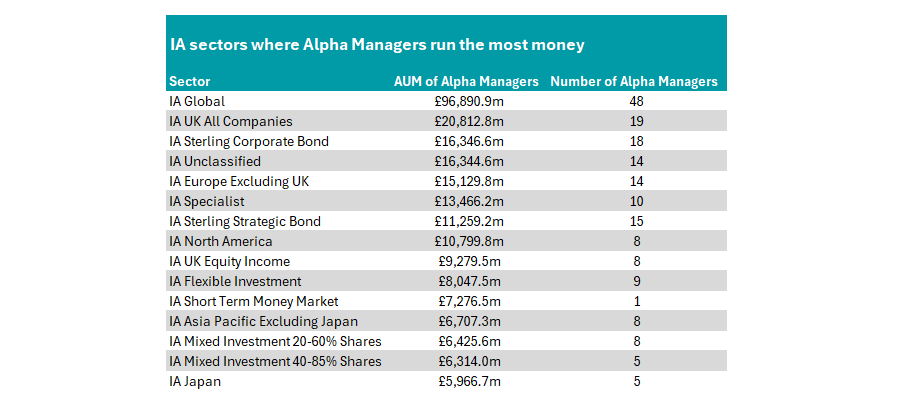

Investors have ploughed some £276bn into funds run by FE fundinfo Alpha Managers, according to the latest Trustnet study, with more than a third piling into funds in the IA Global sector.

The sector is the area where investors are most likely to find a fund run by an Alpha Manager, with 48 portfolios out of the 378 funds in the sector managed by at least one top-rated manager.

Terry Smith dominates with a combined £23.5bn across his two funds in the peer group: Fundsmith Equity (£22.9bn) and Fundsmith Sustainable Equity (£630m).

This is despite investors pulling a net £3.2bn from the Fundsmith Equity fund last year, making it the most-sold portfolio in the sector.

The flagship portfolio has been a bottom-quartile performer in each of the past two years and has failed to beat the MSCI World since 2021 – a rare bout of underperformance for the manager who has a stellar long-term track record.

Also raking in investors’ cash is Kristian Heugh, who runs the £11bn MS INVF Global Opportunity fund. These were the only two managers in the sector with more than £10bn in assets under management (AUM).

Source: Trustnet

In second place is the IA UK All Companies sector, where 19 funds are run by Alpha Managers with a combined AUM of £20.8bn – less than the Fundsmith Equity fund alone.

The biggest here is the £3.8bn Artemis UK Select fund, run by Alpha Manager Ed Legget as well as Ambrose Faulks. The managers had a strong year in 2024 and had the highest information ratio of all IA funds, building on the portfolio’s impressive long-term track record.

Anthony Cross and his team run two funds in the sector: Liontrust Special Situations and Liontrust UK Growth, with combined AUM of £3.4bn.

Alex Wright’s Fidelity Special Situations and Mike Fox’s Royal London Sustainable Leaders Trust have also managed to rake in more than £3bn of investors’ cash.

IA Sterling Corporate Bond was in joint third place, with investors putting £16.3bn in funds run by Alpha Managers. Around a third of this was placed with Alpha Manager Paola Binns across two portfolios: Royal London Investment Grade Short Dated Credit and Royal London Sterling Credit.

The sector was joint third with the IA Unclassified peer group – a hodgepodge of funds that do not fit into any other sectors. Colin Reedie and Matthew Rees’ LGIM Global Corporate Bond dominated here, with AUM of £7.9bn. Both have achieved the Alpha Manager title.

Both peer groups contain 14 funds run by Alpha Managers, while IA Sterling Strategic Bond has one more (15), making it the fourth most populous sector for managers with the top title.

IA Europe Excluding UK (14) is next, with Alpha Managers running £15.1bn of investors’ money, followed by IA Specialist (£13.5bn) and then IA Sterling Strategic Bond (£11.3bn).

Perhaps the biggest anomaly lies in the IA Short Term Money Market sector, where there is only one fund on the list. Tony Cole and Alpha Manager Craig Inches’ Royal London Short Term Money Market fund has been dominating the space, with AUM of £7.2bn.

The fund topped interactive investor’s most-bought funds list in January, with analysts suggesting its costs (0.1% a year) and yield (4.8%) make it an attractive proposition.

“Money market funds own a diversified basket of safe bonds that are due to mature soon, normally within just a couple of months, as well as cash deposits and other short-term savings instruments, meaning that investors can earn an income on their cash with minimal risk,” they said.

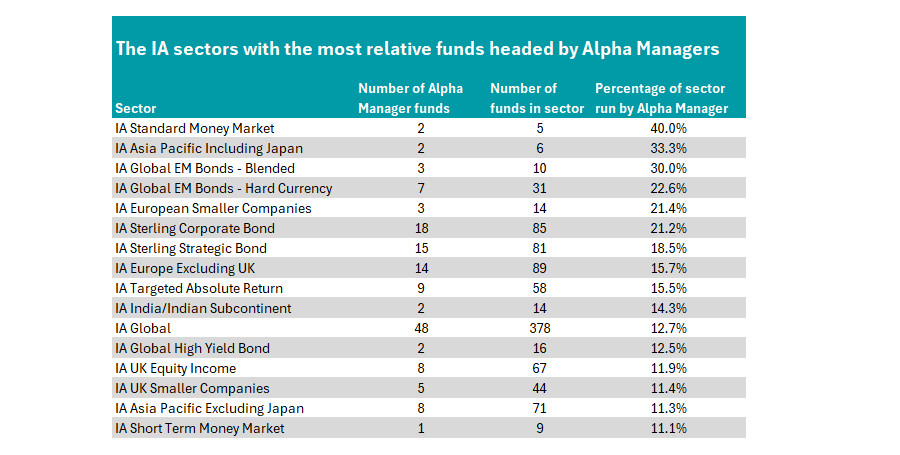

While investors have the most money in the sectors above, the list of sectors where the odds of finding a fund run by an Alpha Manager is very different.

Source: Trustnet

Smaller sectors such as IA Standard Money Market and IA Asia Pacific Including Japan, which have five and six constituents respectively, have two qualifying portfolios each, meaning 40% and 33.3% of these sectors are run by people with the top rating.

IA Sterling Corporate Bond is the first sector with more than 40 funds on the list. With 18 Alpha Manager-run funds out of the 85 in the sector, investors have a 21.2% chance of picking a portfolio headed by someone with the title.

Meanwhile, it is Europe where equity investors are most likely to hit on a fund managed by someone with the rating. Some 21.4% of the narrower IA European Smaller Companies peer group is headed by someone with the rating, while this figure dips slightly to 15.7% of the 89-fund strong IA UK Europe Excluding UK sector.

This story follows the rebalance of the FE fundinfo Alpha Manager awards. Earlier this week we looked at the fund groups with the most Alpha Managers, as well as those who have held the title every year since its creation in 2009.