Funds with concentrated portfolios arguably carry more risk, as managers take substantial bets on a handful of stocks, meaning that performance is tied to a small number of individual bets. Yet the potential for reward is far greater because managers’ best decisions are not watered down.

High conviction stock picking is, after all, what active management is all about – offering investors a differentiated product whose performance does not mirror an index.

Simon Evan-Cook, a fund manager at Downing, said: “Within the equity component of our Fox Funds, we own eight funds that have more than 50% of their portfolios held in their top 10 stock picks. This is because we only buy ‘full blooded’ active equity funds and avoid the opposite – closet trackers – like the plague.”

Below, Trustnet asks experts which funds with concentrated portfolios they would bet on.

Odyssean Investment Trust

Ben Mackie, portfolio manager at Hawksmoor, picked Odyssean Investment Trust, which Hawksmoor holds in The MI Hawksmoor Vanbrugh and The MI Hawksmoor Global Opportunities.

Managers Stuart Widdowson and Ed Wielechowski apply a private equity approach to public markets and only hold 18 UK small-caps, with their top 10 holdings accounting for 81.1% of the portfolio, according to FE Analytics.

Mackie said: “The concentrated approach reflects the extremely high bar for portfolio inclusion with the manager seeking to own companies with strong competitive positions and high-quality business models that are trading below their view of intrinsic value.”

Widdowson and Wielechowski typically make sure there are catalysts for the value of their holdings to be realised. These can include ‘self-help’ initiatives, operational improvements as well as merger and acquisition activity, although the fund has not benefited from the latter catalyst recently.

As they take meaningful stakes in less liquid, smaller names, Widdowson and Wielechowski often engage with the management teams of their investee companies to encourage changes.

“This engagement, combined with the stock selection process and active positioning results in a highly differentiated approach,” Mackie added.

The fund often invests in sectors where the managers have expertise, such as industrials, TMT (technology, media and telecommunications) and healthcare.

Performance of trust since launch vs sector

Source: FE Analytics

Since launch, the fund has outperformed its average sector peer by 33.7 percentage points and is the third-best performing investment trust in the IT UK Smaller Companies sector over five years.

HC Snyder US All Cap Equity

Evan-Cook picked HC Snyder US All Cap Equity, a US equities fund in which the top 10 holdings make up 56% of the portfolio.

“The managers aim to make their portfolio the crossover between the two Venn-Diagram circles that are ‘highest-quality companies in the market’ and ‘cheapest companies in the market’. If they get this right, it means that they hold a portfolio of very high-quality companies trading at very attractive prices and there’s a lot to love about that,” he explained.

Not many companies exhibit those characteristics at any given time, which explains the concentrated nature of the 21-stock portfolio.

The fund employs a multi-cap approach to US equities, encompassing large-caps such as Mastercard and Charles Schwab, along with lesser-known small- and mid-caps such as Clean Harbors and BWX Technologies.

Performance of fund since launch vs sector and benchmark

Source: FE Analytics

BlackRock Global Unconstrained Equity

Darius McDermott, managing director of Chelsea Financial Services, pointed to BlackRock Global Unconstrained Equity, a global equity fund whose top 10 holdings account for 63.7% of the fund.

FE fundinfo Alpha Manager Michael Constantis and Alister Hibbert believe the market’s obsession with short-term results presents an opportunity for long-term investors to back a small selection of exceptional businesses.

As a result of this ‘buy-and-hold’ strategy, the managers trade infrequently and allow the power of compounding take effect over the long haul.

McDermott said: “Portfolio adjustments are driven solely by fundamental changes in a company's prospects, valuation extremes, or the emergence of superior investment opportunities.”

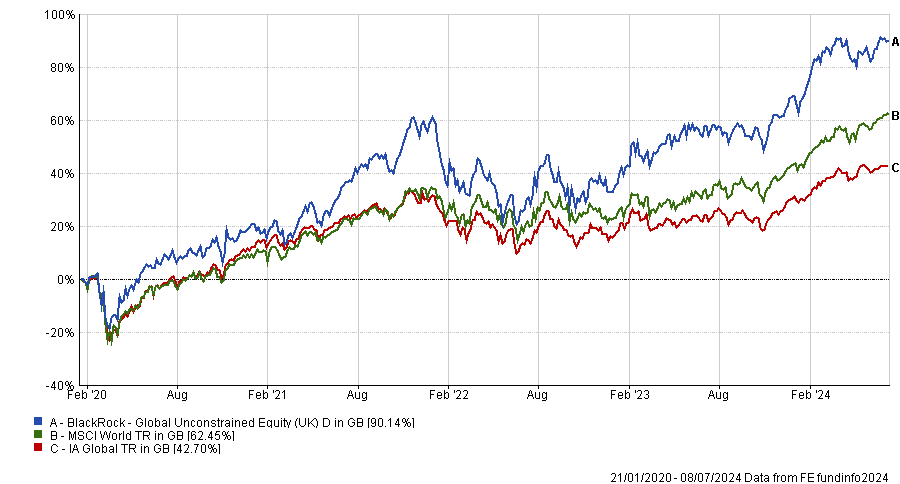

Performance of fund since launch vs sector and benchmark

Source: FE Analytics

The fund was launched in January 2020 and sits in the top quartile of the IA Global sector over three years.

Martin Currie Global Portfolio Trust

McDermott also highlighted Martin Currie Global Portfolio Trust, which follows a similar approach, with 52% of the portfolio invested in the top 10 holdings.

In fact, reducing the number of holdings to eliminate low-conviction stocks was one of the first initiatives manager Zehrid Osmani took following his appointment in 2018.

The portfolio now comprises quality growth businesses that Osmani considers leaders and innovators in long-term investment themes such as technological advancements, resource scarcity and demographic shifts.

McDermott added: “Each holding is carefully selected to ensure it contributes a unique and valuable element to the overall portfolio, leading to a distinct composition compared to traditional global benchmarks.”

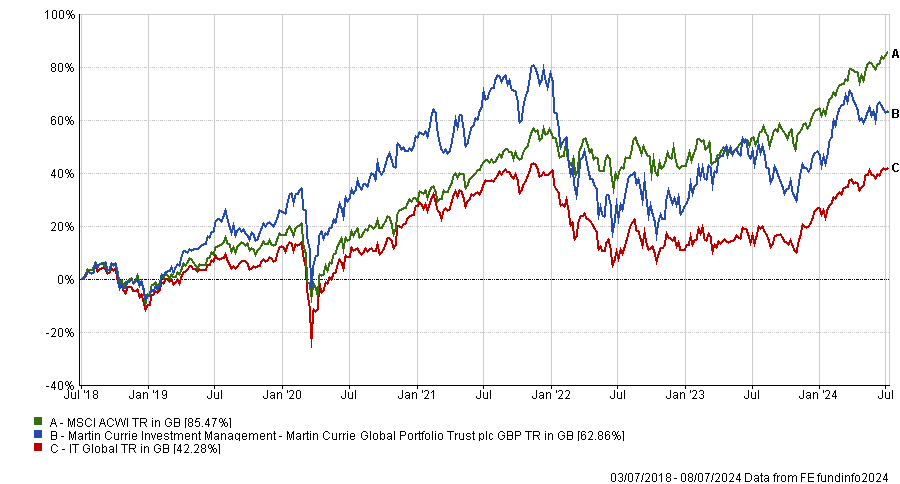

Performance of trust since manager’s appointment vs sector and benchmark

Source: FE Analytics

Since Osmani’s appointment, Martin Currie Global Portfolio has outperformed its average peer sector but lagged its benchmark.