Defensive strategies play a crucial role in portfolios by protecting capital, minimising drawdowns and providing a higher return than cash savings accounts. They can also act as a source of liquidity if investors need cash at a time when other assets have hit a rough patch; this is particularly pertinent for retired investors who rely on their savings for income.

Money market funds, which are one rung up the risk ladder from cash, occupy this space and have taken in a wealth of inflows during the past couple of years. However, their returns are expected to come down along with interest rates, making now an opportune time for investors to reassess this part of their portfolios.

Against that backdrop, Trustnet asked fund selectors which conservative strategies they currently favour.

Ninety One Diversified Income

Chris Metcalfe, chief investment officer of IBOSS Asset Management, holds Ninety One Diversified Income. Although it is a multi-asset fund, with just 9% in equities, Metcalfe said it is “relatively defensive”.

Managers John Stopford and Jason Borbora-Sheen aim to provide income with the opportunity for capital growth, targeting a return of about 4% per annum, with volatility of less than half that of UK equities.

More than half the fund is in developed market sovereign bonds but it also holds emerging market local currency debt, investment-grade corporate bonds, high-yield and equities.

Performance of fund vs sector over 10yrs

Source: FE Analytics

Incorporating multi-asset funds such as this introduces different views on asset allocation to diversify away from IBOSS’ own outlook. “We don’t have all the answers,” Metcalfe said. “It isn’t a lack of confidence but it is humility. Other people will have different opinions and they might be right.”

Another reason for adding multi-asset funds is that they can move money around faster than IBOSS can, if they need to react to rapidly shifting markets.

AXA Global Short Duration Bonds

Eduardo Sánchez, associate research director, fixed income, alternatives and multi-asset at Square Mile Investment Consulting & Research, suggested the AXA Global Short Duration Bond fund for investors seeking a combination of liquidity, capital preservation and income that outstrips cash.

The fund allocates globally across investment-grade corporate bonds, high yield, inflation-linked bonds and emerging market debt, and is managed by FE fundinfo Alpha Manager Nicolas Trindade and Nick Hayes.

“Its short duration focus means that around 20% of the portfolio matures annually, enabling the managers to re-invest maturing bonds at higher yields. This potentially allows the fund to benefit in a rising interest rate environment when traditional fixed-income assets face headwinds,” Sánchez explained. “The constant stream of bonds maturing provides a natural source of liquidity.”

The strategy has historically been less volatile than longer-dated bond funds because shorter-dated bonds have lower interest rate risk and increased visibility over corporate earnings, he added.

Performance of fund vs sector and benchmark since inception

Source: FE Analytics

TwentyFour Absolute Return Credit

TwentyFour Absolute Return Credit is a short-term bond fund with strict risk parameters that aims to achieve a positive absolute return in any market.

Rosie Cook, investment analyst at One Four Nine Portfolio Management, said: “By keeping duration short, the interest rate risk is reduced and with active management, the credit risk is also reduced, resulting in a low volatility fund that can weather most market conditions without experiencing significant drawdowns.”

Performance of fund vs sector since inception

Source: FE Analytics

Although it only invests in fixed income, the portfolio sits in the IA Targeted Absolute Return sector and has made 17.6% over the past five years.

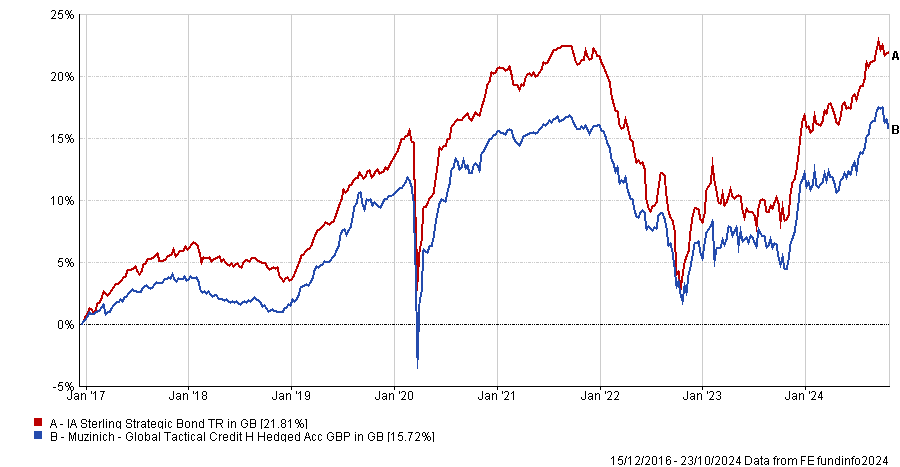

Muzinich Global Tactical Credit

Rob Burgeman, investment manager at RBC Brewin Dolphin, suggested Muzinich Global Tactical Credit (hedged). It aims to achieve returns of cash plus 5% over the full business cycle with a focus on capital preservation.

The fund invests in corporate debt across the full credit quality spectrum with a focus on sub-investment grade debt. “The resulting portfolio represents a mix of long-term investments and dynamic tactical positioning and uses derivatives extensively to manage the risks within the portfolio,” Burgeman explained.

“This allows the manager to react swiftly to the changing market environment and alter the fund’s exposures to sectors, geographies or credit quality accordingly.”

Performance of fund vs sector since inception

Source: FE Analytics

BlackRock ICS Sterling Liquidity

At the more conservative end of the spectrum, BlackRock ICS Sterling Liquidity is a money market fund that aims to maximise income and maintain capital in nominal terms. Managers Matt Clay and Paul Hauff have been running the portfolio for 15 years so bring a lot of experience to bear.

Laith Khalaf, head of investment analysis at AJ Bell, said: “The low fund charge of 0.1% means that more returns from the underlying portfolio find their way into investors’ pockets.”