Shareholders of the Edinburgh Worldwide Investment Trust have voted against the proposals of activist hedge fund Saba Capital Management at today’s general meeting, marking the seventh consecutive defeat in the US hedge fund’s ongoing campaign to address persistent share price discounts.

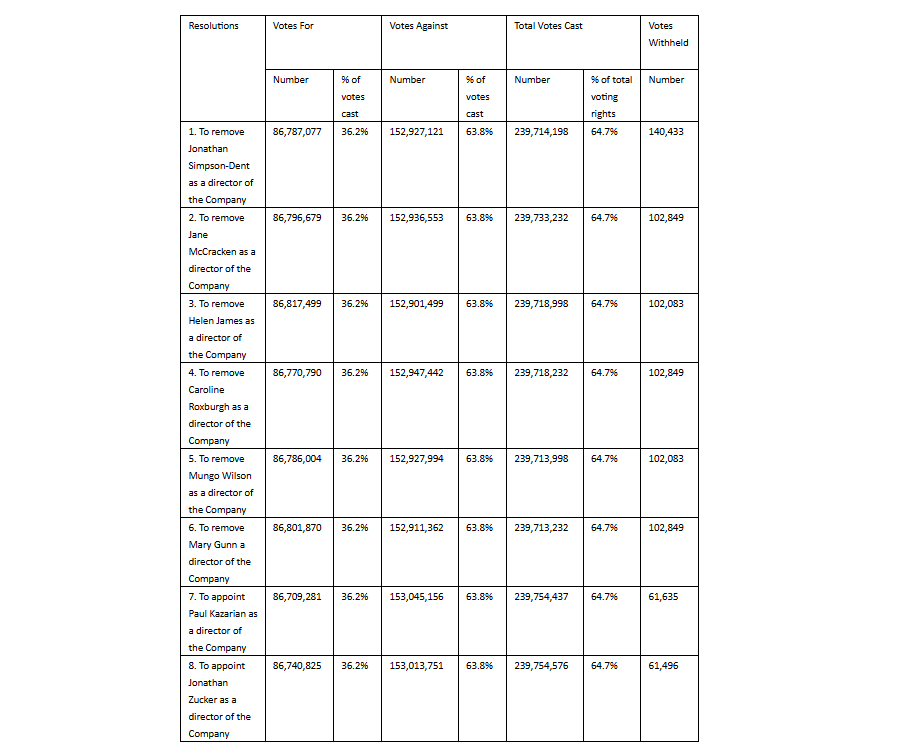

Around 64.7% of shareholders turned out to vote, of which 63.8% voted against all eight of Saba’s proposals, which included removing all board members and replacing them with Saba Capital’s own representatives.

The plan, should Saba have been successful, was to replace the portfolio managers with Saba Capital and introduce a new mandate to invest in other undervalued investment trusts.

Jonathan Simpson-Dent, chair of the Edinburgh Worldwide Investment Trust, said: “Shareholders have spoken. They have rejected Saba Capital's proposal for a fundamentally different strategy based on fundamentally different principles with a fundamentally different investment approach”.

Source: London Stock Exchange Group

However, Saba’s battle with investment trusts will continue. Richard Stone, chief executive of the Association of Investment Companies (AIC), said: “This is the end of round one, but Saba’s most recent requisitions show that this may not be over yet”.

Indeed, earlier this week, it targeted another four investment trusts, suggesting they convert into an open-ended fund rather than continue as closed-ended structures.