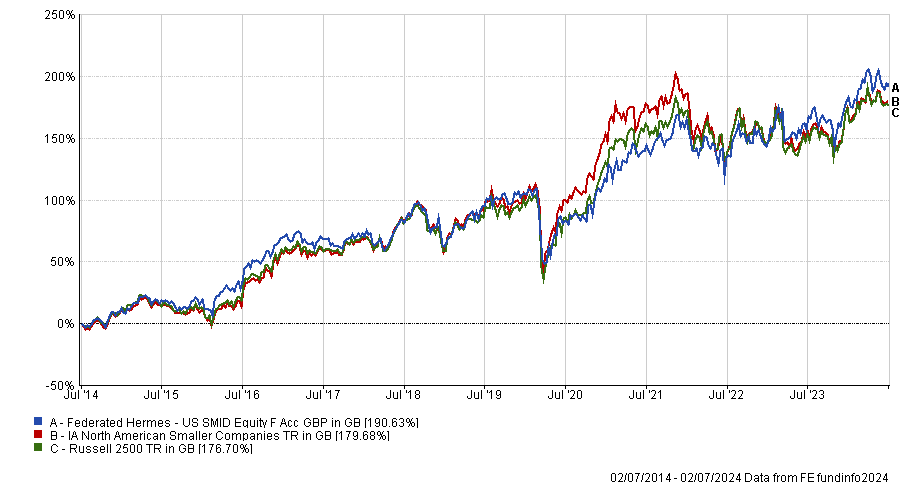

Knox has spent the past 15 years with Federated Hermes, where she co-manages the US SMID Equity strategy. The $999m fund is a top-quartile performer in the IA North American Smaller Companies sector over three years and has an FE fundinfo Crown Rating of four, placing it in the top 25% of funds for alpha, volatility and consistently strong performance over this time.

Performance remains above the Russell 2500 index and the average peer over five and 10 years as well, as the below chart shows.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

The £1.6bn Premier Miton US Opportunities fund is third quartile over five years and fourth quartile over one and three years, compared to peers in the IA North America sector, reflecting a market where recent performance has been concentrated amongst a handful of tech giants – a tough environment for funds that hunt further down the market cap spectrum.

The fund pursues a high conviction approach with a concentrated portfolio of 35-45 holdings. Its largest positions are Graphic Packaging Holdings, Raymond James Financial, Tetra Tech, Charles Schwab and Intercontinental Exchange.

The £35m US Smaller Companies fund is fourth quartile in the IA North American Smaller Companies sector over three and five years but third quartile over one year.