Infrastructure, housebuilders, small- and mid-cap stocks and dividend-payers should all benefit from interest rate cuts during the remainder of 2024, according to BlackRock. The manager also has a favourable outlook for the healthcare sector.

Yet the turbulence characterising the summer months has not completely dissipated, said Helen Jewell, chief investment officer of BlackRock fundamental equities, EMEA.

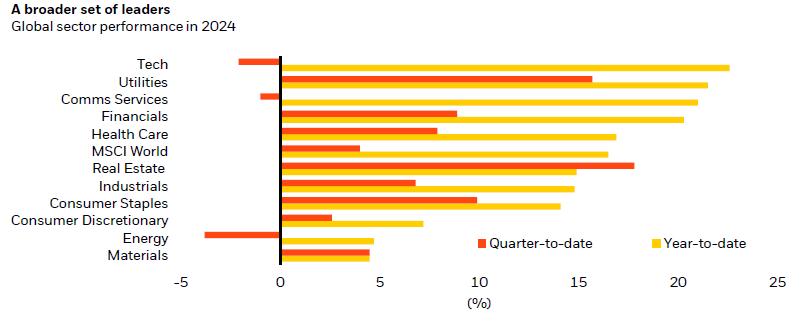

During the “tumultuous” third quarter, investors rotated from cyclical stocks into more defensive names such as financials and utilities, which “rose up the performance rankings as global market leadership extended beyond tech.”

Source: BlackRock Investment Institute, data to 17 Sept 2024

She expects this dynamic to continue. “Worries around recession and AI may result in more volatility and further broadening in market leadership as investors seek to diversify portfolios,” she said.

Below, she highlights the sectors she expects to prosper during the remainder of this year.

Rate-cut beneficiaries

Areas that suffered during the rapid rate-hiking cycle and were weighed down by borrowing costs and mortgage rates, such as construction and housing, are poised for a reversal of fortunes.

“Some recent earnings calls in these sectors highlighted green shoots of activity in both the US and parts of Europe, including areas such as the Nordics where construction was severely impacted by higher rates,” Jewell said.

In the UK, housebuilders have the additional tailwind of supportive government policy.

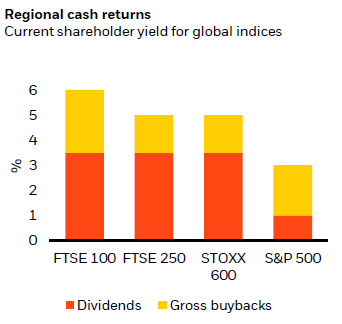

Companies that offer stable sources of income are likely to become more popular amongst investors as bond yields decline. “This is another reason we believe the UK is worth a look – the FTSE 100 has a current shareholder yield (dividends plus buybacks) of 6%, versus 3% for the S&P 500,” she noted.

Source: Goldman Sachs Global Investment Research, BlackRock, Sept 2024

Across Europe, small- and mid-caps remain attractive given their propensity to benefit from falling rates as well as their cheap valuations, she added.

Infrastructure

Infrastructure stocks are slated to be another winner in an environment of moderating inflation and rate cuts. Because these companies are capital intensive and “a significant amount of equity value is driven by long-term cash flows”, their valuations are inversely correlated to bond yields.

With valuations currently languishing at levels comparable to the 2008 global financial crisis, this is an attractive entry point for investors, she said.

Over the longer-term, the ‘four D’s’ of decarbonisation, deglobalisation, demographics and digitalisation should bolster the sector further.

Earnings resilience

With market volatility still on the horizon, BlackRock is sticking with companies that have long-term earnings resilience. This includes large technology and semiconductor companies profiting from increased AI spending, as well as more cyclical areas, such as construction and industrials, that should benefit from decarbonisation.

“This emphasizes the importance of selectivity. There's a clear divide between those companies that have exposure to energy efficiency, electrification, data centre demand and automation, and those that don’t – and are therefore more vulnerable to an economic slowdown,” Jewell explained.

Healthcare

The healthcare sector is going through a period of rapid innovation in the fields of obesity medication, atrial fibrillation treatments and oncology drugs. Obesity drugs could be worth more than $100bn in sales in the US by 2030, Jewell noted.

Ageing populations are boosting demand for healthcare, underpinning earnings for the sector and making it more resilient to market cycles and periods of geopolitical tension. Many healthcare companies already deliver stable income streams to their shareholders and long-term demographic trends are supportive of this dynamic.

All that said, many companies within the healthcare sector, such as vaccine makers, have had a tough couple of years since supply/demand dynamics were warped by the Covid pandemic.

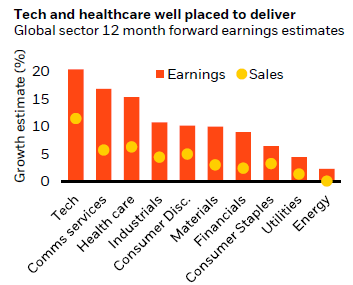

The sector is now going through a cyclical recovery. As a result, “healthcare earnings are expected to lead most sectors over the next 12 months, while the sector is available at a 5% discount global stocks,” Jewell pointed out.

Source: BlackRock Investment Institute, Sept 2024