Investors who chased performance by buying the best-performing stocks over the past 10 years have made the highest returns, according to research by AJ Bell.

Typically, investors are told to spread their assets across different asset classes, as nothing can continue to rise forever. But over the past decade, the best returns have been made by those who narrowly followed the stocks that were already on the up.

Laith Khalaf, head of investment analysis at AJ Bell, said: “One of the basic tenets of investment is not to buy an asset just because its price has gone up. And yet, in the past decade, performance chasing has been a much better strategy than buying investments where prices have fallen sharply – a blind bargain-hunting approach which appeals to many people but comes with its own health warnings.”

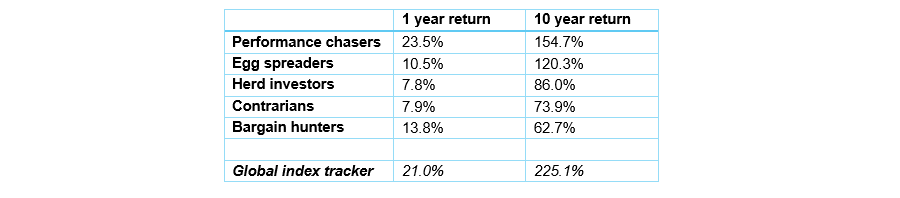

The firm put five strategies up against one another. These were performance chasers, egg spreaders, bargain hunters, contrarians and herd investors.

For performance chasers, the research assumed each year an investor would buy a fund in the best-performing sector of the previous year. Conversely, bargain hunters bought a fund from the worst-performing sector of the previous 12 months.

Herd investors bought a fund from the most popular sector and contrarian investors bought a fund from the least popular sector, while egg spreaders diversified across five equity fund sectors, putting 20% in each of US, UK, Europe, Japan and emerging markets funds.

Source: AJ Bell

The best performers

Performance chasing returned 23.5% in 2024 and 154.7% over 10 years, turning a £10,000 initial investment made a decade ago into £25,468 today. It was the best of the bunch by a wide margin, with egg spreaders in second place. Despite the strong returns, however, Khalaf said “performance chasing comes with large risk warnings attached”.

“An area which has performed well in one year has probably become a crowded trade and vulnerable to both overvaluation and profit-taking. This may have been mitigated in recent times as trends have tended to be extreme in both size and duration, most notably in the technology sector. Nonetheless, a reversal in market trends could be exceptionally painful for undiversified performance chasers,” he said.

In second place was the egg spreaders, or those who used a diversified strategy split 20% across the US, UK, Europe, Japan and emerging markets and rebalancing each year to maintain 20% in each.

“There is an intuitive appeal to this approach to spreading risk around, though over the past 10 years it has delivered much less than a global tracker fund, which allocates money to regional markets based on the size of companies within them,” said Khalaf.

The key to this strategy is the weightings. Investors can dial up or down their exposure to each market. However, if the US continues to outperform other markets, this more regionally diversified approach will fall behind a simple global passive strategy, as it has done for the past decade.

Middle of the pack

Herd investing and contrarian investing delivered “remarkably similar results” over the last year, despite being polar opposites, although over the longer term there is some daylight between the two with herd investors claiming a lead over 10 years.

“Neither has been a particularly successful strategy though when compared to egg spreading or performance chasing, or to simply buying and holding a global tracker fund,” said Khalaf.

“Part of the reason these strategies may have struggled is that in risk-off markets, safe haven assets tend to be popular, and likewise in risk-on markets, they tend to be unpopular.

“Hence absolute return funds make it into both herd and contrarian investment strategies several times over the past decade, and that can lead to muted returns compared to an approach that invests more heavily in shares.”

The bottom dwellers

Over the past decade, bargain hunting has brought up the rear with a 10-year return of 62.7%. The opposite of performance chasing, investing in the worst-performing sectors has been broadly fruitless.

There was some merit in 2024 when this investor would have invested in a China fund, which returned an average 20.6% loss in 2023 but made 13.8% last year as Chinese equities staged a comeback.

“But over the long term the bargain hunting strategy hasn’t delivered vintage performance,” said Khalaf.

While the strategy can be a natural tendency for some investors, “the numbers suggest it’s far from a one-way ticket to riches”. “Investors who are tempted to catch falling knives should remember that the mathematical definition of a stock that has fallen 90% is one which has fallen 80%, and then halved in value.”

The real winners

Although the study highlighted how the momentum trade has worked out for investors in the past decade, the real winners from the study were passive funds as buying and holding a global tracker fund beat all the styles over 10 years.

“It will also have done so at a lower cost, and with less effort than switching your investments every 12 months. A £10,000 investment in a global tracker fund 10 years ago would now be worth £32,510,” said Khalaf.

However, he noted that a global tracker fund includes an element of performance chasing, as stocks that have done well become a bigger part of the index and therefore larger allocation in the funds which follow it.