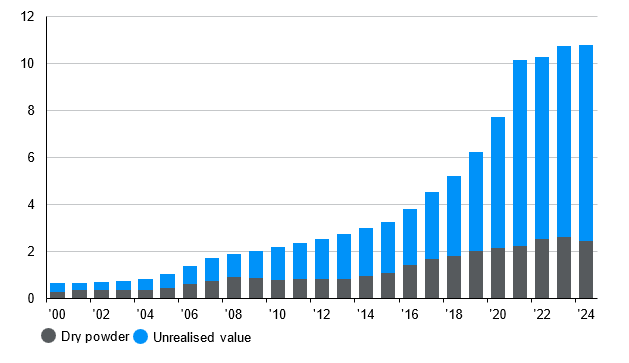

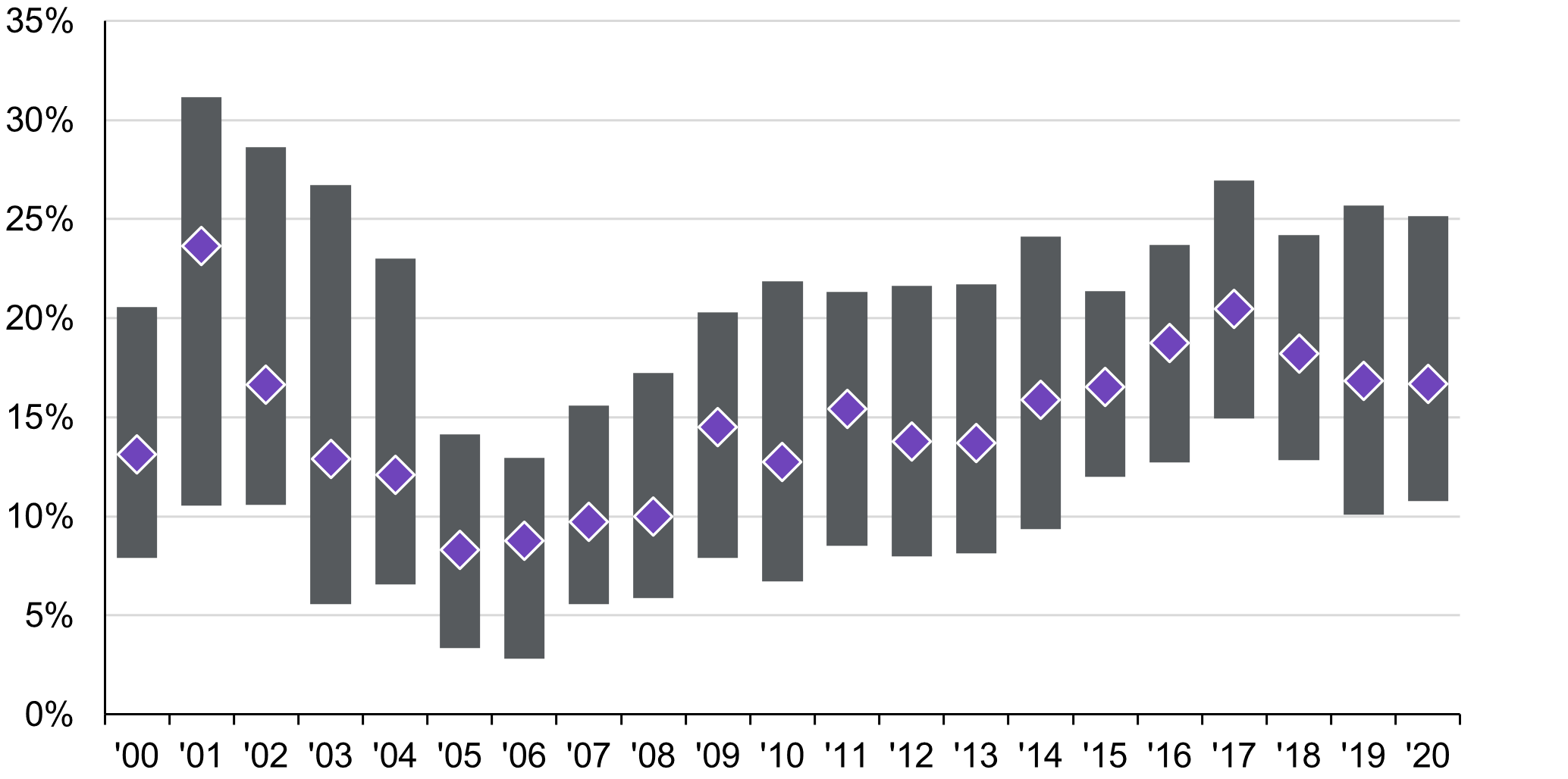

Over the past decade, private equity has expanded to an industry managing over $10trn in assets. This growth is fuelled by several factors. First, private equity has consistently delivered attractive returns, with top-quartile returns often exceeding 20% annually, and remarkably, it has maintained positive returns throughout the past two decades.

Second, abundant private capital has encouraged many innovative companies to remain private longer. For example, the median age of a company at IPO rose from four years in 1999 to 12 years by 2020. This trend, along with established companies going private, has reduced public market opportunities and increased private equity's appeal.

Global private equity assets under management (in $trns)

Sources: Preqin, J.P. Morgan Asset Management. Dry powder refers to committed but uncalled capital. Strategies include venture capital, balanced, buyout and growth. 2024 is to Mar 2024. Data as of Nov 2024.

However, the formula that fuelled these impressive returns – cheap debt, expanding valuations and quick exits – now faces unprecedented challenges. Rising interest rates have fundamentally altered the industry's traditional playbook, while market volatility has complicated both dealmaking and exits.

Within these challenges lie opportunities for evolution and innovation, as the industry adapts its strategies and develops new tools for value creation. Understanding how private equity operates, and how it is transforming, is crucial for navigating this changing landscape.

Global private equity return dispersion by vintage year: 2000-2020 Internal rate of return

Sources: Burgiss, J.P. Morgan Asset Management. Global private equity is represented by global buyout funds. Diamond represents the median manager return, gross of fees. Top and bottom of the bar represent top and bottom quartile returns. Data as of Nov 2024.

Understanding the traditional private equity model

Before examining current challenges, it's essential to understand how private equity traditionally creates value. Private equity firms typically acquire companies through funds that pool capital from institutional investors, operating on a 10-year lifecycle or longer.

These funds have two distinct phases: the investment period for acquiring companies, followed by years focused on development and exits. Limited partners (LPs) provide the capital, while general partners (GPs) source deals, manage investments and implement value creation strategies.

The value creation playbook has historically relied on three approaches. Entering new markets, launching new products and bolt-on acquisitions can all drive revenue expansion. Margin enhancement focuses on operational improvements and cost reduction. Multiple expansion, perhaps the most significant driver of returns in recent years, increases company valuations through both operational improvements and favourable market conditions. Over the past decade, global buyout returns have primarily stemmed from this multiple expansion, supported by low interest rates.

The new interest rate reality

The landscape shifted dramatically in 2022 when central banks raised interest rates to combat inflation. Higher borrowing costs have fundamentally altered the economics of leveraged buyouts, making it harder to achieve historical returns through debt-dependent strategies. Reduced public market valuations have limited IPO opportunities, while strategic buyers have become increasingly cautious, creating a persistent pricing disconnect between sellers' expectations and buyers' willingness to pay.

This exit slowdown stems from a fundamental valuation mismatch: private equity firms that acquired companies at higher valuations during the low-rate environment are reluctant to sell at today's lower multiples and realise losses. Meanwhile, potential buyers, facing higher borrowing costs, cannot justify matching historical valuations. This standoff has dramatically reduced exit opportunities across all traditional channels – IPOs, strategic sales and secondary buyouts.

The impact reverberates throughout the private equity ecosystem, creating challenges for both general and limited partners. For GPs, a weak exit environment forces longer hold periods for portfolio companies, straining operational resources and potentially delaying new investments. For LPs, slower distributions create liquidity pressures, particularly for pension funds and institutional investors who rely on private equity returns to meet obligations, maintain allocations, and fund new investments.

Adapting to change

Rather than standing still in front of these challenges, several innovations have emerged across the industry.

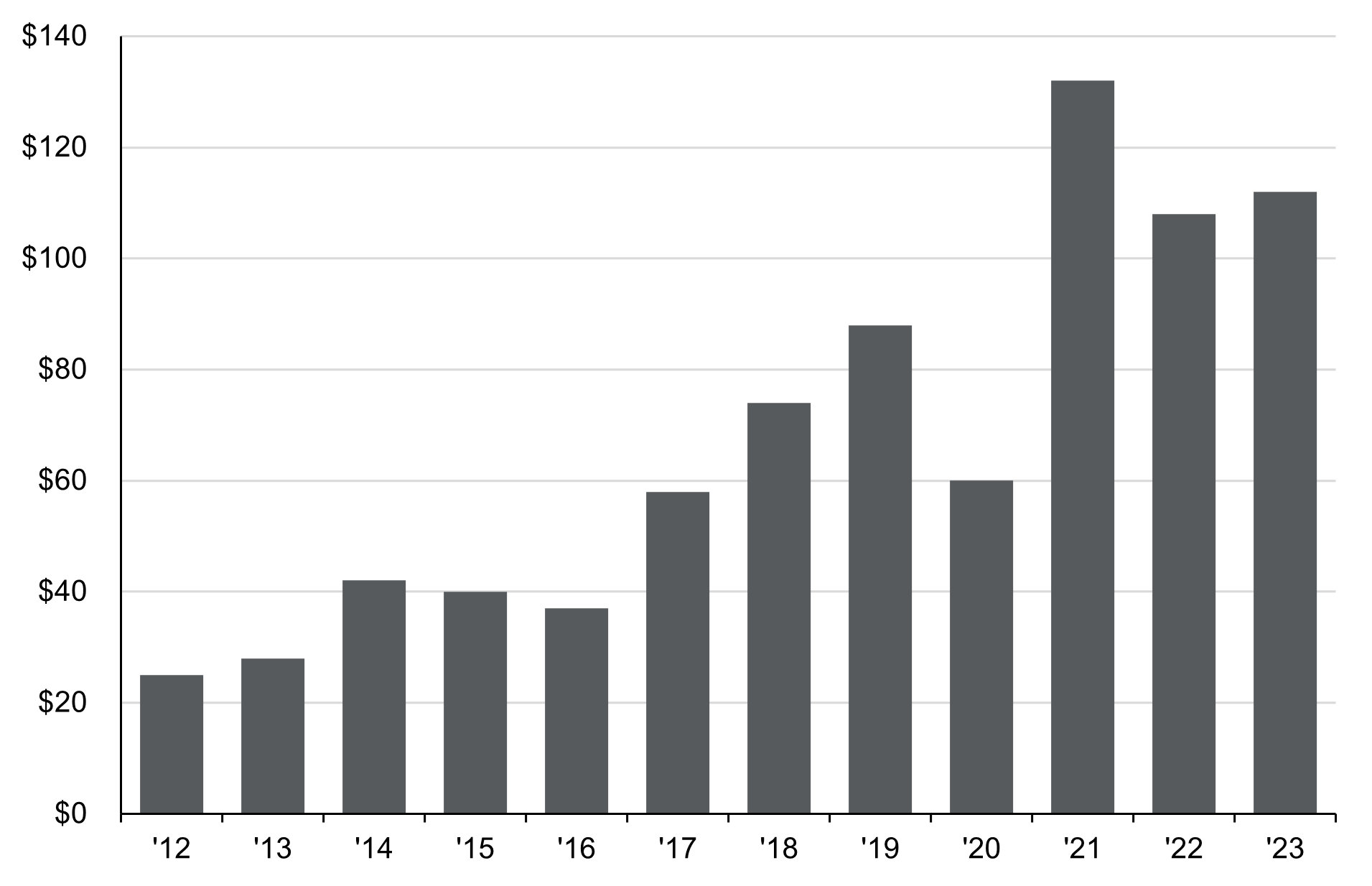

The secondary market has evolved into a crucial liquidity mechanism, offering solutions for both limited and general partners. Traditional LP-led secondaries, where investors sell their fund positions to other institutions, continue to provide portfolio rebalancing opportunities.

However, GP-led secondaries have become increasingly significant as fund managers face pressure from traditional fund lifecycles. These transactions allow managers to retain promising assets beyond standard holding periods when they see further value creation potential, whilst simultaneously offering existing investors the choice to either cash out or maintain exposure through a new vehicle – effectively solving both the exit timing challenge and the LP liquidity need.

Global private equity secondary market volume ($bns)

Sources: Greenhill, J.P. Morgan Asset Management, Jefferies’ ‘Global Secondary Market Review’, Jan 2024. Secondary market volume represents total value of general partner and limited partners-led secondary transactions. Data as of Aug 2024.

Financial innovation has also played a key role in adapting to the new environment. Net asset value (NAV) financing has emerged as a flexible tool, allowing private equity firms to leverage the value of their existing portfolio without forcing premature exits. This innovation helps bridge temporary liquidity gaps while maintaining long-term value creation potential, providing firms with more options for managing their portfolios.

The path forward

While recent innovations offer tactical solutions to distribution challenges, the industry is undergoing a fundamental shift. With traditional exits constrained, private equity firms must find new ways to generate returns without relying on quick exits or multiple expansion.

The answer lies in operational transformation. By focusing on core business improvements over financial engineering, private equity firms can build portfolio value that bridges today’s valuation gaps. Though this approach typically requires longer holding periods, it can produce substantive value increases that justify higher valuations even in a high-rate environment, ultimately enabling attractive exits that meet LP distribution needs.

Opportunities are emerging. Middle-market investments are gaining prominence, as these deals typically rely less on leverage and offer greater potential for operational improvement. Private equity firms can find attractively priced entries and create value through hands-on operational involvement, while also having greater opportunities to exit.

Similarly, the secondary market offers new investors attractive entry points by acquiring existing LP interests at discounts to net asset value (NAV), often due to liquidity pressures or market uncertainty. Secondary funds also typically have shorter investment horizons than primary commitments, allowing for quicker returns and diversified exposure across vintages, sectors and geographies. As secondary funds grow more sophisticated, investors can build more selective portfolios that capitalise on cyclical opportunities.

As the industry adapts its playbook for a high-rate environment, firms that pivot from financial engineering to operational transformation will continue to deliver compelling returns. Private equity isn’t just adapting to survive; it’s evolving to become an even more essential part of modern capital markets.

Aaron Hussein is a market strategist at J.P. Morgan Asset Management. The views expressed above should not be taken as investment advice.