The chair of the Baillie Gifford’s Scottish Mortgage Investment Trust, Fiona McBain, will step down from her role this year as part of a board reshuffle.

Justin Dowley, the current senior independent director, will succeed her from the conclusion of the 2023 annual general meeting.

This announcement follows a clash at a board meeting last week between McBain and one of the non-executive directors, Amar Bhidé, who has also left the board, according to regulatory filings this morning.

Among his critiques, Bhidé highlighted that McBain has been part of the Scottish Mortgage trust’s board since 2009, which would be in breach of the UK Corporate Governance code for a UK company, but as an investment trust Scottish Mortgage falls under the auspices of the Association of Investment Companies (AIC), which does not have time limits on board members in place.

Analysts at Numis Securities welcomed McBain’s resignation, stating that it is generally “best practice” to have an active board refreshment programme. Yet, it pointed out at the fact Dowley has already been on the Scottish Mortgage Trust’s board for eight years.

They said: “The company will need to continue to explain the long tenure of its chair.

“The announcement appears somewhat reactionary to last week’s press comments by Professor Bhidé, although one of the issues he raised was around the appointment of new board members, which highlights, as indicated by the board, that this process must have been ongoing.”

The Financial Times also reported Bhidé and McBain had a disagreement over the appointment of two new board members and on the company’s investments in unquoted businesses.

This is because he does not believe the trust has the capabilities and governance clout to be monitor illiquid investments that have little audited information in the public sphere. He said that the trust has been able to manage this feat over the past 10 years thanks to an “utterly aberrant period in financial history”.

Reacting to this comment, Numis’ analysts said: “We believe that suitable resourcing to be able to cope with unquoted investments is certainly a key focus for investors, and we have been asking about this for several years. Significantly, we believe that the nature of Scottish Mortgage’s private investments means that it does not need replicate the teams required at venture capital/private equity firms.

“Scottish Mortgage typically invests at a stage when companies are no longer looking for operational support provided by venture capital firms, and instead are looking for long-term partners to fund the growth of their businesses. Scottish Mortgage/Baillie takes minority stakes, rather than the venture capital approach of taking majority positions and getting heavily involved in operational management and strategy of the companies.”

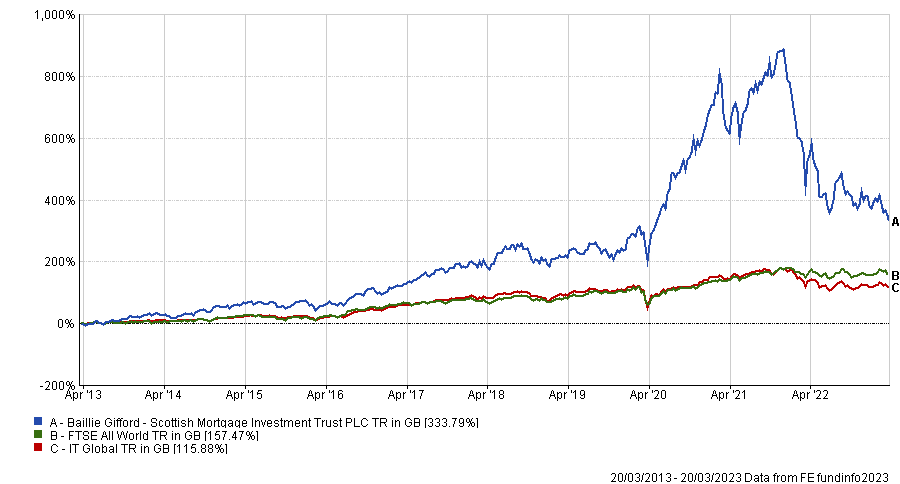

The trust has been the best performer in the IT Global sector over the past decade, up 333.8% over 10 years.

Total return of fund vs sector and benchmark over 10yrs

Source: FE Analytics

However, it has suffered in the short term. Over the past 12 months it is down 33.8% and lost 45.7% in 2022 alone – the worst in its sector.

The £9.3bn trust is managed by FE fundinfo Alpha Manager Tom Slater and deputy Lawrence Burns, who took over from veteran star manager James Anderson upon his retirement in April 2022.