Emerging markets, commodities and UK equity income funds could all be good options for domestic investors if the dollar continues to slide, according to Dennehy Wealth chartered financial planner Ruairi Dennehy.

Currency can be oft-forgotten by investors but can have big implications for overall returns. UK investors will be exposed to the dollar through US equity trackers and will have benefited smartly from the rising American currency.

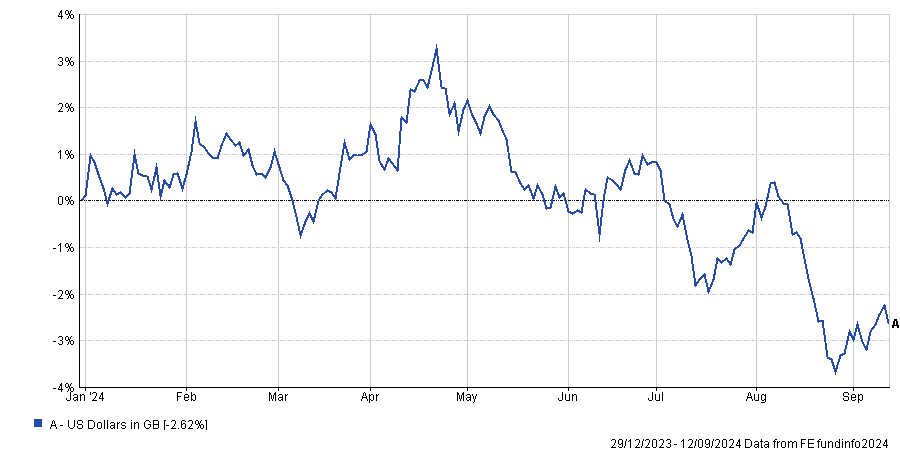

But there are signs this is reversing. So far this year the dollar is 2.6% lower against the pound, but it is 5.7% down from its highs in April, as the below chart shows. Expectations that the Federal Reserve will cut interest rates this week have contributed to the fall.

Performance of currencies YTD

Source: FE Analytics

Darius McDermott, managing director at FundCalibre, said: “While the dollar has dominated as the global reserve currency for decades, there have been market signals that the status quo may be changing.”

Investors therefore may be able to move away from the US stalwarts into other areas that are in line to benefit from this shift.

Asia and the emerging markets

The first place to look is Asia and the emerging markets, which could be set for a big upgrade if the dollar weakens, benefitting both equities and bonds.

Companies from the region tend to take out their debt in dollars but trade in local currency, so a weaker dollar will lower the burden of interest payments. It will also mean cheaper commodities, which are priced in dollars, and improve the competitiveness of their own exports.

“Historically, there has been a very high inverse correlation between the dollar and emerging market equities (a five-year correlation of -0.33),” said Dennehy.

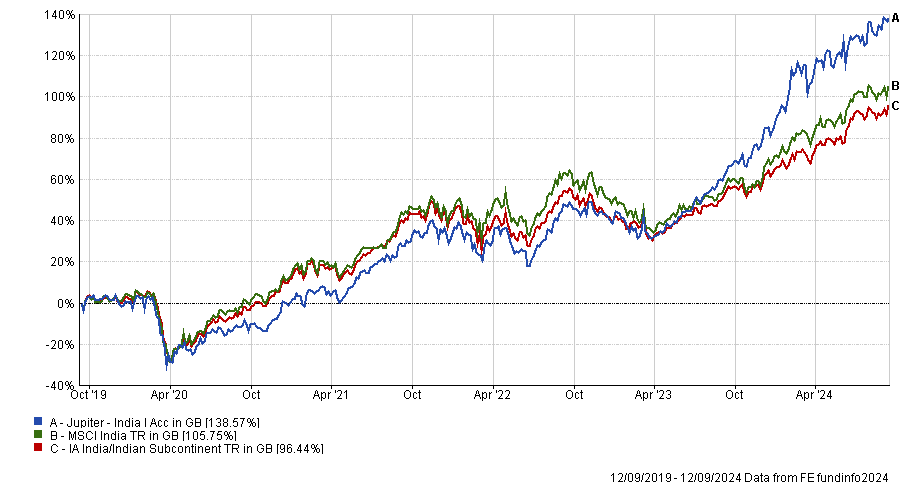

He is a “long-term fan” of India and suggested the Jupiter India fund as one that has “consistently delivered returns to those who are happy to ride out the volatility in the market”.

Indeed, the fund has been the best performer in the IA India/Indian Subcontinent sector and is in the top three over three and five years.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

Those after a slightly broader geographical allocation may prefer Artemis SmartGARP Global Emerging Markets Equity, while “for those more pessimistic about a Chinese resurgence, even in the wake of a weaker dollar”, the Invesco Emerging Markets ex China fund could also fit the bill, Dennehy said.

McDermott suggested Carmignac Emerging Markets. “The fund’s active, benchmark-agnostic approach within the diverse landscape of emerging markets has provided excellent performance since its inception,” he said.

For exposure to Asia specifically, he picked Federated Hermes Asia Ex Japan Equity, a “flexible strategy, which differs from many peers [and] has yielded impressive results historically”. Manager Jonathan Pines “adopts a distinctive investment approach and is willing to buy all types of companies if the price is right”, he explained.

Commodities

Another area that investors could consider is commodities, Dennehy said. “Raw materials, which are priced in dollars, become more affordable to foreign buyers when the dollar declines,” making them more attractive.

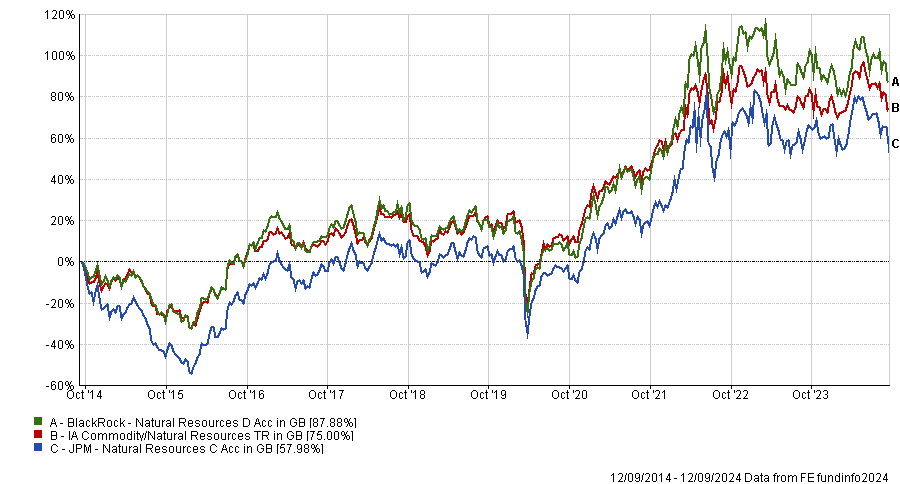

“Obvious” commodity fund choices are JPM Natural Resources or BlackRock Natural Resources. The latter has been the better performer over three, five and 10 years, although the former takes the edge more recently, as the below chart shows.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

Of the commodities, Dennehy said gold in particular has an inverse correlation with the dollar. “They have a tendency to move in opposite directions as gold is seen as a hedge against a weakening dollar,” he said.

Options here include iShares Physical Gold ETF, which he said “can give investors direct exposure to a continued gold recovery”, while a “slightly less volatile option” could be the BlackRock Gold & General fund.

McDermott added that countries such as China are becoming “increasingly wary” of holding too many US dollar-denominated assets.

“They fear the US could potentially ‘confiscate’ those reserves, as happened with Russia's reserves after the Ukraine invasion. This is eroding trust in the dollar and causing central banks – particularly China’s – to start buying gold,” he said, which could add additional support to the gold price.

UK equity income

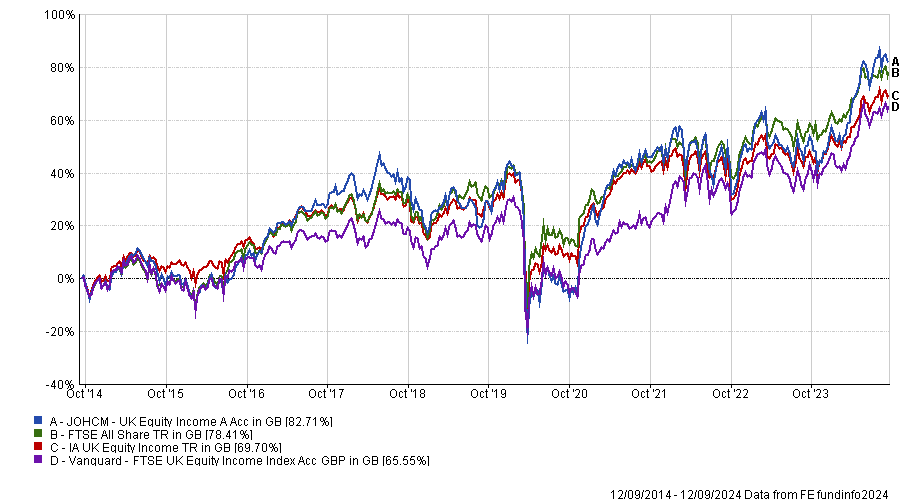

When the US Federal Reserve initiates monetary easing, which it is expected to do this week, “higher-yielding equities will be attractive as dollar interest rates fall,” said Dennehy. Here he suggested two UK options: JOHCM UK Equity Income or Vanguard FTSE UK Equity Income. “Both deliver strong yields and have performed well over the past year in the wake of a fledgling dollar,” he noted.

Indeed, both have been top-quartile performers in the IA UK Equity Income sector over the past 12 months, although the former has the edge over longer timeframes, as the below chart shows.

Performance of funds over 10yrs

Source: FE Analytics

“There is more than just a suppressed dollar at play; from the UK side of things there has been renewed optimism about the injection of growth from the new government that has been absent in the prior years, and the eye-wateringly cheap valuations in the UK are clear, as we can see by the consistent flow of M&A activity in the UK over the past 18 months or so,” Dennehy concluded.