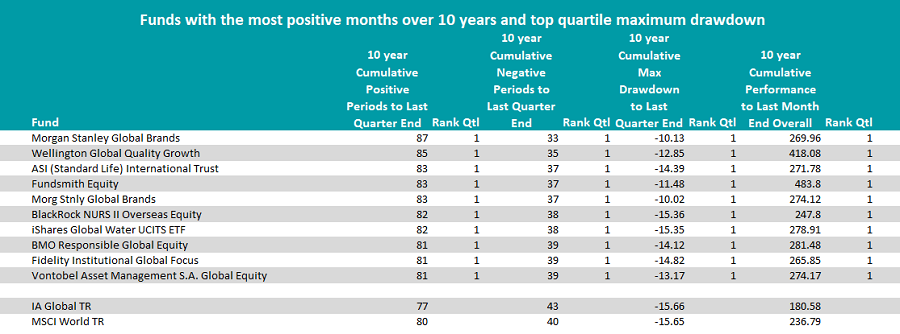

Tech and growth-focused funds account for most of the global funds delivering repeated, consistent outperformance while losing the least amount of money over the past 10 years.

Continuing our series into the funds with the highest number of positive months over the past 10 years and filtering for the top quartile maximum drawdown and returns, Trustnet examined the IA Global sector. We found just 10 funds had achieved this level of consistent returns with minimal losses.

Source: FE Analytics

Morgan Stanley Global Brands

Morgan Stanley’s Global Brands strategy achieved the most positive months in the study – 87 out of a possible 120 – doing so with a maximum drawdown of 10.13%.

Two funds under this strategy appear on the list: a $22.3bn Luxembourg-domiciled SICAV and its £1.2bn UK OEIC mirror. The strategy is managed by William Lock and Morgan Stanley’s international equity team.

Names such as Microsoft, Phillip Morris, Visa and Thermo Fisher are found among its top 10 holdings. These stocks are examples of the high-quality companies the managers think can generate superior returns over the long term.

The companies are built on ‘dominant market positions’ grounded in an intangible but hard to replicate assets. Many of the names above have been dominant consumer or tech stocks during the past decade, benefitting from the global shift into online commerce and increased tech reliance.

Morgan Stanley Global Brands made a total return of 279% over 10 years, beating the IA Global (181%) and MSCI World (237%).

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

It has an ongoing charges figure (OCF) of 0.90%.

Wellington Global Quality Growth

Next is the $10.5bn Wellington Global Quality Growth fund, which had 85 positive and 35 negative months. This was achieved with a maximum drawdown of 12.9%.

FE fundinfo Alpha Manager John A Boselli has run the fund for a decade. Focused on a balance of growth, valuation, capital return and quality criteria in selecting stocks, Boselli looks for companies that participate in market rallies but also protect on the downside.

This has created a focus on investing in high-quality companies which are trading on a discount to the market.

Like the majority of the other funds that featured, its largest holdings include the likes of Microsoft, Alphabet and TSMC.

Over 10 years the fund made a total return of 418.1%, the seventh highest returns in the IA Global sector during that time.

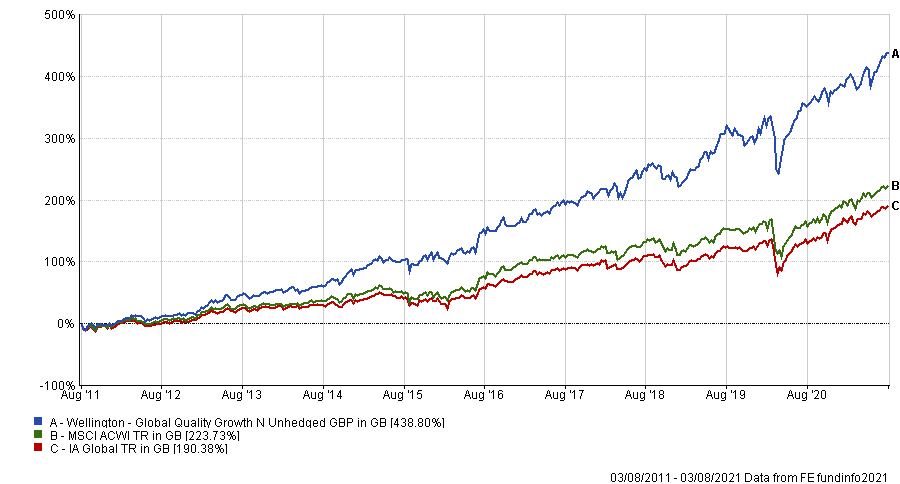

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

Holding an FE fundinfo Crown rating of four, Wellington Global Quality Growth has an OCF of 1.04%.

ASI (Standard Life) International Trust

Third is ASI (Standard Life) International Trust, a £1.7bn portfolio run by Flavia Cheong.

Again, typical of the funds in this list it has a large-cap, growth focus. This is a style has rallied the past decade during the low interest, loose monetary policy environment that enabled growth’s outperformance.

It is invested in numerous mega-cap tech names, including Apple, Microsoft, Amazon, Facebook and Alphabet.

Launched in 1985, ASI (Standard Life) International Trust aims to deliver growth and some income over the medium term, outperforming the MSCI ex UK index over rolling five-year periods.

Over 10 years the fund had 83 positive and 37 negative months, with a maximum drawdown of 14.39%. From that it generated 272% total returns.

It has an OCF of 0.15% and a yield of 2.27%.

Fundsmith Equity

The well-known Fundsmith Equity also has 83 positive and 37 negative months. The giant of the equity space – it’s £27bn in size – is FE fundinfo Alpha Manager Terry Smith’s flagship portfolio.

Smith’s investment mantra is to buy good companies without overpaying, and then to simply ‘do nothing’ – a buy-and-hold strategy.

The 20-30 holdings will ideally be resilient to change, particularly technological evolution.

This is underpinned by a strict set of ‘values’ which include no hedging, trading, index hugging, shorting or debt used in the process.

Smith’s stock picking ability has seen him generate the fourth best total returns in the IA Global sector over 10 years, 483.8%. This was achieved with a maximum drawdown of 11.48%.

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

Holding an FE fundinfo Crown rating of five, Fundsmith Equity has an OCF of 1.06%.

BlackRock NURS II Overseas Equity

Next is BlackRock NURS II Overseas Equity.

The portfolio invests at least 70% in other investment funds, including ones run by BlackRock, gaining indirect exposure to shares. Currently the entire fund is invested in five BlackRock portfolios covering UK, North America, Europe, Pacific and Japan.

Run by Steve Walker since 2013, the fund has made 247.8% total return since 2011, experiencing 82 positive months and 38 negative months. It had a maximum drawdown of 15.36%.

It has an OCF of £240.9m.

iShares Global Water UCITS ETF

Like the above, iShares Global Water UCITS ETF had 82 positive months and 38 negative months and is run by BlackRock Asset Management.

The $2.7bn passive option tracks the S&P Global Water index, matching the performance of the 50 largest, global companies in water-related businesses.

More than half of the ETF’s exposure comes from the US but it does have global exposure across developed and emerging markets.

It has made a total return of 278.9% over 10 years with a maximum drawdown of 15.35%.

Its OCF is 0.65%.

BMO Responsible Global Equity

Back into active funds with the BMO Responsible Global Equity, which is managed with an environmental, social and government (ESG) focus. It was one of the first funds to apply a negative screening process.

Launched in 1987, BMO Responsible Global Equity was originally a purely negatively screening fund. This is still part of the process today but as one element of a more layered sustainable investment process.

Now, BMO Responsible Global Equity looks for opportunities within megatrends, such as ageing demographics, demands on healthcare systems, urbanisation and climate change. A key layer is engagement, where the BMO team aims to work with the companies it invests in to improve their practices to being more ESG focused.

Managers Jamie Jenkins and Nick Henderson have a concentrated portfolio of 40-60 stocks. They manage the risk profile by not taking super high convictions on individual stocks, rather having an active core of global equities that can achieve high-outperformance long term.

This has seen the fund generate 281.5% total returns in 10 years, translating to 81 positive and 39 negative months. This was achieved with a maximum drawdown of 14.12%.

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

It has an FE fundinfo Crown Rating of four and an OCF of 0.79%.

Fidelity Institutional Global Focus

Also with 81 positive months out of 120 was Fidelity Institutional Global Focus, a £107.m fund run by Aditya Shivram since the start of last month.

Shivram has continued the process of investing in global equities, unconstrained from the benchmark. These stocks are identified within macro themes and must have high conviction, high liquidity and a margin of safety in its valuation to make it into the fund.

Since 2011 it has made 265.7% total returns and a maximum drawdown of 14.82%.

It has an OCF of 0.92% and an FE fundinfo Crown rating of four.

Vontobel Asset Management S.A. Global Equity

Finally is FE fundinfo Alpha Manager Matthew Benkendorf and Iqbal Ramiz’s Vontobel Asset Management S.A. Global Equity fund.

The pair use a bottom-up approach investing in quality-growth. These types of stocks could benefit from the cyclical tailwind going on in markets, according to the managers.

Benkendorf and Ramiz have forecast the value rally that has dominated investment focus for months has largely “played out”, leaving the fundamental drivers of quality growth companies intact.

The $4.7bn fund made a total return of 274.2% over 10 years, experiencing 81 positive months and 39 negative, all with a maximum drawdown of 13.17%.

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

It has an OCF of 1.1% and an FE fundinfo Crown rating of four.