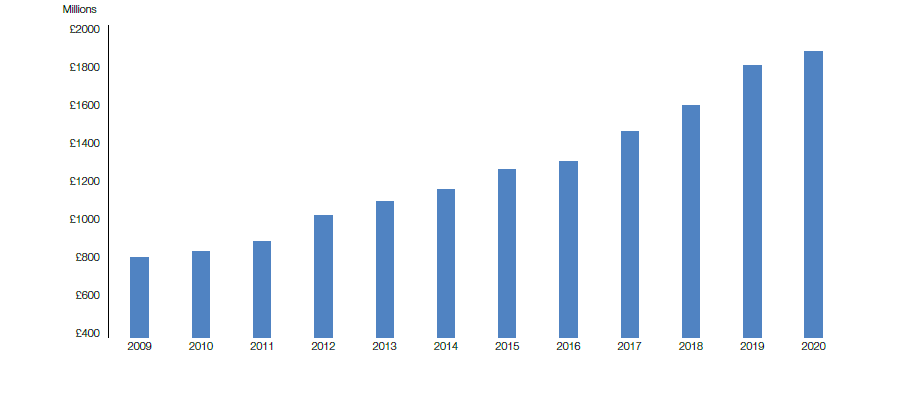

Investment trusts raised dividends by 4.2 per cent in 2020 to a record £1.88bn, despite UK payouts being down 38 per cent and global dividends down 12.2 per cent, according to the Link Group Dividend Monitor.

More than three-quarters of trusts raised payouts during the midst of the Covid-19 crisis, from April to December of last year.

This success can be attributed to the sizeable levels of reserves worth £1.6bn that investment trusts could turn to in times of difficulty.

Revenue reserves are an important feature of investment trusts and allow them to withhold up to 15 per cent of their annual income to hold as a reserve that can distributed in the future.

This differs from open-ended investment companies, which must pay out all of their dividends each year.

In a year that was the worst on record for UK dividends, the utilisation of revenue reserves gave income investors greater confidence that their income streams would not be hit by an unexpected drop.

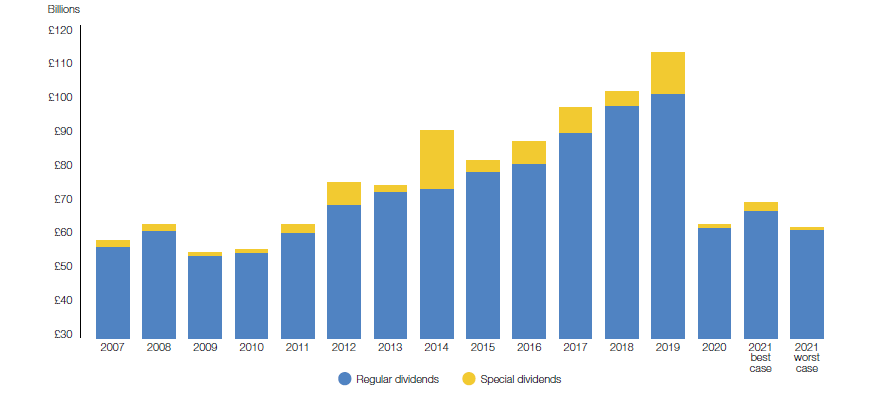

UK dividends – all listed companies excluding investment trusts

Source: Link Group

The Link Group Dividend Monitor showed that UK PLC payouts fell by an unprecedented 44.1 per cent last year to £61.9bn, taking the total paid to shareholders by UK-listed companies back to a level last seen in 2011.

Globally, it was still a difficult year and the latest Janus Henderson’s Global Dividend Index showed global payouts were down 12.2 per cent, with one-third of companies either cutting or cancelling dividends.

However, research from the Link Group showed investment trusts beat this global dividend drought in 2020 and dished out an extra £87m in dividends in 2020, equivalent to a 4.2 per cent annual increase.

Collectively, investment trusts distributed a record £1.88bn in 2020, increasing what they pay to investors by 123 per cent over the last 10 years – meaning every year without fail has shown growth.

Trusts investing in UK equities raised payouts by 3.8 per cent in contrast to the 38 per cent underlying decline in UK dividends.

Investment trust dividend payments

Source: Link Group

At the end of March last year, just as companies around the world first began to cancel and cut their dividends, Link Group’s analysis of trust balance sheets showed that trusts in the UK had revenue reserves of £2.2bn – over a fifth more than they had paid in dividends during 2019.

Just over a quarter of this was required to pay dividends already declared, but that left them with £1.6bn at their disposal.

Over the full year, the main global equity sector accounted for a third of the dividend growth from all investment trusts, raising dividends by 9.3 per cent despite global dividends falling 12.2 per cent.

This can be attributed to the large revenue reserves of global trusts, worth two years of payouts so they had a healthy cushion.

Susan Ring, chief executive of Link Group UK, said: “The more internationally diversified trusts are, the less they have been exposed to the steepest dividend cuts. Global trusts have big reserves and have seen a relatively small reduction in the dividends paid to them by the companies they hold.

“Trusts focused on UK equities are more vulnerable. They still enjoy the cushion of long-accumulated reserves, but prudence suggests some cuts are likely as dividends from UK companies are going to take some time to regain previous highs.”

Ian Sayers, chief executive of The Association of Investment Companies, added: “The oldest, most established investment trusts have had decades to build up revenue reserves and this is serving them well now.”

He added that using profits from capital returns to pay dividends may serve as a useful short-term solution, which would allow fund managers to invest for total returns and then for the board to structure the income according to the needs of the investors.

“Investors in investment trusts are loyal,” said Sayers. “They think long term so they will look beyond the current crisis.”

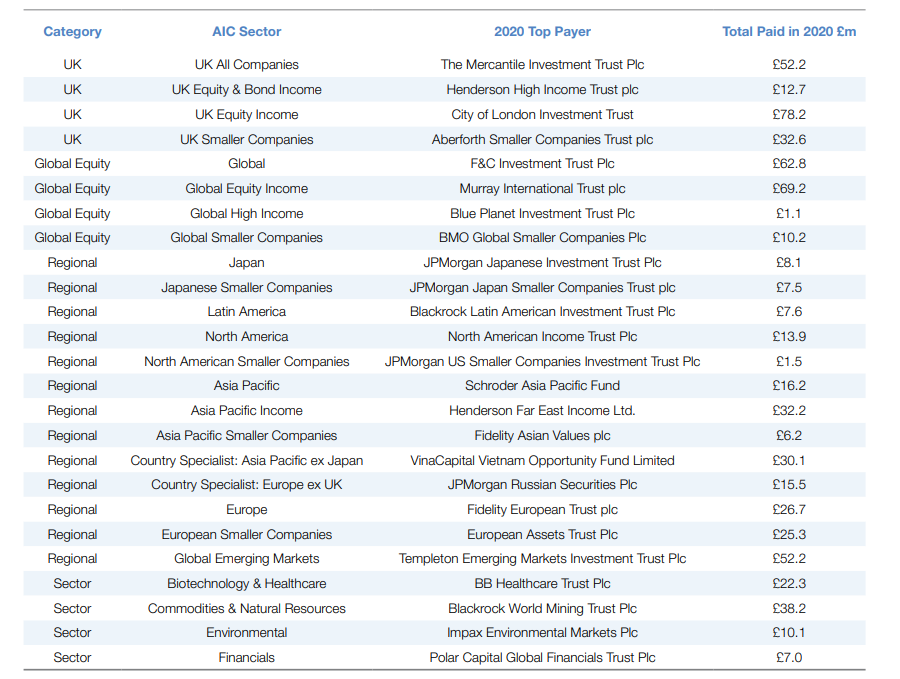

Paying £78.2m in dividends last year, the £1.6bn City of London Investment Trust is at the top of the list of payers in 2020.

The UK equity income trust has been managed by Job Curtis since 1991 and contains British American Tobacco, Diageo and Royal Dutch Shell within its top holdings.

In second, from the global equity income sector, it was the £1.5bn Murray International Trust, which paid £69.2m in dividends.

Another global fund also paid a strong dividend of £62.8m in 2020, the F&C Investment Trust, managed by Paul Niven. According to Winterflood Research, “the trust provides investors with an attractive long-term savings vehicle offering diversified exposure to global equities, both publicly listed and private”.

2020’s top investment trust dividend payers

Source: Link Group

Finally, Mercantile Investment Trust and Templeton Emerging Markets Investment Trust both paid £52.2m in dividends last year.

Of the £2.6bn Templeton strategy, Rayner Spencer Mills Research said: “A longer-term view is taken on stocks and the team do not try and anticipate short-term market direction.

“There is an emphasis on a number of secular growth themes which include how technology is re-shaping the global economy, the under-penetration of consumer goods and services in the emerging world and the premiumisation of consumer goods as incomes rise.”