FE fundinfo Alpha Manager Terry Smith’s Fundsmith Equity has dropped down the list of funds being bought by interactive investor customers, falling out of the top 10 list of most bought funds for August.

It marks the first time the veteran stock picker’s £24.1bn portfolio has been absent from a monthly top 10 since the firm started tracking the figures in 2018.

In recent years, the fund has not lived up to the spectacular long-term gains to which investors had become accustomed.

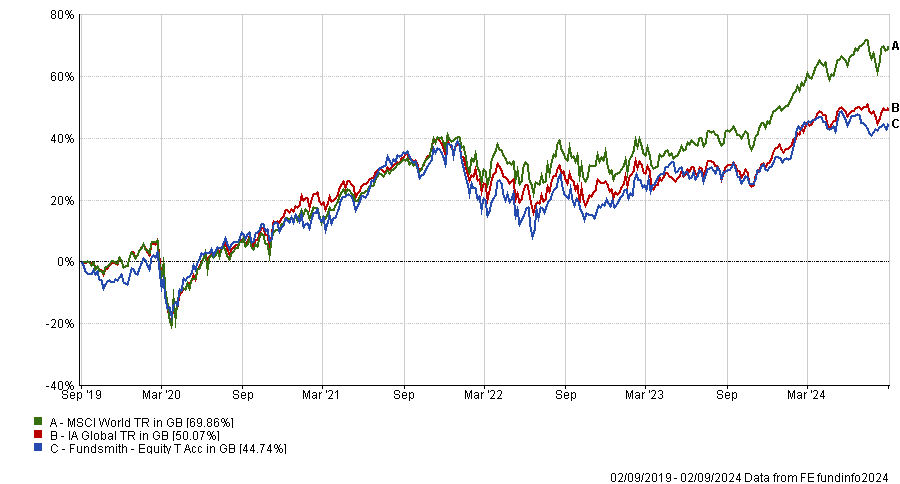

Fundsmith Equity has failed to make a top-quartile return against its IA Global peer group since 2019, with two second-quartile years (2020 and 2021) followed by two third-quartile efforts. As such, over five years it lags both the sector average and the MSCI World, as the below chart shows.

Performance of fund vs sector and MSCI World index over 5yrs

Source: FE Analytics

The fund is below average again this year, while over the past six months it has been completely flat. Despite this, the fund remains the fourth best in the sector over 10 years.

Not all popular funds are struggling to gain investors’ attention, however. The Vanguard LifeStrategy range boasted three funds on the most-bought list, with the 80% Equity fund the most popular of the trio, sitting in second place.

Taking the top spot was L&G Global Technology Index Trust. The £3.3bn passive fund tracks the FTSE World Technology Index and uses a full replication method, meaning it buys all of the stocks in the index at the same weighting as the benchmark.

It has been a strong option for investors over all timeframes, sitting in the top quartile of the IA Technology & Technology Innovation sector over the past one, three, five and 10 years.

The fund has undoubtedly been boosted by recent market trends, with tech giants leading the charge in markets on the back of an artificial intelligence (AI) boom that has made it difficult for active managers to outperform.

Analysts at FE Investments recommend the fund, noting that L&G as a firm has “over £200bn of assets under management in its passive products”, placing it amongst the “global leaders” and granting a “significant economy of scale when it comes to placing trades or spreading the costs of infrastructure”.

Passive investing was the theme of August, with just two active funds – Royal London Short Term Money Market and Jupiter India – making the top 10.

In the investment trust world, there was no lack of popularity for Scottish Mortgage, which retained the top spot as the most bought investment company last month.

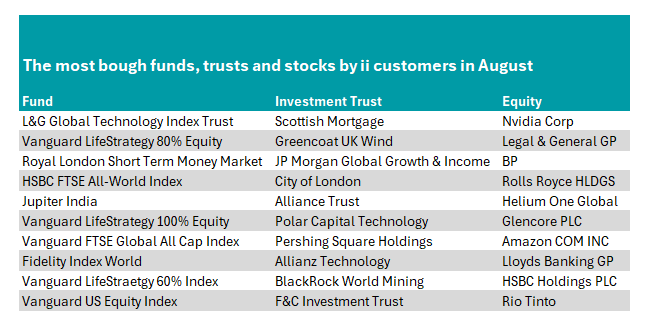

Stalwarts such as City of London, F&C were also among the top 10, as well as other more specialist names, such as Greencoat UK Wind and BlackRock World Mining, as the below table shows.

Source: Interactive investor

Lastly, turning to individual stocks, Tesla’s disappointing second-quarter earnings meant the electric vehicle giant dropped off the top 10 list entirely for August – despite holding third place in July.

But stock market darling Nvidia remained popular. Despite beating expectations in its results towards the end of the month, the volatility caused a fall in the share price. Investors were undeterred, however, making it the most-bought stock on the platform for the second month in a row.

Richard Hunter, head of markets at interactive investor, said: “August started shakily and ended strongly, providing some buying opportunities as the month progressed either to add to holdings or to buy on the dip, and ii customers took full advantage.

“At the centre of the volatility was the US market darling Nvidia, which not only was at the centre of a technology tempest but also reported its latest quarterly update which, despite beating expectations, resulted in a fall in the share price. The shares ended up 11% in August and are ahead by 148% in this year alone.”

Another ‘Magnificent Seven’ stock – Amazon – entered the top 10, while in the UK, investors increased their exposure to the “usual suspects”.

“Rolls-Royce remains well regarded by investors, adding another 7% in the month to now register a gain of 66% so far this year, while there was also a strong presence of the perennial income-generating stocks,” said Hunter.

“Legal & General, who also reported numbers in the month, currently has a dividend yield of 9.2% and was joined by the likes of BP (5.3%), Lloyds Banking (5%), HSBC (7% and 9.4% including special dividends) and Rio Tinto (7%).”