Commentators have been quick to call the end of the 60/40 portfolio, but adding alternative assets might not bring huge benefits, data by Trustnet has found.

A traditional balanced portfolio is 60% invested in equities and 40% in bonds, providing investors with strong diversification, with the fixed income portion expected to rise when stocks fall, and vice versa.

Many have challenged this negative correlation in recent weeks, however, as there is concern that bonds and equities have moved in tandem for too long.

David Hollis, the upcoming manager of the Artemis Strategic Assets fund, told Trustnet that the new rising interest rate environment spells trouble for the strategy.

Vivek Paul, head of portfolio research and UK chief investment strategist for the BlackRock Investment Institute, agreed, stating: “In the new regime characterised by higher volatility, higher inflation and supply constraints, bonds won’t work as well as a portfolio ballast compared to during the Great Moderation. Portfolios need to be built differently.”

Vanguard multi-asset product specialist Mohneet Dhir disagreed, noting that the traditional allocation hinges on investors accepting the trade-off between risk and reward, and appreciating the historical characteristics of different types of investment.

“It would be remiss not to acknowledge the double fall of both stock and bond markets in 2022, but occasionally this can happen before the negative return correlation between equities and bonds reasserts itself. Indeed, global bond prices rose in the first half of March as global equities sold-off,” he said.

For investors that do want to make a change to their portfolio and add more diversification, we looked at some of the most popular alternative asset classes to see if their addition was worth it over the long term.

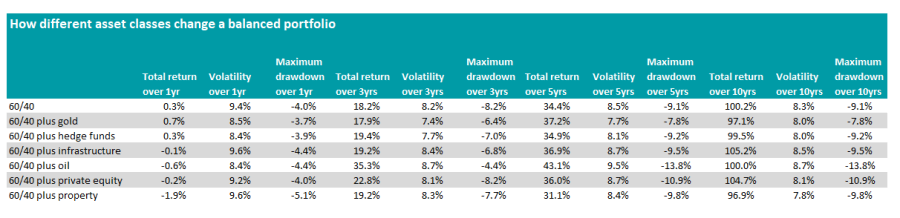

The answer depends on whether investors want to dampen their risk, or boost returns. In the below table, we have shown the returns made by a 60/40 portfolio, which is represented by the MSCI World and Bloomberg Global Aggregate index respectively.

We have included total returns over one, three five and 10 years, as well as the maximum drawdown and volatility for each time period.

Over a decade, the portfolio has doubled investors’ money, up 100.2%, with volatility of 8.3% and a maximum drawdown – the most an investor would have lost over consecutive months – of 9.1%.

Source: FE Analytics

The best addition to a portfolio would have been infrastructure, which is represented by the FTSE Developed Core Infrastructure index.

It would have added 5 percentage points over the decade, and is the only asset that would have been a net gainer over three, five and 10 years.

The other asset class to add value to the portfolio over 10 years was private equity, measured by the IT Private Equity sector average, as no benchmark index was applicable.

Here, investors would have made 4.5 percentage points more over the decade and volatility would have been lower, although the biggest consecutive fall of 10.9% is slightly more.

Oil was the most volatile addition and would have given investors the biggest maximum drawdown, with returns in-line with the 60/40 portfolio.

However, the picture changes when adding the S&P GSCI Brent Crude Spot in more recent years. Oil has surged over the past few years as Covid and then the war between Russia and Ukraine has disrupted supply chains and caused the price to spike.

Over three years, a 10% position would have almost doubled the return of the traditional 60/40 portfolio (35.3% versus 18.2%), the best on the list.

The worst addition is over 10 years property, represented her by the IT UK Commercial Property sector. Overall investors would have been 3.2 percentage points worst off, although volatility would have been significantly dampened. At 7.8%, this is the least volatile strategy, the data shows.

Adding a 10% position to gold and reducing the exposure to equities and bonds commensurately, represented by the S&P GSCI Gold Spot, would have netted investors 97.1% over the decade, less than the traditional portfolio, although the maximum drawdown was the lowest on the list at 7.8%.

However, over the past year it would have been the best thing to own, more than doubling the meagre returns of 0.31% offered by a 60/40 portfolio and also topping the charts over five years.

Lastly, the addition of the HFRI Fund Weighted Composite index to represent hedge funds would have also reduced the volatility (8% over 10 years), but reduced returns slightly (99.5%).