Rathbones head of multi-asset investment David Coombs has been buying gilts “aggressively” as yields rise to attractive levels.

Gilts typically made up a small portion of the Rathbone Multi-Asset and Rathbone Greenbank Portfolio funds that Coombs manages, but he has ramped up exposure from 0.8% to 4.7% over the past year.

“We started buying gilts quite aggressively for the first time in a while,” he said. “We’ve dipped our toe from time to time but we've really taken some meaningful positions this time.

“You're getting paid in absolute terms for being in the bond market for the first time in about 10 to 15 years, so that's been a big shift .”

Coombs held 13.1% of his funds in cash on average over the past five years, but he sliced that down to 3.7% as he began spending on fixed income assets.

“We've been taking cash down quite drastically – we’re down to about 2% in our medium risk fund, which is the lowest it's been in a long, long time,” he said.

“That's telling you that we think you're getting rewarded for taking risk. We haven't really changed our equity position, so it's really been moving into gilts and selectively a bit of credit.”

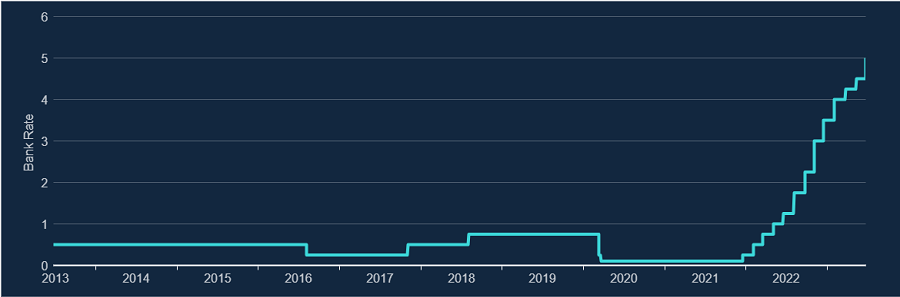

The Bank of England raised interest rates in the UK to 5% last week, creating a potentially attractive entry point for investors to buy gilts.

Base rate over the past 10 years

Source: Bank of England

Their price is heavily dependant on base rates, so a high starting point means there is a higher chance that its value will have risen when investors cash out at the end of its duration, hence Coombs’ buying spree.

“It’s a really significant move for us,” he explained. “I don't think we've been that low in cash for about 10 years because you had no bond returns.

“We were holding cash because we didn't want duration risk. I can’t remember the last time we had this much duration risk in the portfolio - we had none last year.”

Coombs started off by mostly buying short-dated bonds over one to two years, which were offering yields of around 4.5% to 5% due to the inverted yield curve. As the year moved on and those gilts matured, he began buying gilts with longer durations of 10 to 30 years.

“We still hold the short-dated stuff while we wait for the maturity to run off because it’s a decent return,” Coombs said. “As the short stuff runs off, we’re constantly recycling that into longer duration.”

Monetary policy and the wider economic backdrop have played a pivotal role in fixed income markets, but Coombs doesn’t think the risk of a recession would be as bad as most people think.

“I'm probably more optimistic than many than most at the moment,” he said. “I'm starting to feel that the risk of global recession is receding.

“The market got so fixated on the recession story. Every economist and strategist was positioning for recession and that immediately makes me nervous because when consensus is so consensual, it's often wrong.”

He noted that high employment, resilient corporate earnings and falling inflation are among some of the key aspects of the economy that make him optimistic.

Whilst fixed income markets have presented some appealing opportunities, Coombs wants to maintain exposure to equities.

Some investors have gone too far in fortifying their portfolios, cutting equity exposure down to a few defensive sectors that won’t perform well in all market conditions.

“It takes a brave person to go underweight risk on equities at the moment,” Coombs said. “A lot of people are hiding in defensive names that have performed poorly this year. If I was holding them, I’d be really nervous.

“There's a lot of mixed signals coming from the data and that makes me want to stay fully invested in equities, but by buying more duration, at least I've now got more in the portfolio if that risk of recession does come through.”

If or when a recession comes, its impact on equities is unlikely to be as negative as the market currently forecasts, according to Coombs.

He reduced positions in companies such as Microsoft and Nvidia this year over fears that hype around artificial intelligence has over-inflated share prices, but a recession is unlikely to leave a long-term mark on most companies.

“A two-quarter recession at -0.2 isn’t brilliant, but nor is it disastrous for those companies that have got significant monopolistic earnings potential and long-term growth drivers,” Coombs said.

“Sure, you'll get some share price volatility but that’s not really going to touch the sides to sentiment Are two negative quarters of growth going to destroy Alphabet?”

Nevertheless, Coombs said that having a higher allocation to gilts across his funds now makes him “more comfortable with [the] equity positions” if a recession is worse than expected.

When it comes to bond markets, Capital Group fixed income investment director Edward Harrold said having a global scope helps.

Different economies around the world are at different stages in their hiking cycle, with many central banks in emerging markets putting on pressure early and already getting on top of inflation.

Harrold – who has no exposure to gilts – said it is worth looking globally to find fixed income opportunities that best suit investors’ needs.

“UK inflation remains significantly above the Bank of England’s target rate of 2% and the market currently expects further hikes through 2023 and 2024,” he said.

“Diversifying exposure across different markets allows investors access to this variation and means portfolio positioning can be tilted toward those markets where the macroeconomic environment is more favourable to fixed income.”