The past three years have given investors plenty to contend with but there are a few global equity funds that have beaten their peers on a wide range of metrics, Trustnet research shows.

The Covid-19 lockdown of 2020, 2021’s re-opening rally and 2022’s inflationary shock have put markets on a rollercoaster ride in recent years, causing many formerly top funds to fall down the performance tables.

In this study, Trustnet looked for IA Global funds that have been at the top of their peer group for total returns in recent years but also a range of closely watched risk metrics.

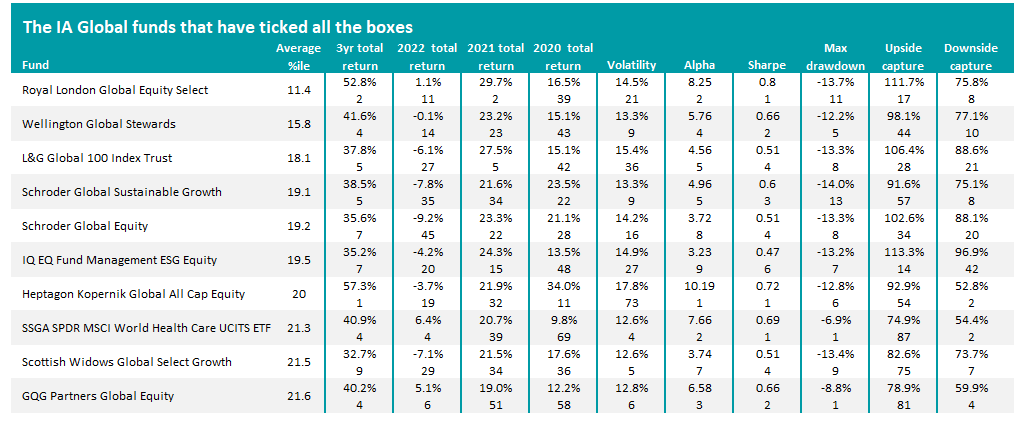

In order to identify outperformance on a broad range of measures, we worked out an average percentile score for each fund’s cumulative total returns, volatility, alpha, Sharpe ratio, maximum drawdown, upside capture and downside capture over the past three years, as well as returns in each of 2022, 2021 and 2020.

The most common benchmark for the sector was used for all of the funds (in the case of the IA Global sector, that’s the MSCI AC World index) and the lower the average percentile, the better the fund has performed overall.

After running the numbers, Trustnet found Royal London Global Equity Select was the IA Global fund that has ticked the most boxes for investors over recent years. Managed by James Clarke, Will Kenney and Peter Rutter, the £762m fund has an average percentile of just 11.4 across the 10 metrics looked at in this research.

Total return of Royal London Global Equity Select vs sector and index over 3yrs to end of 2022

Source: FE Analytics

It has made a 52.8% total return over the past three years – a second percentile result and the seventh highest return in the peer group. As would be expected, it is in upper percentiles of the sector for pretty much all metrics; its worst ranking is thanks to its 16.5% return in 2020 (39th percentile) and its best is a first percentile Sharpe ratio.

While some funds are managed with growth or value investing approaches, Royal London Global Equity Select aims to be relatively neutral when it comes to style – something that may have helped in the past three years when the market has been rotating between growth and value.

Wellington Global Stewards came in second place with an average percentile score of 15.8, driving by strong numbers for its three-year returns, volatility, alpha, Sharpe and maximum drawdown.

Fund managers Mark Mandel and Yolanda Courtines look for companies that generate high return on capital and whose management teams and boards display “exemplary stewardship” to sustain those returns. They define ‘stewardship’ as balancing the interests of customers, employees, communities and the supply chain in the pursuit of profits as well as incorporating environmental, social and governance (ESG) into corporate strategy.

An index tracker - L&G Global 100 Index Trust – is the third best IA Global fund across the metrics we looked. The 10 funds with the best average percentiles across the 10 metrics can be found in the table below (the upper row for each fund shows the actual result for the metric, while the lower row is the percentile ranking).

Source: FE Analytics

Many of the biggest and best-known funds aren’t featured in the table above, so where did they end up?

Fundsmith Equity, which is the bigger active fund in the IA Global sector, is ranked 122nd out of 429 funds in this research, owing to a 37.9 average percentile score. The £25bn fund has generated very strong long-term numbers but is now mid-table over three years after the market rotation away from its preferred growth stocks has dragged on recent returns.

Well-known growth funds such as Lindsell Train Global Equity (ranked 277th with an average percentile of 56) and Rathbone Global Opportunities (ranked 235th with an average percentile of 50.9) have come out worse than Fundsmith Equity in this study.

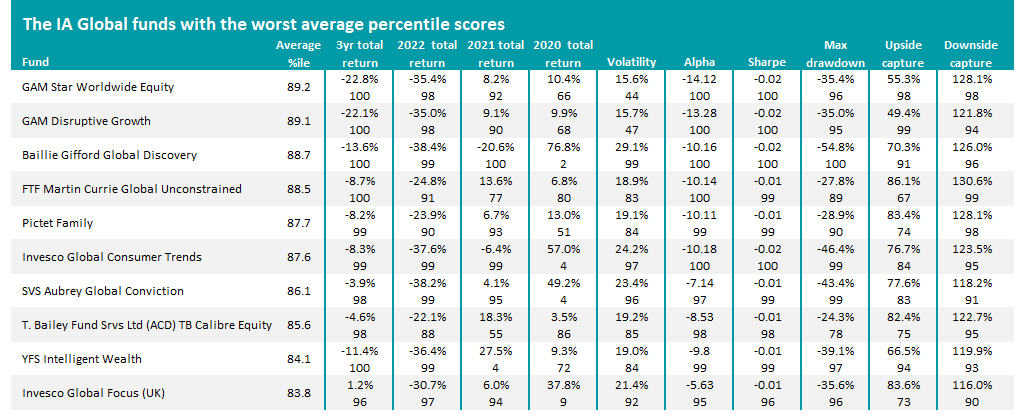

The worst funds in this research, however, are those that leaned heavily into growth stocks in the US tech space, as can be seen from some of the funds in the below table.

Source: FE Analytics

While US tech had led the market for an extended period, it was one of the hardest hit areas when leadership shifted away from the growth style and investors looked for companies more likely to pay out in the near term.