China is on the cusp of developing its own domestic technology, which could rival the best international competitors. Innovation in the tech sector is a major reason why the Guinness Asian Equity Income fund has gone overweight China – a contrarian position, given many other managers’ bearish views of the struggling Chinese economy.

China relies mostly on repurposed technology and machinery at present but it has the potential for innovation that could catapult its economy to the next level, said Edmund Harriss, chief investment officer of Guinness Global Investors.

For instance, Chinese companies can produce semiconductor chips to levels matching Taiwan and Korea, exceeding expertise in the US, even if Chinese companies still have to use repurposed infrastructure.

“China is catching up and it is keeping pace,” he said. “There’s only so much technology you can steal; at some point, you have to develop your own.”

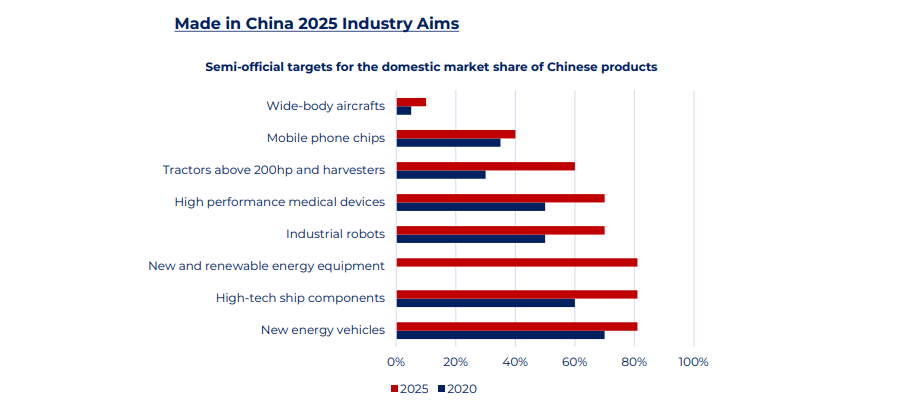

The semiconductor industry has prospered under the Made in China government initiative introduced in 2015, aiming to modernise China’s industrial capacity and end the region’s reliance on international technology. As part of this strategy, China is focussing on the ‘industries of the future’, including medical devices and renewable energy sources.

Made in China 2025 industry aims

Source: Made in China 2025, Industrial Policies: Issues for Congress, Congressional Research Service (2023)

“These are areas where China’s limited labour force, with a high set of skills, can now be repurposed and combined with capital, to take China from a middle to a higher income economy over the next 10-15 years,” he explained.

China represents 34.4% of the £186.8m Guinness Asian Equity Income fund, its second-largest overweight position. The Guinness team’s bullish outlook for the tech sector, which it perceives as an underappreciated opportunity, is a major part of the investment thesis.

The fund focusses on companies that have generated profits over the long-term (eight years) with strong dividend growth and a decent yield. Guinness has found several Chinese companies that meet its criteria, including medical technology specialist China Medical Systems.

The expertise of Chinese academics in several technology-related fields is another reason underpinning Harriss’ conviction. Chinese academics are currently cited in 55% of all publications relating to electric batteries and 68% in the top 10 publications. By comparison, US academics are referenced in just 10% of the top 10 publications. This expertise is reflected in China’s 80% market share in electric batteries.

In artificial intelligence (AI) and hardware innovation, Chinese academics are now cited in 31% of the top 10 publications, compared to just 14% from US thinkers.

These developments have contributed to China’s growing economic complexity, rising from the 46th country in the Economic Complexity Index in 1995 to the 19th in 2021.

Economic Complexity Index (ECI) Ranking

Source: Harvard Growth Lab – The Atlas of Economic Complexity, Observatory of Economic Complexity

Nevertheless, although Harriss believes that China’s future is brighter than many expect, he acknowledged that the country faces myriad challenges. Consumer confidence is low and the time needed for new technologies to scale up is limiting progress.

“China’s economy is in a transition from old-style debt-fuelled growth into more productive areas, but it’s a painful transition,” he added.

While China is poised to become a powerhouse in the long-term and many companies are undervalued, investing there remains challenging. Harriss argued that careful stock picking – rather than a catch-all approach such as passively tracking an index – is a better way to get into position for when the market surges. “Buying China is not the way forward, it comes down to the stocks you choose”, he concluded.