US equity managers have been rewarded lately for sticking closely to their benchmark’s largest stocks, whether their investment process mandates a small tracking error or high conviction, focussed bets.

Across the board, most US equity funds’ top 10 holdings read like a roll call of tech giants, with some combination of Nvidia, Microsoft, Meta, Amazon and Alphabet in there, and sometimes all five.

Nvidia has been the star performer and all but three funds in the IA North America sector with top-quartile returns over the past 12 months count it amongst their largest 10 positions.

For the three outliers – Brown Advisory US Flexible Equity, Capital Group Investment Company of America and Principal GIF US Blue Chip Equity – having low or no exposure to Nvidia was a headwind to relative performance, for which they had to compensate with superior stock-picking elsewhere.

This they managed, with all three funds outperforming the S&P 500 over the past 12 months, against which Brown Advisory and Capital Group are benchmarked. Principal US Blue Chip Equity is benchmarked against the Russell 1000 Growth, however, which it lagged.

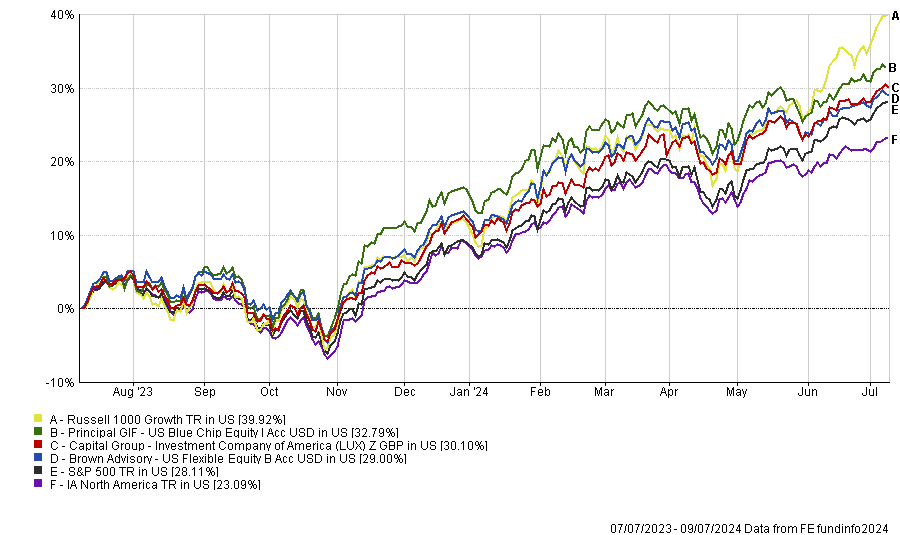

Performance of funds vs benchmarks and sector over 1yr in dollars

Source: FE Analytics

The funds made up ground by owning other ‘Magnificent Seven’ names amongst their top 10 positions. All three funds hold Microsoft, Amazon and Alphabet. Brown Advisory and Capital Group own Meta Platforms while Capital Group also has Apple.

Other technology companies loomed large. Maneesh Bajaj at Brown Advisory has a stake in Taiwan Semiconductor Manufacturing Co., Capital Group holds Broadcom and Principal owns Intuit, a financial software provider.

The funds have exposure to beneficiaries of artificial intelligence and technological innovation themes in other sectors as well, through Mastercard, Visa and Netflix. All three funds own Mastercard while Principal holds the other two stocks.

Two of the funds own defence and aerospace manufacturing companies, which have soared on the back of rising geopolitical tension and defence spending. Capital Group holds General Electric and RTX Corp. (formerly Raytheon Technologies), while Principal has TransDigm Group.

Financial services also feature. Thomas Rozycki and K. William Nolin at Principal Global Investors own the insurer Progressive Corp. and the Canadian investment group, Brookfield Corporation. Bajaj holds Warren Buffett’s Berkshire Hathaway and private equity firm KKR.

The only healthcare stock amongst the three funds’ top 10 holdings was medical insurer UnitedHealth, which Brown Advisory’s $781m fund owns.

Meanwhile, Capital Group’s $449m fund has exposure to travel and leisure with Royal Caribbean Cruises.

Despite not piling into Nvidia, these three funds’ performance was still closely correlated to their respective benchmarks, with at least a 0.95 correlation.

For investors with passive exposure to the US stock market who want to use active stock pickers for diversification: GQG Partners US Equity had the lowest correlation to the S&P 500 amongst all the funds with top-quartile one-year returns, despite Nvidia being its largest holding. Its correlation to the benchmark was 0.74 during the year to 9 July 2024.

GQG Partners U.S. Equity is managed by three FE fundinfo Alpha Managers, Rajiv Jain, Brian Kersmanc and Sudarshan Murthy. The $1.6bn fund’s largest positions include Eli Lilly and Novo Nordisk, which dominate the diabetes and weight loss drugs market, alongside a clutch of tech stocks: Nvidia, Meta Platforms, Microsoft, Amazon, Broadcom, Uber Technologies and the less well-known app developer AppLovin Corp. It also owns Visa.

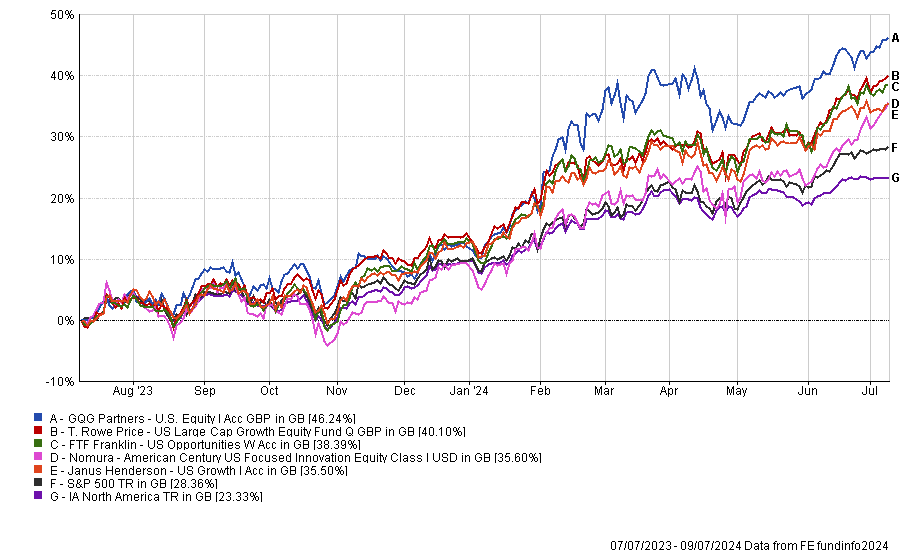

Performance of funds vs S&P 500 and sector over 1yr

Source: FE Analytics

Close by, T. Rowe Price US Large Cap Growth Equity had a 0.75 correlation, while three top-quartile funds had a 0.77 correlation to the S&P 500: FTF Franklin US Opportunities, Janus Henderson US Growth, Nomura American Century US Focused Innovation.