The Federal Reserve cut interest rates by 50 basis points at its most recent meeting and is expected to wield the knife again early next month, a move that would be welcomed by investors.

It may be easy to forget the next Fed meeting, given it is scheduled at the same time as the US election but it could have more impact on investors’ portfolios than the election result.

If the Fed continues to cut rates, following the fastest interest rate hiking cycle in history, this should improve the outlook for equities, with the relative value of bonds and cash falling. Likewise, a less punitive interest rate should stimulate growth, with more savers encouraged to use their cash rather than keeping it on the sidelines.

Gerrit Smit, manager of the Stonehage Fleming Global Best Ideas Equity fund, said: “Broadly, lower beta stocks – those expected to deliver steady growth and profits – are likely to find buyers in a lower interest rate world.

“Longer duration stocks – those more driven by future earnings, such as technology companies – will have to continue to deliver strong earnings to outperform.”

As such, he recommended three US companies that are strong, steady performers, that should do well as rates fall and investors move towards the more defensive end of the stock market.

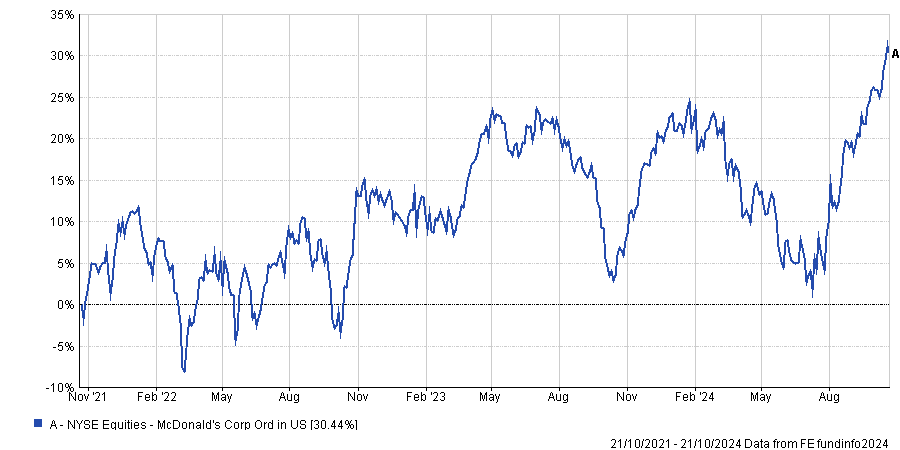

First up is fast food chain McDonald’s, which has taken on a lot of leverage in recent years as it has refranchised many of its restaurants. This has “led to a material step up in its profit margin,” said Smit, which is being used – along with the new debt – to finance share buybacks.

“While the business has a large debt pile, it has comfortably retained its investment grade status thanks to the significant and secure rental income it earns on its large restaurant property portfolio, with the operators (the franchisees) the permanent tenants,” he noted.

Shares have performed strongly of late, shooting higher throughout the end of August and September as investors began to price in the first Fed rate cut.

Performance of shares over 3yrs

Source: FE Analytics

Buying companies with a large amount of debt is atypical for quality-growth managers, who often look for companies with strong balance sheets, but lower rates should help with the interest burden, meaning Smit was unconcerned by its leverage position.

“McDonald’s will reissue or repay $12.8bn of its debt over the next five years. The falling interest rates will help keep its interest costs down, protect its credit rating and enable the company to continue to return more excess cash to its shareholders,” he said.

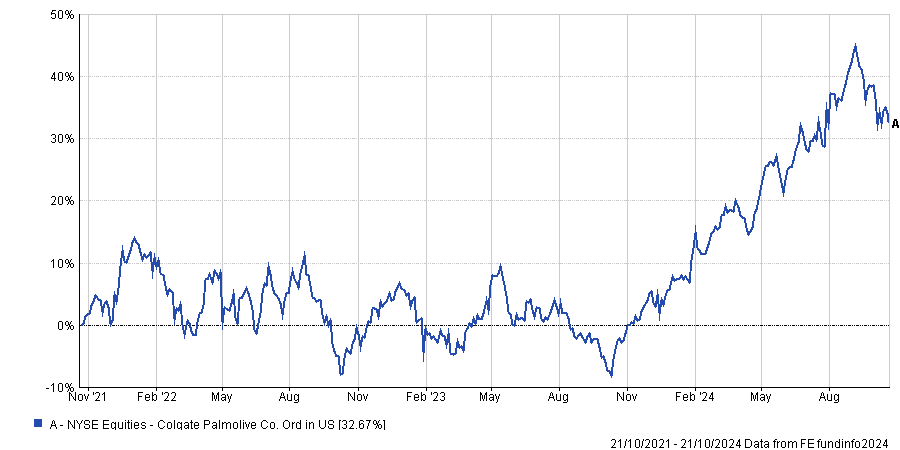

His next selection was Colgate-Palmolive, the international consumer goods company that provides everything from dental products to pet care and hygienic items.

Shares have rocketed over the past year, up 44.3% since their most recent nadir in October 2023, and Smit saw a runway for further improvements.

Performance of shares over 3yrs

Source: FE Analytics

“In a world of muted economic growth and lower interest rates, its revenue is expected to be less impacted as consumers continue to spend on essential items,” said Smit.

“Valuations for the staples sector are generally inversely correlated to bond yields. Given their defensive free cash flow profiles and attractive dividend policies, many investors view staples as a bond-proxy investment. This leaves Colgate well positioned as a top-performing company in a sector that stands to benefit from lower rates.”

Additionally, the company has “stepped up” its spending on innovation and marketing as inflation has cooled, all while keeping its prices at higher levels. “This resulted in Colgate’s organic growth increasing and winning market share,” he said.

Lastly, Linde is a chemical company and the largest industrial gas company in the world. Founded in Germany, domiciled in Ireland, headquartered in the UK and listed on the US Nasdaq exchange, it is the definition of multinational.

“Linde provides a constant, reliable supply of process and atmospheric gases used for everyday needs across a wide range of end industries,” said Smit.

“Volumes supplied are therefore closely correlated to underlying industrial production and economic activity. For additional organic growth, it is dependent on customers’ capital expenditure, with higher interest rates having a negative impact by limiting capex.”

Therefore, as interest rates move lower, funding costs will decrease, which should “incentivise customers to step-up investments behind large scale capex projects and drive Linde’s project backlog higher”.

Lower rates can also spur underlying economic activity, noted Smit, which in turn will prompt higher use of industrial gases.