Bonds have roared back into popularity over the past year as rising interest rates have led to yields spiking. While this has been bad news for investors already in bonds (as the price has subsequently dropped), it means new investors can pick up attractive yields with potential for capital gains if central banks slow down monetary policy tightening.

Last year was an aberration from the previous decade, when central banks around the world spent years attempting to jumpstart low and slow economic growth by keeping rates low.

During this time, as much as 90% of the world’s bonds paid less than 1%, but now this has changed and the asset class is gaining traction among investors who had previously had to get creative to find low-risk returns.

James Penny, chief investment officer at TAM Asset Management, said investors may have to take very little risk when looking for bonds to balance out their equity portfolios.

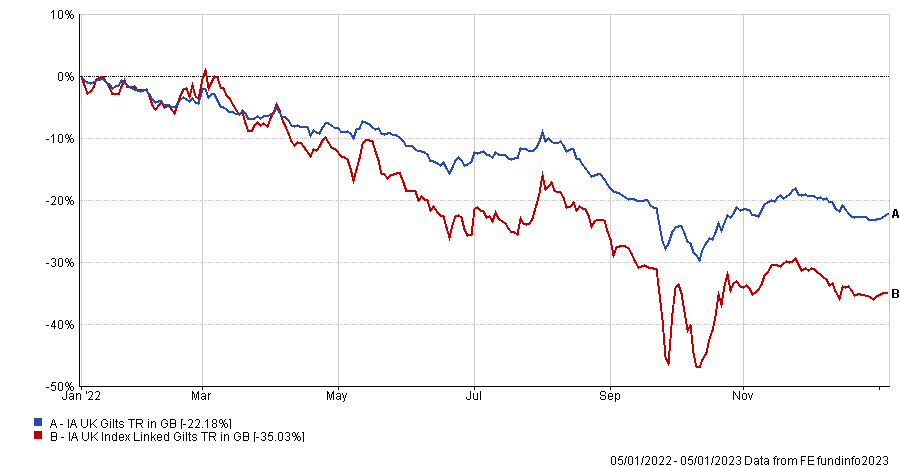

He highlighted the UK gilt market as one that could shine in 2022, despite it being a tough place to invest recently. Indeed, the average funds in the IA UK Gilts and IA UK Index Linked Gilts sectors are down 22.2% and 35% respectively over the past year.

Total return of sectors over 1yr

Source: FE Analytics

However, Penny said the market is much less likely to suffer the same volatility as it did following the ill-fated mini-Budget late last year.

“The Sunak government is trying to show investors the UK is a core developed market, with renewed stability. Importantly, there are still overseas buyers for UK debt, which remains essential to the government,” he said.

“While the UK recession looks to deeper than other nations, if Westminster can ensure stability, we could witness an improved economic trajectory in the UK, boosting prospects for the pound. Gilts may then start to behave more like bonds traditionally have behaved in a recession.”

Fatima Luis, senior portfolio manager at Mirabaud Asset Management, said investors could take on a bit more risk by looking at investment grade corporates, which are the ‘safest’ loans from companies with the highest credit rating.

“They are looking like the more attractive allocation choice over government bonds. We are seeing price action in the investment grade market more akin to what we would typically see for high yield corporates experiencing serious issues,” he said.

“For example, you can currently buy quality, A-rates names for about 60 cents on the dollar – representing a 40% discount to par. This is the type of price point you would expect to see in a default scenario – not for quality, stable debt. This price discrepancy is being driven by the move in rates rather than fundamental issues with the credit.”

For investors willing to take on even more risk, Simon Matthews, senior portfolio manager for non-investment grade credit at Neuberger Berman, said high yield is now an appealing option.

While investors will have to contend with defaults – the risk that a company is unable to pay back the interest or even the initial starting value of the loan – the rate at which this is happening remains historically low (although on the upswing).

“This is consistent with healthy balance sheets and positive free cash flow growth,” he said, noting that the outlook for 2023 is that default rates remain “below average”.

“Non-investment grade credit, especially given its lower duration profile and attractive yields, could continue to see investor demand as valuations remain very attractive on an absolute and relative basis. The yields are compensating investors for the below average default outlook and will continue to provide durable income,” said Matthews.

Not all high yield bonds are created equal however, according to Michael Della Vedova, portfolio manager of the T. Rowe Price Global High Income Bond fund.

He said that European high yield bonds are more attractive than their US counterparts, for example, despite the former’s likely recession and geopolitical tensions.

“While Europe’s economy could suffer a deeper slowdown than its peers, the European high yield market should benefit from having less exposure than the US to cyclical markets,” he said.

Total return of sectors over 1yr

Source: FE Analytics

Indeed, in the US just 52.3% of high yield companies are rated BB (the highest within the bucket), while this rises to 70.7% for European firms. Similarly, fewer are rated CCC or below (the lowest grade) in Europe (5.5%), compared with their US rivals (11.1%).

“Furthermore, Europe’s market is younger and less mature than the US, meaning it potentially offers more opportunities for price and information discovery,” he said.

Turning to specialist areas, Thede Rüst, head of emerging markets debt at Nordea Asset Management, said emerging market corporate bonds look good heading into 2023, particularly in Latin America – a region that has boomed over the past 12 months as commodity prices have soared.

“Corporates from Latin America are particularly appealing, given the region has very little direct exposure to current geopolitical risks,” he said. “In addition, countries like Brazil have deep local markets, which issuers can tap as an alternative source of liquidity.”

Meanwhile, Tony Carter, fixed income fund manager at Sarasin & Partners, suggested investors look at Additional Tier 1 (AT1) bank debt, which has sold off heavily over the past year, but have – and may continue – to perform if US inflation data remains lower than expected.

“We favour bonds with high fixed coupons (8%+) for the first few years, which reset to a widespread over swaps/treasuries in the relatively unlikely event the issuing banks do not call them at the first opportunity. Also, real yields of circa 1.5% on five-year TIPS look like good value. These instruments are well-insulated against any resumption of the sell-off next year,” he said.