Quilter Investors has added the Goldman Sachs Absolute Return Tracker fund to its Cirilium Passive Portfolios.

Introducing the hedge fund replication strategy will give clients access to a wider set of investment opportunities at no additional cost, Quilter said.

The $1.3bn Goldman Sachs Absolute Return tracker fund is a diverse, multi-strategy portfolio that invests long/short across equities, bonds, currencies, credit and commodities. It aims to replicate the performance of the hedge fund industry and is led by Oliver Bunn.

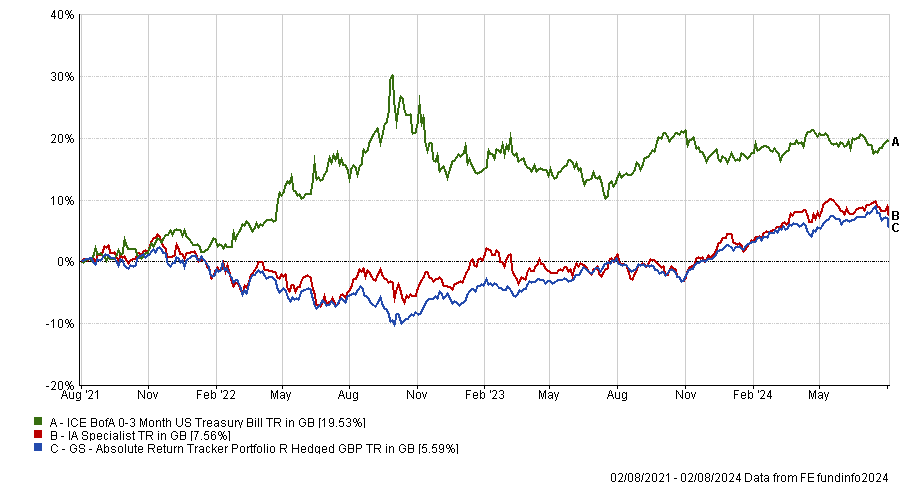

Performance of fund vs sector and benchmark

Source: FE Analytics

Sacha Chorley, portfolio manager at Quilter Investors, said: “Hedge fund exposure is not widely available in passive funds of funds, but we believe multi-asset portfolios across active, passive and blended strategies should have all the tools at their disposal to enhance diversification to help portfolios perform well in a variety of market environments.”

Quilter is in the process of seeding a second passive alternatives fund from another major asset manager for use within the Cirilium Passive Portfolios.

It also added four bond funds: the Vanguard Global Corporate Bond Index fund, the Vanguard UK Investment Grade Bond Index fund, the Amundi JP Morgan GBI Global Government ETF and the Amundi UK Government Bond ETF.