The past three years have seen a reversal of fortunes for fixed income funds. Central banks’ decisions to slash interest rates this year bode well for the asset class, as lower interest rates should enable bonds to deliver higher total returns.

Several fixed-income strategies have proven impressive amidst these turbulent market circumstances, with some even recovering from weak long-term performance to produce stellar numbers more recently.

As part of an ongoing series, Trustnet looks at the funds that have rallied from bottom-quartile performance over 10 years to top-quartile performance over three.

Below, we look at fixed-income funds across the IA Sterling Corporate Bond and IA Sterling Strategic Bond sectors.

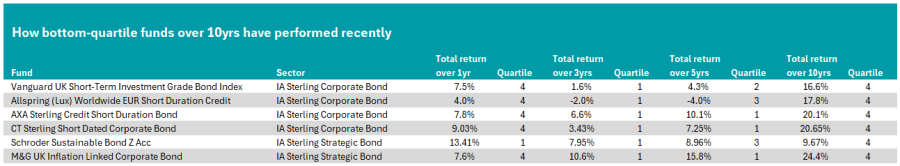

How bottom quartile funds over 10yrs have performed recently

Source: FE Analytics

In the IA Sterling Strategic Bond sector, just two funds meet our criteria of moving from bottom to top-quartile performance over the past three years.

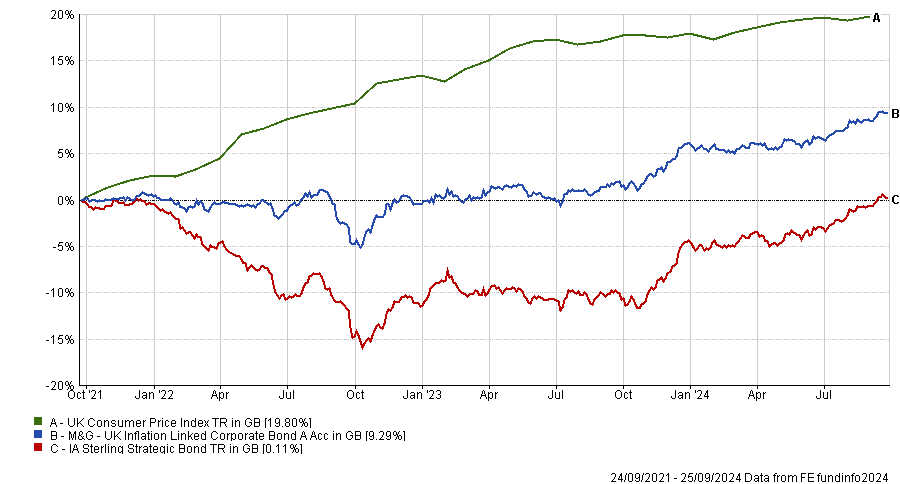

Of those two, the most interesting is the £813m M&G UK Inflation Linked Corporate Bond fund, managed by Ben Lord and Matthew Russell.

The portfolio has an FE fundinfo Crown Rating of five. It has rallied from the bottom 10 funds in its sector, returning 24.4% over 10 years, to a top-five performance of 10.6% over three years. Additionally, the fund delivered a top-quartile effort over the past five years, rising by 15.8% in total.

Performance of fund vs sector and benchmark over 3yrs

Source: FE Analytics

Unlike more conventional corporate bond funds, this strategy came into its own when inflation spiked in 2022. Given its low sensitivity to movements in interest rates, it was not hampered by rate hikes that year. Therefore, the fund boasted a particularly strong 2022 compared to peers, falling by just 0.4% that year.

The fund invests directly in high-quality, inflation-linked corporate bonds, as well as gaining indirect exposure by combining inflation-linked government bonds with derivatives. It also holds floating rate notes.

Analysts at Square Mile, who have given the fund an AA rating, said “there are very few funds of this ilk” giving investors “rare access” to inflation-linked corporate bonds.

“We believe that the fund is both intelligently structured and capably managed to navigate inflation, credit and interest rate markets to the benefit of investors seeking inflation-protected returns over three to five-year time horizons,” they concluded.

The fund’s shorter-term record has failed to impress, however, dropping to the bottom quartile versus peers over the past year.

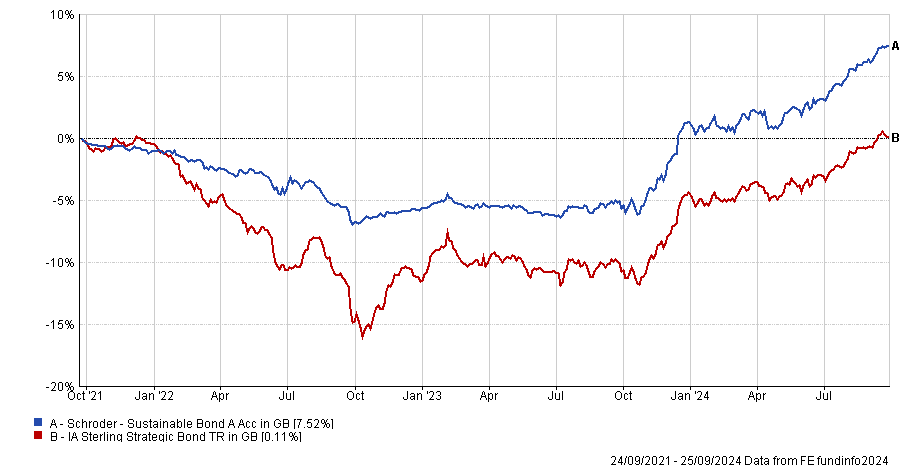

Another example of a strategic bond fund which rallied over three years was the four Crown-rated £67.1m Schroder Sustainable Bond strategy.

It was the second-worst performer in the whole sector over 10 years, but it produced a top-quartile effort over three years, up 8%, and remained in the top-quartile for the past year.

Performance of fund vs sector over 3yrs

Source: FE Analytics

Turning to the IA Sterling Corporate bond sector, a further four funds match our criteria here.

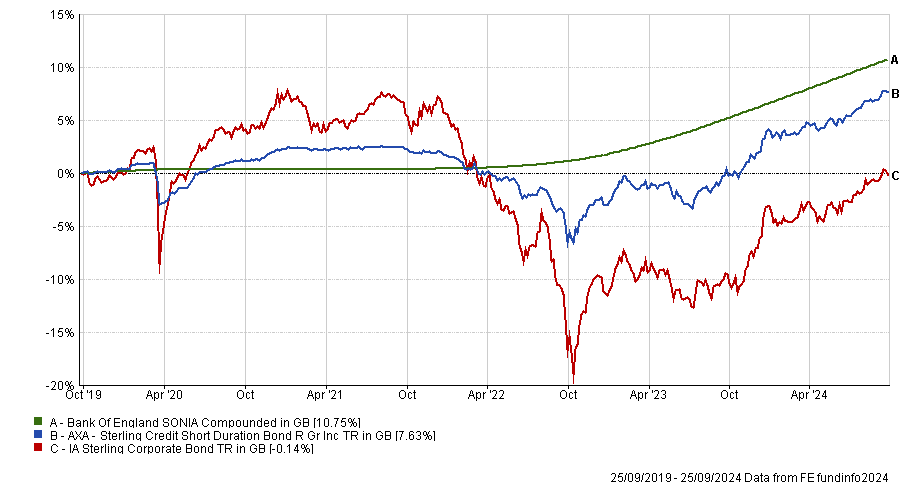

First is the £895m AXA Sterling Credit Short Duration bond, led by FE fundinfo Alpha Manager Nicolas Trindade.

The portfolio has enjoyed an impressive turnaround, rising from the seventh-worst track record in the peer group over 10 years, to the third-best result of 6.6% over three years. Its five-year performance is also impressive, with the fund up by 10.1%, making it the fourth-best in the sector.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

The fund's defensive strategy has enabled it to weather difficult market circumstances and recover much better than competitors in the corporate bond peer group.

It held up well in 2021 and 2022, falling by just 0.1% and 4.2%, respectively. Both years were challenging for other bond funds, with no fixed-income portfolio in the peer group enjoying positive returns in 2022, while just 10 funds rose in value in 2021.

Square Mile analysts gave the fund an AA rating, noting that while its focus on short-dated bonds means returns are lower, the portfolio successfully protects capital in line with its stated objectives.

“Whilst this fund is never likely to excite, it is also unlikely to produce any nasty surprises for investors,” analysts at Square Mile concluded.

Several other funds in the Sterling Corporate bond sector rebounded from struggling long-term performance and enjoyed first-quartile three-year returns. These included the £1.3bn Vanguard UK Short-term Investment Grade Bond Index, the £177.6m Allspring (Lux) Worldwide - EUR Short Duration Credit fund, and the £87.4m CT Sterling Short-dated Corporate Bond fund.