Reducing the number of holdings in the trust was one of the first tasks that Zehrid Osmani undertook when he became the manager of the Martin Currie Global Portfolio trust in July 2018.

When Osmani joined, the trust held around 50 stocks, a number that has been gradually cut down to 29. He explained that he sees more merit on focusing on the best ideas and getting rid of low conviction stocks.

Osmani said: “A typical fund manager will have 45 to 55 stocks in their portfolio and will believe very strongly in the first 20 to 25 stocks. The next 10 to 15 stocks are those that are getting closer to price target which means the conviction is lower by definition.

“The last 10 to 15 stocks tend to be stocks where the fund manager does not have strong views, they are just there to reduce risk by being closer to the benchmark. Our approach is to cut that tail.”

However, a more concentrated portfolio involves more risk and volatility. Over five years, the trust sits in the third quartile of the IT Global sector in terms of downside risk and in the second quartile in terms of volatility.

While Osmani acknowledged the higher volatility and potential risks, he said that a concentrated approach creates more value over the long term.

He said: “We believe that stock indices struggle to create value and can even destroy value for shareholders. On the short-term, a more concentrated portfolio will be more volatile, but if our research is done efficiently and we are able to pick businesses that can create value and compound over time, our returns will outperform the index.”

Performance of trust vs sector and benchmark over 5yrs

Source: FE Analytics

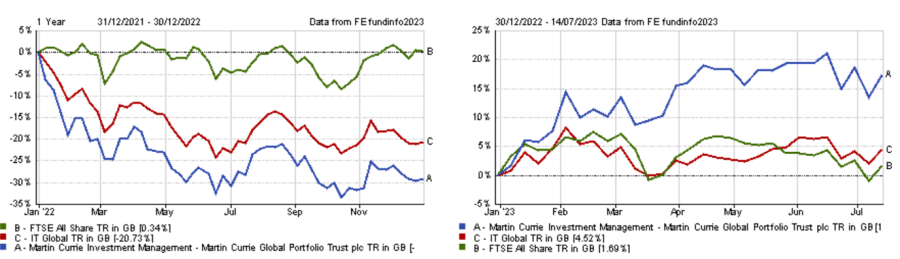

So far, this new strategy has paid off. While the trust sits in the third quartile of the IT Global sector over 10 years, it improved to top quartile over five years, despite underperforming both its sector and benchmark in 2022.

Nicholas Todd, investment trust research analyst at Kepler, said: “This approach was a headwind to performance in 2022, but Osmani has come back strongly in 2023, outperforming now over one year and improving the long-term track record. A large holding in Nvidia would have been a big contributor to this.”

Performance of trust vs sector and benchmark in 2022 and YTD

Source: FE Analytics

Andrew Courtney, analyst at QuotedData, added that the fund’s balanced, quality-growth strategy should “hold it in good stead” going forward.

A more concentrated portfolio is not the only change the trust has been through over the past five years. The board introduced a commitment to structural gearing at the end of 2020 to make a better use of the investment trust structure.

Osmani said: “The reason we think it's an opportunity to have a structural gearing is the assumption that markets will perform positively over the long term.

“In addition, we believe that we can pick superior businesses with more upside potential. Therefore, gearing into our stocks is beneficial to shareholders.”

In a note published in March, Kepler’s Todd wrote that a macro-environment unfavourable to growth would be challenging for the trust and the commitment to gearing could amplify losses. However, he added that a change in economic conditions could lead to a sharp rebound.

When it comes to stock selection, the trust has a sizeable underweight to the US and does not hold any of the FAANGs – Facebook (now Meta), Amazon Apple, Netflix and Google (now Alphabet).

Osmani said: “It's a combination of a lack of valuation attraction for names like Apple and concerns in some of the fundamental assessments. With Meta, we have concerns around the lack of growth as well as regulatory risks.

“In the case of Netflix, it's the competitive pressures. There is a race for content, which is likely to lead to inflationary trends for content which is detrimental for returns. As for Alphabet, it's related to a combination of regulatory threats and valuation.”

The trust also has no direct exposure to China, the fourth largest constituent of its benchmark. Osmani said that he has been reducing the trust’s direct exposure to the second largest economy over the past 24 months as a result of the government’s clamp down on tech businesses and geopolitical uncertainties.