With the mental acuity of current US president Joe Biden under scrutiny, bond markets have begun to price in a victory for former president Donald Trump in the upcoming election, according to AJ Bell investment director Russ Mould.

If successful, Trump would become only the second president in US history to win a second term having previously been ousted from office, following in the footsteps of Grover Cleveland.

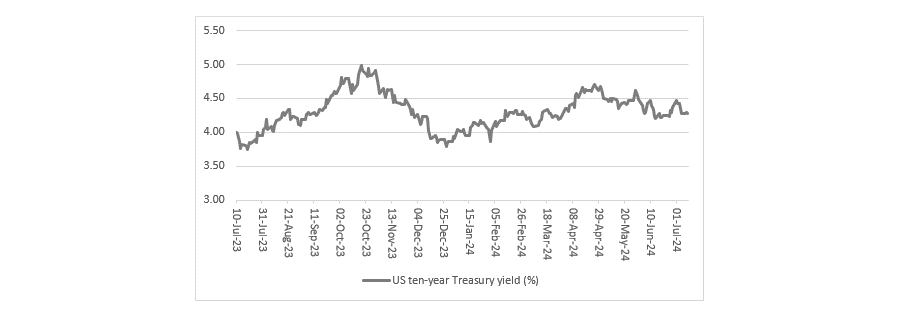

“This can be seen most clearly in how the US 10-year Treasury yield responded to the presidential debate hosted by CNN late last month. The benchmark US government bond saw prices fall and yields rise sharply in response to the broadcast, as fixed income investors began to anticipate a Trump win and the inflation they feared that would bring,” said Mould.

Not all agreed, however. Algernon Percy, managing director of Waverton Investment Management, noted that 10-year US Treasury yields have been “fairly static” over the past quarter, moving between a low of 4.2% and a high of 4.7%, before settling at 4.4% at the end of June.

US 10-year Treasury yields over 12 months

Source: AJ Bell, LSEG Datastream

“This reflected the ebb and flow of sentiment regarding US economic growth and inflation – with the most recent data indicating a gradually slowing US economy that is broadly helpful to a benign inflation outlook, notwithstanding somewhat sticky services inflation and wage growth,” he said.

However, Percy admitted that “short-term noise” around “economic statistics and political shenanigans” could impact yields in the coming months.

On Trump, Mould said some of the former president’s main policies are likely to be inflationary. An extension of 2017’s tax cuts and promises of more to come, for example, should boost consumer spending, which would increase the demand side of the supply-demand dynamic and keep prices high.

This would also run up the US’ already large annual deficit, adding 6% per year to a figure that already stands above 100% of GDP.

“The situation would look even worse, if a soft (or hard) economic landing were to transpire and tax income recedes just as welfare payments rise, as it seems logical to assume that the annual deficit would balloon,” said Mould.

Second, more tariffs on imported goods – not just from China – will hike prices. Lastly, reducing immigration would limit the pool of workers available, with wages likely to rise as a result.

But Mould noted that Biden is “not promising hair-shirt austerity” either. Indeed, if the incumbent president wins, in his first term the US is expected to “rack up” an additional $7trn in borrowing.

This all comes at a time when US Federal Reserve chair Jay Powell is “dangling the carrot” of interest rate cuts, providing inflation continues to cool, Mould said.

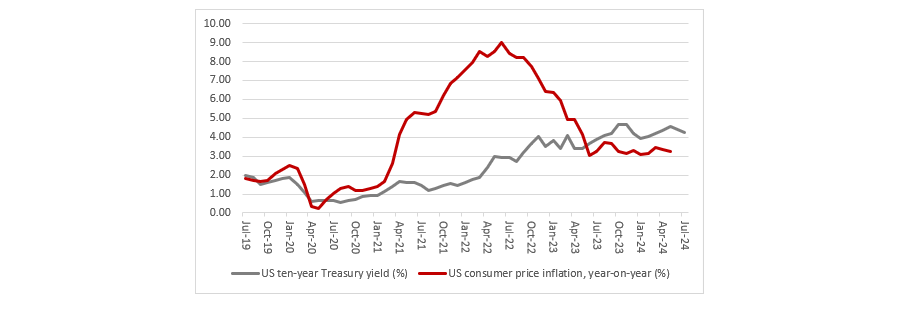

This presents a dilemma. On the one hand, investors may want to lock in yields if the Fed does indeed start to cut in the Autumn of this year, as some expect. On the other, although yields are currently above inflation, as the chart below shows, any spike in prices would soon erode this return.

US 10-year Treasury yields vs inflation over 5yrs

Source: AJ Bell, LSEG Datastream

As such, bond investors need to ask themselves what an appropriate level for US 10-year yields might be. “The base case is the 2% inflation target. An investor may then wish to add some term premium to that, since the headline rate is stuck near 3%, thanks to strong services inflation,” he said.

“Then there remains the incipient inflation risk offered by both presidential candidates. And then there is America’s massive deficit which could both pressure the Fed to cut rates to keep the Federal interest bill manageable (since it is now running at $1trn a year) and oblige the US to offer tempting yields so it can find buyers for its newly issued debt.”

All of this implies 10-year Treasury yields are likely to stay above 4% for the foreseeable future, suggesting capital appreciation on these bonds (currently paying 4.28%) could be limited.

“Investors must then decide whether the coupon is enough to compensate for inflation risk, if US Treasuries are to form a part of a balanced, diversified portfolio,” concluded Mould.