Royal London Asset Management has hired a trio of fund managers from Aviva Investors. FE fundinfo Alpha Manager Richard Saldanha will become lead manager of the Royal London Global Equity Income fund, with Matt Kirby as his deputy. Francois de Bruin will take over the Royal London Global Equity Select fund, with support from Saldanha.

RLAM has also promoted its head of sustainable investments, Mike Fox, to head of equities.

These appointments follow the departures of Peter Rutter, Nico de Walden, James Clarke, Chris Parr and Will Kenney, who left Royal London’s global equity team in April to set up a new venture.

Saldanha is taking over the global equity income fund from Richard Marwood, co-head of UK equities, who inherited it from de Walden in April. Marwood continues to manage the Royal London UK Equity Income and UK Dividend Growth strategies.

The Global Equity Select fund was run by Rutter, Clarke and Kenney but then passed to Fox and now de Bruin.

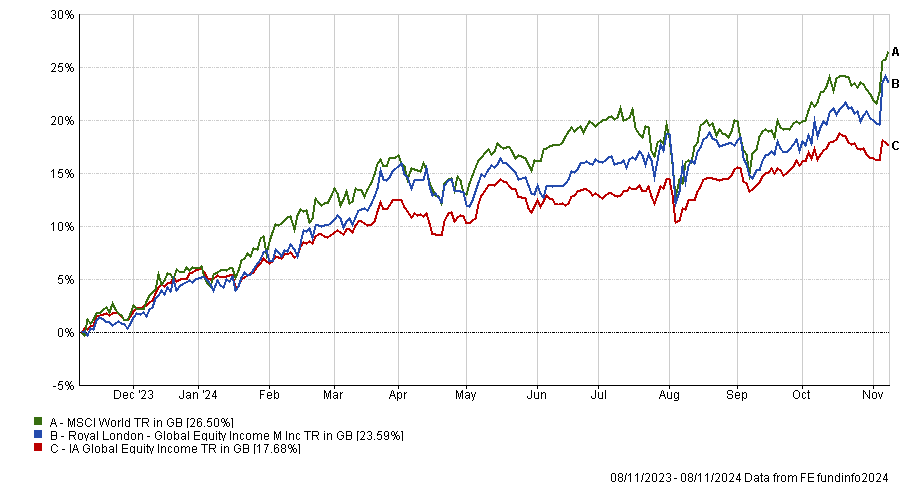

Performance of fund against sector and index over 1yr

Source: FE Analytics

Saldanha said: “I am looking forward to applying my experience to Royal London’s Global Equity Corporate Life Cycle investment process. The experience of the team and our consistent process will stand us in good stead to focus on delivering good outcomes for clients across the economic cycle.”

The investment process focuses on which stage each company has reached in its life cycle and whether the business is accelerating, compounding, slowing and maturing, already mature or in a turnaround situation.

According to Royal London chief investment officer Piers Hillier, Fox was “the natural choice to head up the equity team,” as he “has built our sustainable investment funds into a world-class investment proposition over the past 20 years and has delivered consistent investment returns for clients.”

Fox added: “The breadth and scale of our resources, combined with the stability of Royal London, provides a fantastic platform, allowing us to meet the needs of existing and new clients, in the UK and internationally.”