Equity income managers have to grapple with a dilemma. If their investable universe is limited to dividend payers, which tend to be stable, resilient companies that grow relatively slowly, how can they juice up returns?

Stephen Anness, head of Invesco’s Henley-based global equity team, said: “In income land, you might run the risk of having a lot of companies that look very similar. But what you miss is companies that grow a bit faster. You miss some companies which are going through some degree of market repair, such as Rolls-Royce. So we try to think differently about where dividends may be coming from in the future.”

The Invesco Global Equity Income fund navigates this issue by having a flexible mandate. Anness can invest up to 20% in stocks with higher growth potential, such as US tech, but a low dividend yield or no dividend at all. Then he can funnel up to 10% into companies he expects to resume paying dividends but which are going through challenges.

In the same vein, the fund pursues an all-weather approach, investing in companies at different points in their evolution, which are exposed to different market dynamics.

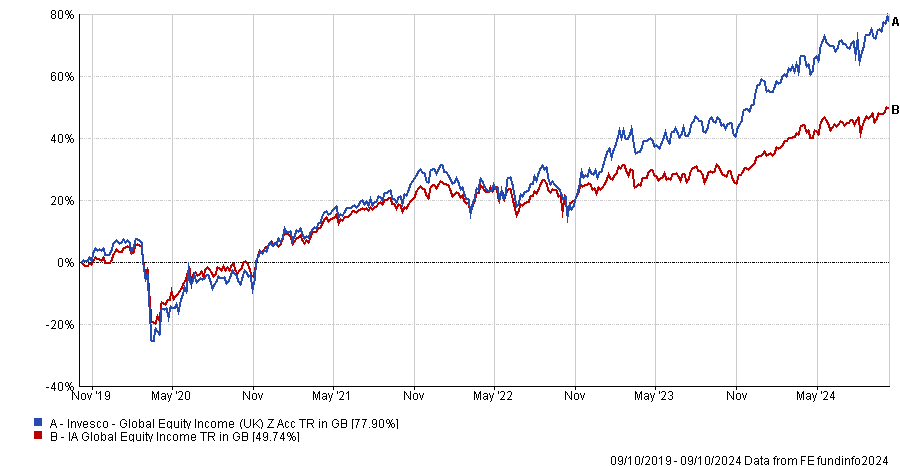

This philosophy has paid off. The fund is the third-best performing strategy in the IA Global Equity Income sector over both three and five years to 9 October 2024, according to FE Analytics. It is sixth over 12 months and seventh over 10 years.

Performance of fund vs sector over 5yrs

Source: FE Analytics

Below, Anness tells Trustnet why he recently invested in Coca-Cola Europacific Partners and London Stock Exchange Group and why he’s sticking with Norwegian oil and gas company, Aker BP despite its poor performance this year.

Please describe your investment process

At its simplest, we are trying to buy good companies on sale. They don't have to be the best companies, but there is a minimum quality threshold. A tailwind of growth is important to us, but we try to find companies whose valuations do not reflect their growth potential.

What is your approach to income?

The bulk of the portfolio is in dividend compounders, such as Coca-Cola. We're trying to find companies that have a reasonable starting yield, which can grow their dividends. That’s a powerful combination. We’re looking for high-single-digit to low-double-digit dividend growth.

We have some capacity in the portfolio to buy companies such as Nvidia or Microsoft with either a very low dividend yield or no dividend, if we think they can generate capital growth. We bought Nvidia in 2022 but we sold it a year later, which was too early.

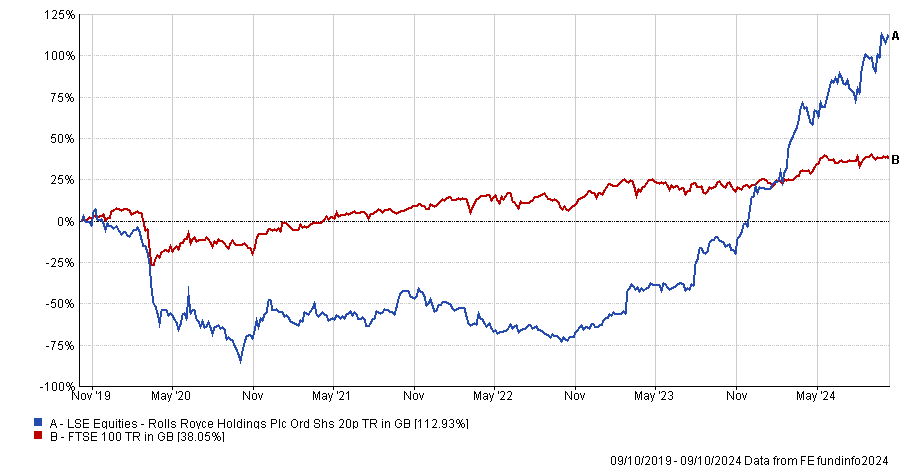

Finally, we can invest in companies we expect to initiate a dividend, such as Rolls-Royce.

The pandemic was an absolute nightmare for Rolls-Royce but the new management team has done a phenomenal job. One of their key tasks was to restore the strength of the balance sheet.

Rolls-Royce did that partly through an equity raise and partly through cash generation, and that led to credit rating upgrades, enabling the business to announce that it will pay a dividend early next year.

Rolls-Royce vs FTSE 100 over 5yrs

Source: FE Analytics

Which are your best performing holdings?

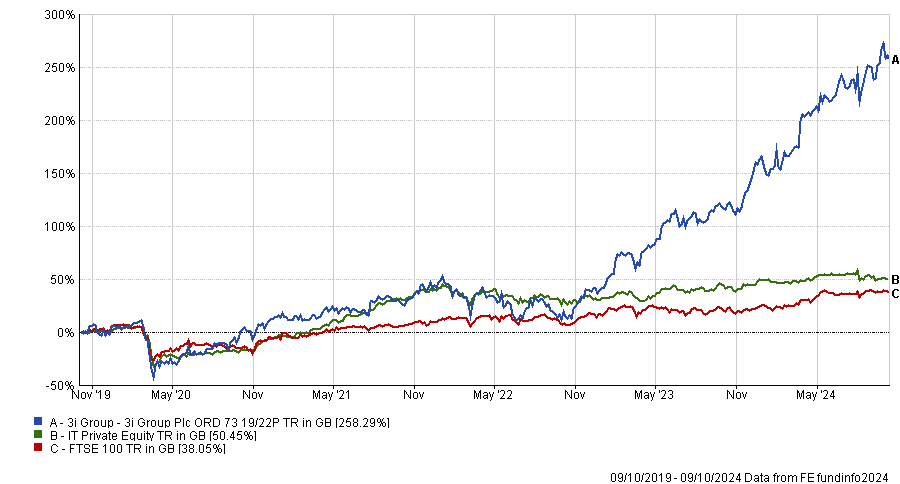

The three top positions over the past year have been 3i, Broadcom and Rolls-Royce. For all of these companies, the market has been through a reappraisal of how good they really are.

3i Group is the fund’s largest position. It has grown its dividend by 16.5% for the past three years and at an average rate of 12% over five years. We initiated the position in the autumn of 2020 at a starting yield of 3.5%, then we added to it when the yield was about 4%.

3i Group vs other private equity trusts and FTSE 100 over 5yrs

Source: FE Analytics

People used to think Broadcom was a black box, but the new management team has done a wonderful job, not just in turning around the operations, but also explaining it to investors in a clearer fashion. There has been reappraisal in terms of how much profit and free cash flow that business can generate.

Share price performance of Broadcom over 1yr

Source: Google Finance, data to 10 Oct 2024 in US dollars

Which stocks have detracted from performance?

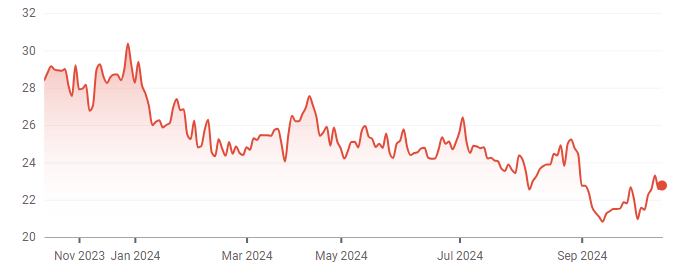

The three worst performers in the past year have been glass bottling company Verallia, Reckitt Benckiser and Aker BP, the Norwegian oil and gas company.

Glass bottling companies tend to enjoy local monopolies because the economics of transporting an empty glass bottle to a vineyard to be filled are not easy.

After Covid, there was a rebound in the consumption of wine and spirits, which led to further restocking at retailers, pubs and vineyards. In 2023 demand slowed from those high levels as there was already enough wine and spirits in the system, but the medium and long-term outlook for this business is good.

We exited Reckitt Benckiser because we lacked confidence in its long-term trajectory. Its brands do not have the same pricing power as Coca-Cola, for instance, and face stiffer competition.

Aker BP’s issue is the oil price. The whole energy sector has underperformed and we are significantly underweight. Aker has low-cost, low-carbon barrels and is one of the best-positioned oil companies from a cost perspective. It is reinvesting in new projects to offset the decline rate from mature oil fields.

Share price performance of Aker BP over 1yr

Source: Google Finance, data to 10 Oct 2024 in US dollars

Its dividend is 11.5%. Over the next five years, we will get half our money back via the dividend, and we will be left with a company that is roughly the same size as it is now, whereas many other oil companies are shrinking.

Have you added any stocks to the portfolio recently?

We bought Coca-Cola Europacific Partners this year. It has the bottling rights for Coca-Cola across large parts of Europe, Indonesia and the Philippines. The business has decent volume growth and good pricing power.

London Stock Exchange Group (LSEG) was another recent purchase. It's not really a stock exchange business anymore, it’s a data business providing valuable, critical infrastructure. For instance, it provides data feeds that asset managers like Invesco use for fixed income pricing and equity pricing.

Investors in LSEG sold £2bn of shares into the secondary market last year and we took advantage of that to bulk up our position substantially.

We also bought Old Dominion Freight Line, which is a less-than-truckload provider of transport. Because of the slowdown in the US economy and weaker consumer spending, there has been a bit of fear surrounding the stock, but it continues to grow market share and it has good pricing power.

What do you enjoy doing outside of fund management?

I spend time with my family – we have three kids and three dogs – and I enjoy cycling and tennis.