The £962m M&G Recovery fund, managed by Michael Stiasny since 2020, has been a perennial laggard for much of the past decade but there are signs the fund may be on the road to its own recovery.

Formerly managed by veteran stockpicker Tom Dobell, the fund was a darling among investors, peaking with assets around £8bn in 2012. But a rough decade for the value style and poor choices by its managers meant performance suffered and outflow followed.

But has this recent rise been enough to redeem it in the eyes of the experts, and is now the right time to buy, expecting it to continue rallying?

Following surges in performance this year, James Yardley, senior research analyst at Chelsea Financial Services, noted that many investors hoped this was a sign that the portfolio would “recover its mojo”.

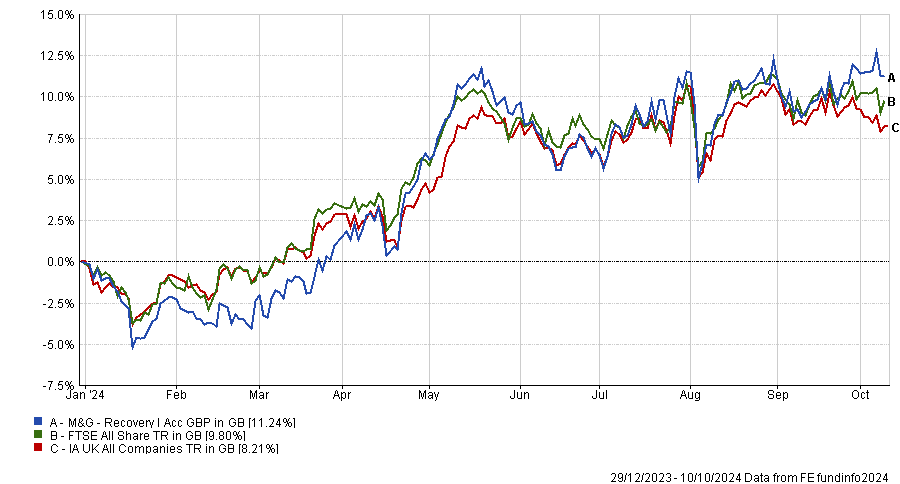

The fund is a top-quartile performer in the IA UK All Companies sector over the past six, three and one months. Year-to-date, the fund has enjoyed a top-quartile return of 11.2% compared to the peer group average of just 8.2%.

Performance of fund vs sector and benchmark year-to-date

Source: FE Analytics

More broadly, when the fund has performed well, it often enjoys supranormal returns. For example, over 10 years it had the eight-best maximum gain in the sector of 27.1%. The M&G strategy also had one of the widest maximum drawdowns of 41.3%, however.

For most experts, while the fund is improving it is too early to assume this will continue. Yardley said: “There have been some small green shoots following some asset allocation moves but long-term numbers remain hugely disappointing.”

By most metrics, performance remains well below trend, with a bottom-quartile effort over five and 10 years. With the fund up by 22.2% over 10 years, it had the second-worst returns in the peer group.

While the fund has improved under Stiasny, moving into the third quartile over one and three years, this surge is not enough to justify purchasing the portfolio in its current state, according to Yardley. “While some investors may sense an opportunity – for us, there are simply better alternatives out there.”

Paul Angell, head of investment research at AJ Bell, was another expert unimpressed by the resurgence of the portfolio.

Angell said: “As ever investors should assess several factors before buying an actively managed fund: these include the calibre of the management team, the team's investment philosophy and process, the fund's performance track record and its fees relative to peers.”

Even considering the recent progress, Angell noted that “the fund has underperformed the market each calendar year [prior to 2024], across both up and down markets” since Stiasny took over from Dobell.

So, what are the potential alternatives for investors looking for a value-focused strategy?

The most popular choice was the £894m Schroder Recovery fund, which both Yardley and Samir Shar, senior fund research analyst at Quilter Cheviot, selected. This is another value-focused strategy targeting unloved businesses, making it well-suited for investors with a higher risk tolerance.

Shah said: “The team has been adept at managing through periods in which its style is somewhat out of favour, with the past 10 years primarily favouring growth investors.”

Despite the poor run for value funds generally, the portfolio achieved top-quartile results in the IA UK All Companies sector over three and five years, up by 49.5% compared to a sector average of 28.7% over the past half a decade.

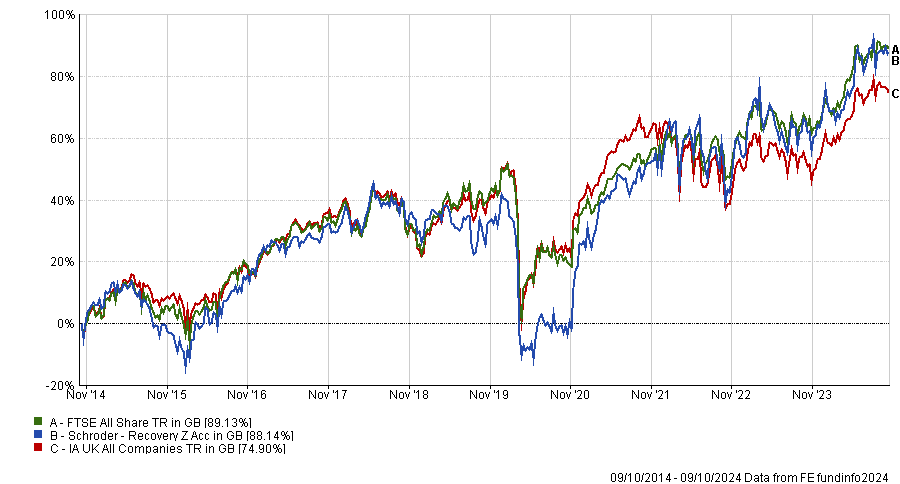

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

While the fund fell into the second quartile over the past year and 10 years, still beating the average peer, although it slightly underperformed the market over the decade, making a return of 88.1%. This was just below the FTSE All Share benchmark result of 89.1%.

The fund can be boom or bust depending on the whether the style is in favour however. Its highly concentrated approach has led to volatility, including in 2019, when it was up 9.8%, the fourth worst performance in the sector.

Analysts at Square Mile said: “One of the characteristics that stands this fund in good stead is that its managers have a sound appreciation of the dangers that this type of investment can entail.

“They truly invest with a style that the fund’s name would suggest, bringing both the potential for outsized returns and the accompanying elevated risk levels."

While the high-risk approach makes it unsuitable as a core holding, it is recommended by Square Mile as part of a broader portfolio.

For other alternatives suggested by the experts, Angell pointed to funds such as Man GLG Income, Fidelity Special Situations and Schroder Income. Yardley also identified Jupiter Special Situations as an interesting choice for the more value-focused investors.