The potential for undervalued mid- and small-caps to lead the UK’s recovery has been widely touted, yet Artemis’ Ed Legget thinks large-caps are a better place to be.

“Today we’ve got more large-caps in the fund than I’ve ever had in my career,” said Legget, an FE fundinfo Alpha Manager who has been running money for 20 years.

“A lot of the very large stocks offer free cash flow yields that – other than at times of extreme stress such as Covid and the great financial crisis – we haven’t seen before in our careers.”

Shell and most of the UK’s large banks are offering distribution yields in the teens, he added, yet their valuations are on “huge” discounts compared to international peers. Shell is worth 40% less than ExxonMobil, depending on the metrics used.

“HSBC is forecast to make broadly the same amount of money as Bank of America this year but it has half the market cap. We’d argue that HSBC’s balance sheet is much stronger in terms of capital ratios. Its dividend yield and cash distribution are much higher because it’s valued at a much lower multiple.”

Around 75% of his £2.6bn Artemis UK Select fund is in large-caps, not least because some of his mid-cap stocks have graduated into the FTSE 100, including Vistry and Weir.

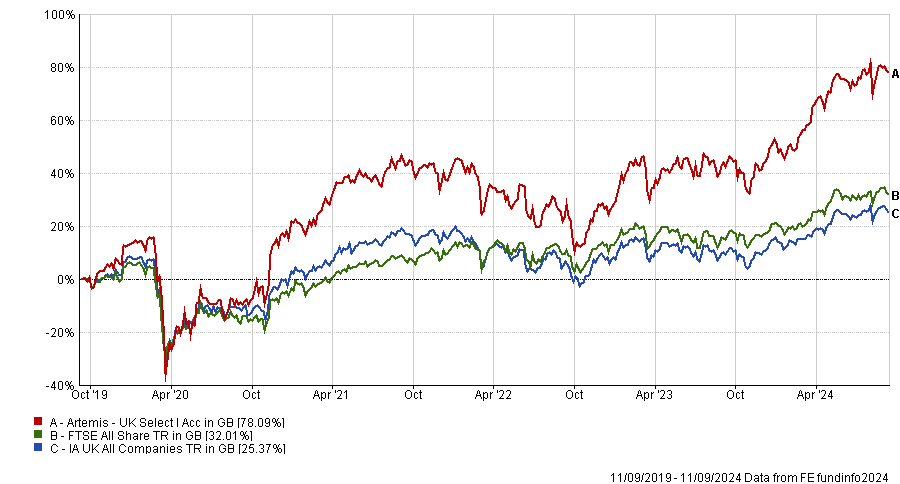

The fund is the top performer in the IA UK All Companies sector over five years to 11 September 2024 and the third-best over 12 months.

Performance of fund vs benchmark over five years

Source: FE Analytics

What is your process?

The portfolio holds 40-50 stocks and we’re 100% focused on compounding long-term returns. In contrast to a few of the funds we get compared to, we are genuinely multi-cap and today we have more large-caps in the fund that I’ve ever had in my career, which reflects where we see the best opportunities from a risk/reward perspective.

We fundamentally believe that, over the long term, our returns are going to correlate very closely with the underlying free cash flow generation of the companies we own. We try to keep a constant three-year time horizon and we are looking for companies whose earnings and free cash flow progression is going to be better than consensus.

We focus a lot on the macroeconomic outlook as well. You can’t look at a company in isolation from what’s going on in the world. You can’t have a view on a housebuilder without having a view on interest rates, the planning regime, mortgage availability, economic growth and unemployment.

What is your current macro outlook?

The savings rate in the UK is currently running at 11% – the historical long-term range is between 5% and 7.5% – and every one percentage point reduction in that savings rate means over £10bn flowing into the UK economy. That’s the prize for the current government if it can get growth going, plug the deficit, meet its spending and tax commitments and build confidence in the economy.

Real wages are growing and the outlook has become clearer following the election and the first rate cut from the Bank of England. As a result, we think there’s scope for the UK consumer to start saving less and spending more. Therefore we like domestic consumer cyclicals such as Next and pub group Mitchells and Butlers.

What is your outlook for the banking sector?

Banks are incredibly undervalued and we own all five large UK banks. Because of the way they hedge their balance sheets, it takes a long time for the interest rate rises we’ve seen to fully earn through into the profit and loss account, so we expect them to continue to see net interest income and top-line growth into 2025 and even 2026. If the economy does pick up, we might start to see some loan growth as well.

HSBC trades on 6x earnings, it yields 7.5% and, on top of that, you get a special dividend because it sold its Canadian business, as well as 6% in buybacks. Meanwhile, NatWest has retired 30% of its equity in two and a half years.

What was your best performing stock in the past year?

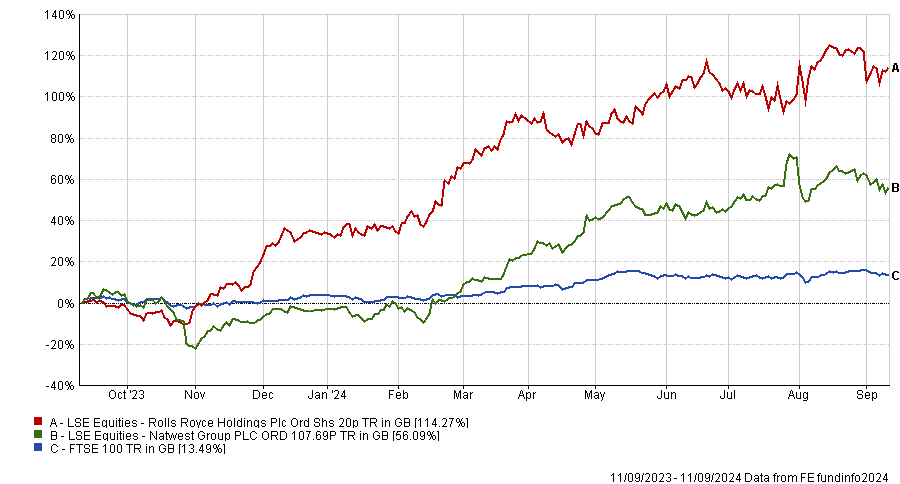

The best performer was Rolls-Royce, which was up 123% in the year to 31 August and was the second-largest contributor to the fund’s performance.

It has been a good story over the past 18 months but a tricky story for the past 10 years. Going forward, it has an exciting combination of strong and visible end-market growth across not just civil aerospace but also its defence and power systems businesses. This is a restructuring story led by a board that now has much more industrial experience and we believe there is a lot of potential for growth, profits and cash flow ahead.

NatWest was the largest contributor in percentage terms for the fund because it was a bigger holding.

Performance of stocks vs FTSE 100 over 1yr

Source: FE Analytics

Which stock detracted the most from performance?

The largest detractor was sports betting company Entain, which owns Ladbrokes and Coral and is down 43% for the year to 31 August. It has lost market share in the US where its BetMGM joint venture’s products and technology have fallen behind its larger competitors, Draftkings and FanDuel. There were also regulatory headwinds in the UK and Australia.

Entain now has a new chief executive coming in and a new chair, and there are signs that the operating performance of the business is starting to turn around, so we are hopeful we can claw back some of the value lost there.

What do you enjoy doing outside of work?

Cooking, travel, sailing, golf. I’ve got two sons so I spend a lot of time on touchlines.