European financials, UK value and China are all “unloved” areas worth allocating to but they should also continue to back the likes of Terry Smith or Baillie Gifford, according to James Penny, UK chief investment officer at TAM Asset Management.

The past 14 months have been a rollercoaster for investors with both high-growth tech and healthcare stocks, as well as out-of-favour “value” stocks, leading the market at various points.

Markets are entering a “whole new world” Penny said, moving away from the growth, bull-run into a period of more uncertainty. To make the most of this, Penny said he has been increasing his allocations to three, less favoured markets, specifically China, UK value and European financials.

China

The Chinese equity market has taken a lot of hits recently after investors were shaken by the authorities’ new regulations on technology and education stocks, as well as a wider breakdown in the property sector, but Penny said now could be a good time to allocate to the region.

“When China has a good year it is not uncommon to see it do 45% in a year, I don’t even need it to do half that to do the job,” he said.

China has a lot going for it at the moment, he added. Authorities looking for positive PR this year have finished “ripping up the floorboards” on regulations in 2021.

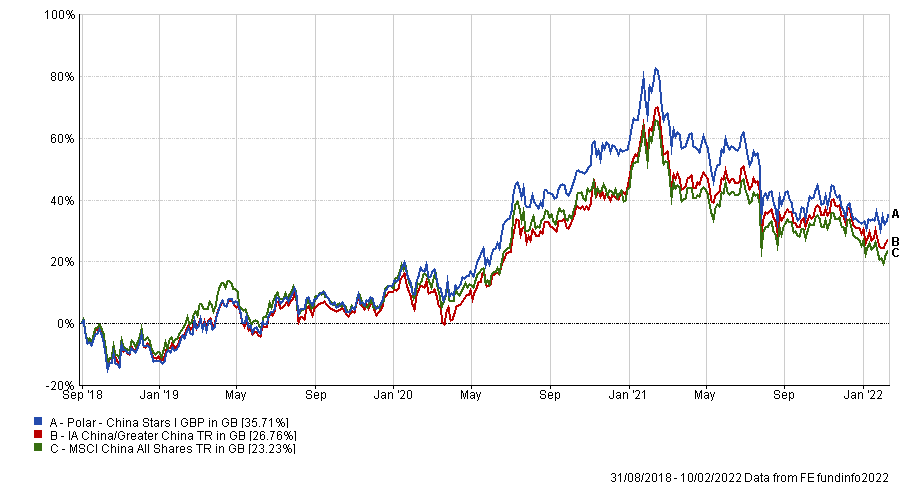

One fund he recommended was the Polar Capital China Stars portfolio, run by FE fundinfo Alpha Manager Jorry Rask Nøddekær and Jerry Wu. Since it launched the fund has beaten the average IA China/Greater China peer and its benchmark with a total return of 35.7%.

Performance of fund vs sector and index since launch

Source: FE Analytics

Another was Baillie Gifford China, which underperformed last year as its aggressive growth bias fell out of favour. Indeed, year-to-date it is down 5.1% but over the long-term the fund has been a strong performer, making the sector’s fifth-highest returns over 10 years (226.2%).

UK Value

Fund flow data for 2021 showed that, while investors were putting money to work in global equity markets, they were bypassing the UK – something they have done for several years.

However, as the market has rotated over past few months, old-economy stocks, such as banks, oils and mining sectors – which dominate UK large-caps – can still have their time in the sun.

“In January unless you had an overweight to miners and oil companies in your fund you underperformed because it was such a narrow market, in the UK especially,” Penny said.

The CIO added that he thought “the whole UK market is quite attractive”, but he was particularly focused on the value areas. “I think it’s going to be very interesting for them this year”, if the current dynamics persist he said.

Crux UK Special Situations was Penny’s fund pick here, “a fantastic, small- and mid-cap fund picker”.

“I think today a lot of the work in funds is done on Bloomberg and is done by screening 5,000 companies a second and I quite like the idea of an old school stock picker that understands balance sheets, which Crux do really well,” he said.

The fund takes a buy-and-hold approach, taking a 20-year view on strong UK brands, such as Rio Tinto, Aviva and Prudential, a strategy that has generated long-term outperformance. It has made 39.8% since it launched, more than doubling the returns from the IA UK All Companies sector (15.3%).

Performance of fund vs sector and index since launch

Source: FE Analytics

European financials

The final unloved area is European financials, an allocation Penny said was inspired by the US. American financials have done well but the sector faces a lot of negativity regarding banks’ bonuses, he said, so it is better to back Europe the “next horse in the race”.

Penny said the European Central Bank made financials a stronger play by “refusing to admit that there is any inflation in its economy.

“The moment they sound slightly hawkish you just watch European financials start popping, every single time.”

Here, Penny selected a passive option, the iShares MSCI Europe Financials Sector, which provides broad exposure to an entire theme while keeping the cost down.

Performance of the ETF vs sector since launch

Source: FE Analytics

“Passives are a necessity in portfolios,” Penny said. “They are a very useful and effective active management tool”, which he uses alongside his active allocations, such as Invesco European Equity.

Former winners

Higher levels of interest rates and inflation has been causing massive issues for the previous market leaders and Penny said “for a balanced manager it’s been wonderful to see that correction and see people who said that growth’s run would never end eat some humble pie.”

As a balanced fund manager, Penny said he had to resist going overweight on growth, making him underweight the US by default, “which has always been a pain trade for me”.

Given the structural headwinds facing the S&P 500 at the moment, Penny said it was not a farfetched conclusion “that the US probably might not be a great place to be this year”. But this could change very quickly if the US Federal Reserve reversed its monetary policy “which is becoming a serious concern”, Penny said.

“The market has accelerated to maximum hawkishness pricing in four rate hikes. Nobody has said this, everyone has just decided this. All you need is the oil price to stop rallying and CPI to come down and people to stop worrying about Omicron. Then the Fed could turn around and say inflation is coming off on its own we’re only doing two hikes,” he said.

If taking a balanced view, it is crucial for investors to maintain some exposure to developed market growth. “I've still got some super impressive growth funds that are just in case in case I’ve got it wrong,” Penny said.

“Terry Smith would be a very good ‘just in case’ manager”, along with Baillie Gifford American, which has been hammered in the recent rotation, he said.

| Name | Sector | Fund Size(m) | Fund Manager | Yield | OCF |

| Baillie Gifford American | IA North America | £4,399.20 | Gary Robinson, Tom Slater, Kirsty Gibson, Dave Bujnowski | 0.00% | 0.51% |

| Baillie Gifford China | IA China/Greater China | £507 | Mike Gush, Sophie Earnshaw, Roderick Snell | 0.11% | 0.76% |

| Invesco European Equity (UK) | IA Europe Excluding UK | £2,316.40 | John Surplice, James Rutland | 2.11% | 0.93% |

| iShares MSCI Europe Financials Sector UCITS ETF | Gbl ETF Equity - Financial | £718.20 | 0.18% | ||

| Polar China Stars | IA China/Greater China | £14.60 | Jerry Wu, Jorry Rask Nøddekær | 1.07% | |

| TM CRUX UK Special Situations | IA UK All Companies | £222.60 | Richard Penny | 1.50% | 0.83% |