Some 427 funds have direct exposure to Russian equities but investors in these portfolios should consider their positions, according to experts, after Russian president Vladimir Putin declared he was sanctioning a “special military operation" against Ukraine following weeks of growing tensions.

The global political response has been one of condemnation, with promises from the West to impose further, harsher sanctions against Russia.

Ursula von der Leyen, president of the European Commission, said its sanctions would “target strategic sectors of Russia’s economy”, and would include freezing Russian assets in the EU and halting access of Russian banks to the European financial market.

“This is designed to take a heavy toll on the Kremlin’s ability to finance war,” she said.

This military escalation sent markets into a freefall at the open, with European exchanges down the most. The FTSE 100 ended the day down 3.9% while the German DAX dropped 3.8% and French CAC 40 fell 3.9%. The S&P 500 was not immune, falling 0.9% at the time of writing. Gold and oil rallied though, with the latter breaking the $100 mark very quickly and the gold spot price jumping by more than 3%.

Falling markets can present a buying opportunity but experts have warned investors not to rush into the market that has fallen the most from the conflict: Russia. Indeed, Russian stocks fell 50% when trading reopened on the Moscow stock exchange today, the lowest level since 2016.

Russia represents a small portion of global and emerging markets, making up just 2.85% of the MSCI Emerging Market index, while the average global emerging market fund has around 3% direct exposure to Russia.

Although the allocation to Russia in these funds is small, it will still have a big impact and investors may wish to look at whether their funds are exposed.

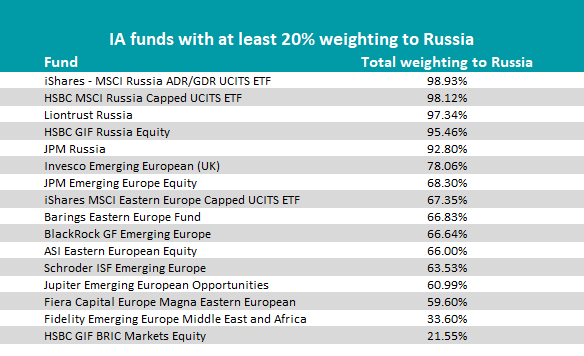

More directly, some 16 funds allocate more than 20% directly to Russian equities, six of which are dedicated Russian equity funds, as the below chart shows.

Source: FE Analytics

Ben Yearsley, co-founder of Fairview Investing, said “the traditional approach is ‘when the tanks roll in you buy’, but this situation is different because the economic sanctions are a key driver here.”

Jason Hollands, managing director of Bestinvest, seconded this stance, adding he would not be buying a country “which has sanctions ratcheting up against it”.

He added that any investor with a dominant allocation to Russia had already made their first mistake.

“You should recognize that there's a risk when you're investing in single country and emerging market funds, which is why you need a wider exposure,” Hollands said.

For those already invested in Russian equities Yearsley said they “might as well stay put”, since they have probably already seen the worst of the falls.

When asked if London-listed Russian equities were a good buy now, given that many of them were in rallying sectors like commodities and banks, Yearsley said they were not out of the woods yet.

“Their problem is that they might be listed here but their assets are in Russia so if they can get their money and assets out of Russia, who is going to be buying them? It’s all well and good being listed here but if its underlying assets and businesses are in Russia they’re going to struggle doing any kind of trading.”

Russian companies listed on the London Stock Exchange (LSE), including Sberbank, Gazprom, Rosneft and Lukoil, also sold-off dramatically when markets opened today.

Hollands said these stocks could even face being delisted from developed markets as part of the economic sanctions, but that is yet to be seen.

“I think it’s going to be a very painful period if you own those assets,” he said.

Even investors not directly invested in Russian equities have been unable to escape the financial consequences of the attack and Hollands warned against trying to be “too smart” now and start drastically shifting portfolio allocations during these volatile periods.

“Chopping and changing your portfolio in the middle of a lot of turbulence is about as risky as trying to change the engine on playing when it's still flying. At times like this, sometimes the best course of action is just to sit things out.”

He said there were two key implications for investors: a further dampening of sentiment and markedly higher energy prices.

Russia is one of the biggest global supply of oil and gas but after these attacks developed economies will be under pressure not to purchase from them. This will likely push energy prices up even further, above the generational highs facing consumers now, and will cause inflation to rise even more.

But Hollands said investors cannot expect a bailout of fiscal easing to help them, because central banks’ credibility is riding on them being able to tame these high levels of inflation.

“Right now you want to be in commodities and financials, because banks benefit from a rising rate environment.” This environment would put further pressure on growth stocks though, which have already struggled this year.