Commentators usually agree that opportunities in the UK market are broadly based, but there is one notable exception – resources, according to Alex Wright, FE fundinfo Alpha Manager of the Fidelity Special Values trust.

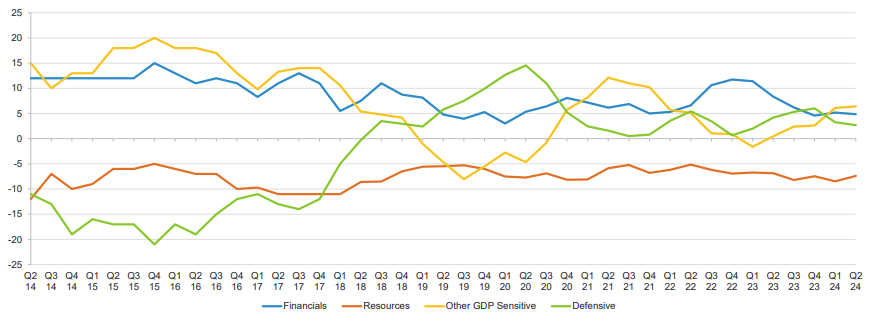

Among his main overweights are financials and defensive companies, but the only real underweights are resources and energy, as the chart below shows.

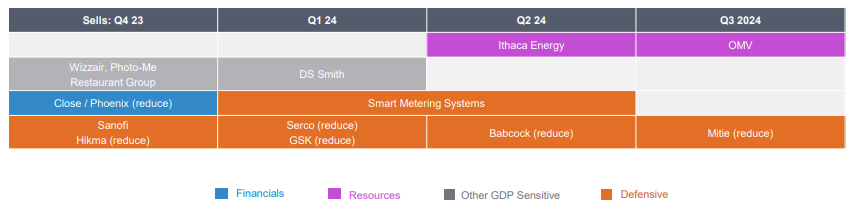

Fidelity Special Values portfolio cuts

Source: Fidelity International

“We are actually overweight in all areas except resources, which we’ve been selling for the past 18 months,” Wright said.

The sector has done well recently, which was one reason why the manager decided to take profits. Despite the cuts, the trust still maintains a “reasonable” 5% exposure to oil companies. Mining, however, remains “a structural underweight” – the manager does not own any of the three top UK miners Glencore, Rio Tinto and Anglo American.

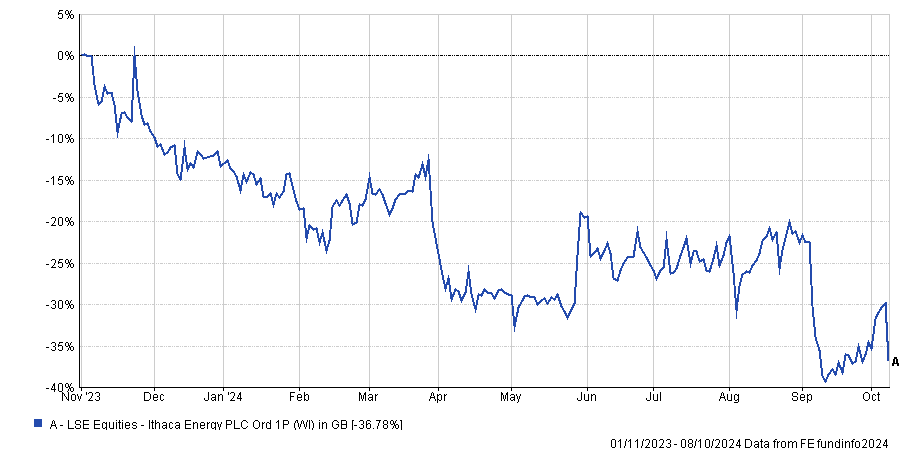

Two examples of energy companies that he has sold in the past six months were Ithaca Energy and OMV AG. The former was bought at IPO in November 2023, as Wright told Trustnet, and since then, its share price dropped by almost 40%, as the chart below shows.

As for OMV, back in 2023, when Wright bought into it, he was “particularly excited” about its gas business, predicting that the price of the commodity would remain structurally higher following the Ukraine war. In the past year, its share price has fallen 11.9%.

Performance of stock since November 2023

Source: FE Analytics

Another area where the trust has been “very heavily weighted in” and that was recently cut was support services, with names such as the multinational Serco, engineering services provider Babcock and facilities manager Mitie.

“All three of those are still in the fund today, but all three have done very well, with a real improvement in the earnings and stock-specific turnarounds,” so the positions were cut throughout 2024, as the table below shows.

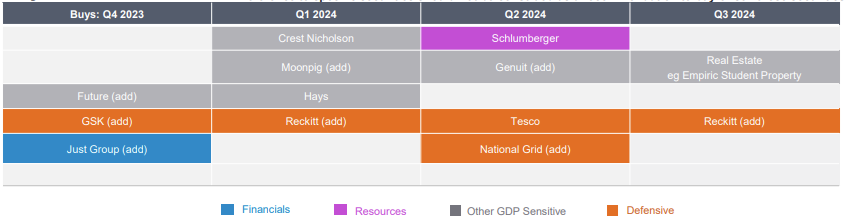

Fidelity Special Values' recent trades

Source: Fidelity International

Industrials remains a large weighting for the trust, but the manager highlighted how that encompasses lots of stocks – some more cyclical, such as Keller (the third-largest position, at 3.1%) and Coats Group; some non-cyclical, such as Serco, Babcock and Mitie.

Finally, with the bid to takeover Smart Metering Systems initiated last year by US giant KKR, Wright started selling out of the company – an operation that was completed in the second quarter of 2024.

As for where the manager is seeing the most value, the names he has been buying are predominantly mid-cap cyclicals, such as property developer Crescent Nicholson, online gift shop Moonpig and plastic piping systems manufacturer Genuit.

Some real estate companies were on the buying list too, including Empiric Student Property, as well as defensive names such as Tesco, which entered the portfolio as a new position in the second quarter.

National Grid was also bought “substantially” on the announcement of the rights issue in May 2024, when the company issued new shares equivalent to 29% of its share capital at a 35% discount to the ex-rights price.

Fidelity Special Values portfolio additions

Source: Fidelity International

The company is not the only large-cap in the trust, which he explained “isn't just about cyclical and mid-caps”. Another large utility in Fidelity Special Values is SSE, and in healthcare, Wright prefers Roche (the second-largest holding at 3.2%) over AstraZeneca, which he does not own “primarily on valuation grounds, as it is very well loved,” he said.

At 4.1%, the top holding in the trust is Imperial Brands (formerly Imperial Tobacco), a call that is “quite differentiated from the average fund”.

The fourth-largest holding is NatWest, as the manager “still sees a lot of value” in financials, which is also the largest sectorial position, making up about 28% of the fund.

Similarly to industrials, the allocation is diversified across multiple individual positions, including banks (beyond NatWest Barclays, Standard Chartered and the Irish bank AIB), insurance, (both life and non-life, motor, reinsurance) and a few real estate names.

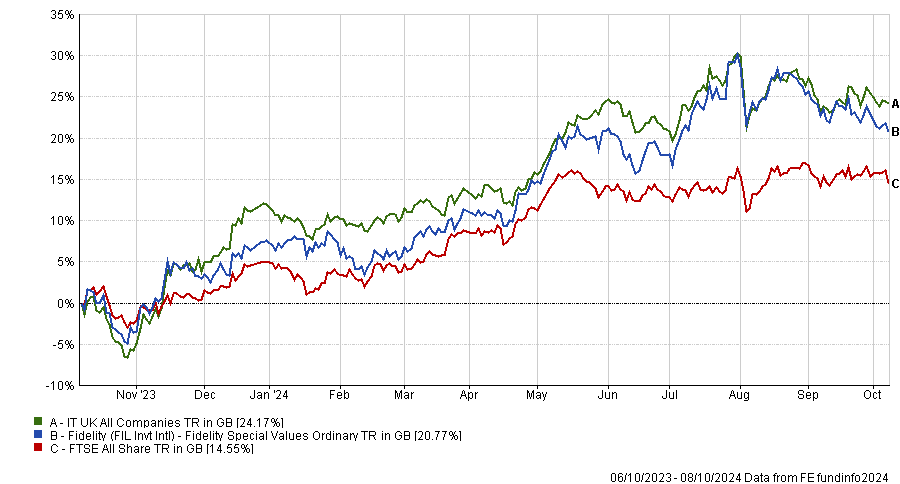

Performance of fund against sector and index over 1yr

Source: FE Analytics

Over the past year, Fidelity Special Values has beaten the FTSE All Share index by six percentage points, but was below the average peer, as the chart above shows.

Over the longer term, the track record improves: over the past 10 and three years the trust was the top name among the seven-strong IT UK All Companies sector and came in third overall (second quartile) over the past five years.