Emerging market equities are often considered to be the riskiest of the world’s stock markets but for the past decade that assumption has not held true.

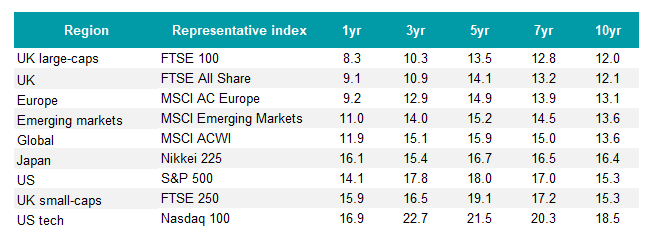

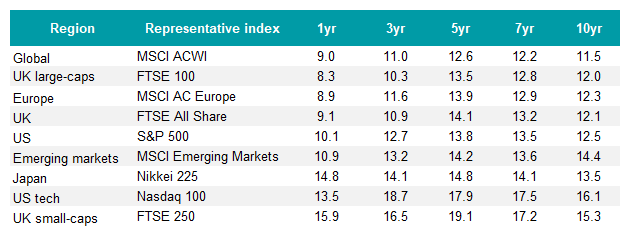

US equities – a region increasingly dominated by mega-cap tech stocks – have been more volatile than emerging markets in local currency terms by a considerable margin, as the table below shows.

Annualised volatility over different time periods in local currency terms

Source: FE Analytics

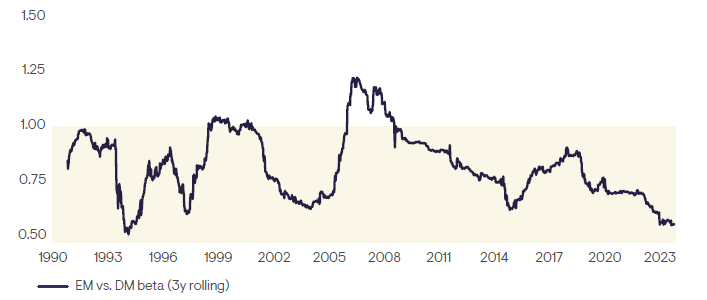

Sahil Mahtani, a strategist at Ninety One’s investment institute, said: “Investors need to re-examine their prior beliefs. Emerging markets have a lower beta to developed market (DM) equities outside of crises, have had lower volatility relative to developed equities in recent years and exhibit lower correlations to DM equities than most comparable asset classes of that size.”

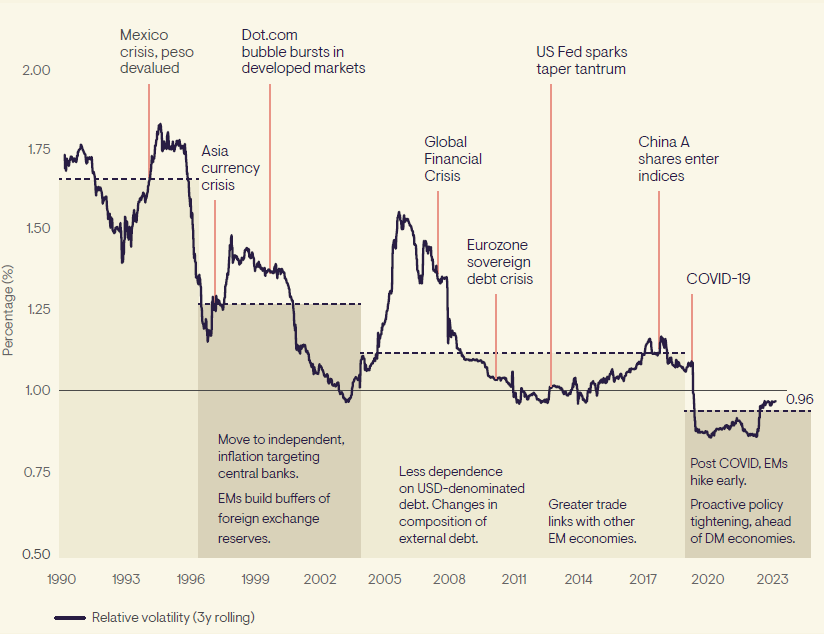

Emerging market vs developed market volatility

Sources: Ninety One, Bloomberg, MSCI, data to 31 Dec 2023

The largest emerging markets “embraced reform after the crises of the 1990s” and have built stronger economies, bringing them “closer to developed markets in terms of governance and frameworks”, he explained.

“Substantial progress has been made across macroeconomic and corporate fundamentals and market structure – one reason why emerging markets outperformed during the period of monetary tightening that began in late 2021.”

The “notable broadening and deepening of liquidity” has been accompanied, at the corporate level, by “a push for higher standards of operating performance and corporate governance, which have helped to drive the rise of companies based in emerging markets, which are global leaders in their industries”, Mahtani added.

Emerging market vs developed market beta

Sources: Ninety One, Bloomberg, MSCI, data to 31 Dec 2023

Emerging markets also have a bad reputation for corporate flare ups and scandals but, as renowned emerging market investor Mark Mobius explained recently, these can happen anywhere in the world.

On the other side of the equation, the S&P 500 has become more volatile and more concentrated. The ‘Magnificent Seven’ tech stocks account for 32% of the index’s three-year volatility, said Michael Nizard, head of multi-asset at Edmond de Rothschild Asset Management.

Ben Jones, director of macro research at Invesco, added: “Since the US is the most richly valued of [the developed] markets, it may be expected to experience greater volatility on negative news flow.”

Macroeconomic factors are also fuelling volatility across developed markets that Jones said can “no longer rely on an ever-supportive central bank to lower rates or pump liquidity into the system at the first sign of trouble”.

However, although emerging markets have been less volatile than the US, they have suffered larger drawdowns – so on that measure, they are riskier.

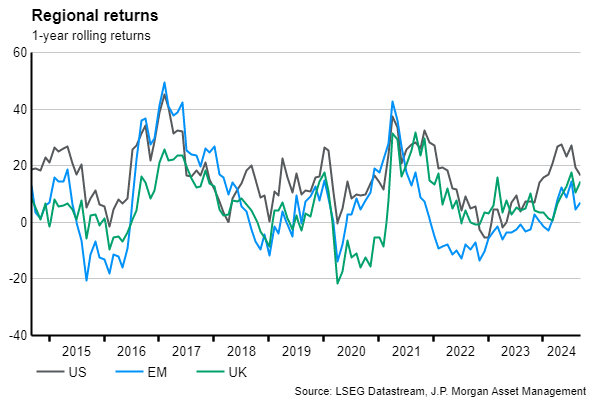

Hugh Gimber, global market strategist at JPMorgan Asset Management, said that during the past decade, “US equities have been in negative territory for one-year returns about 5% of the time. In contrast, for emerging markets and the UK, the same statistic is 38% and 25%”.

The chart below shows rolling one-year returns and “while the grey line [representing the US] is a little more jagged than the blue or the green, US equities have also suffered far smaller downturns”, he explained.

Mahtani acknowledged that emerging market equities can be particularly vulnerable to sell-offs in times of crisis, but that has blinded investors to their diversification benefits, he argued.

“Under normal conditions, emerging markets tend to be less risky than people think. However, during significant crises, the potential losses can be greater. Notions of ‘decoupling’ in times of crisis were always unrealistic. Focusing on these short-term sell-off windows ignores the diversifying benefits that emerging market equities can offer under all other market conditions,” he stated.

Another factor at play is currency risk, which had a significant impact on how investors based on different sides of the Atlantic experienced volatility during the past decade.

Sterling investors would have experienced more volatility in emerging markets than in the tech-heavy US, as the table below illustrates, but the reverse is true for dollar-based investors and in local currency terms.

Annualised volatility over different time periods in sterling terms

Source: FE Analytics

Then there is the risk/return trade-off to consider. Volatility is not a bad thing if investors are rewarded for the risks they take.

Jones said: “Much of the positive news in the past couple of years has been around artificial intelligence and that has meant more upside volatility for US stocks.”

Emerging markets have underperformed other regions during the past decade but Mahtani attributed that to idiosyncratic factors, such as China’s property issues and government interference on tech, which he expects to play out differently going forward.

“Looking ahead, we anticipate that the drag on returns from sectors such as materials, energy, and financials will stabilise, while the emerging market tech sector will be the home of many winners,” he said.

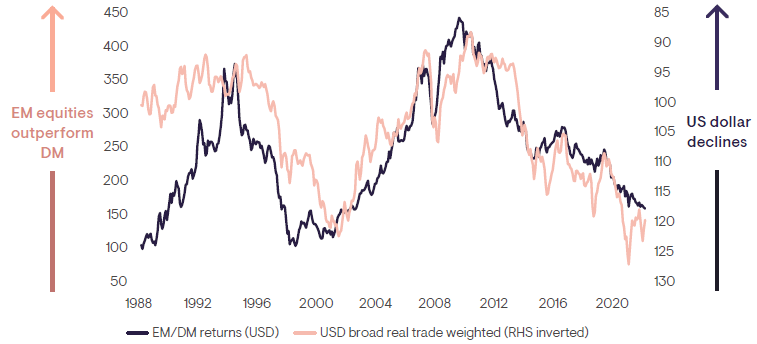

Emerging market equities tend to outperform strongly in dollar downcycles, something that appears to be happening at present with the Federal Reserve poised to cut rates.

“Following a peak in the US dollar, emerging market equities have typically risen by 30-50% in the following six to 12 months,” Mahtani said.

The relative performance of emerging vs developed market equities compared to US dollar strength (1988-2022)

Sources: Ninety One, Bloomberg, data to 31 Dec 2023