Abrdn is to fold former darling Global Absolute Return Strategies, known as GARS, into its diversified asset funds after years of lacklustre performance.

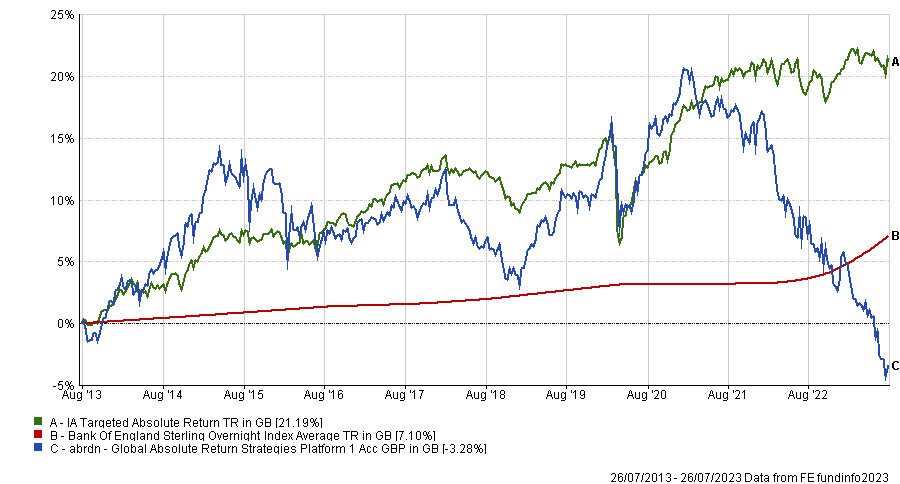

The fallen giant launched in 2008 was originally designed to perform well when equities were performing poorly, but the strategy had been haemorrhaging money for the greater part of the past decade, as shown in the chart below.

At the peak of its fame in May 2016, assets under management (AUM) reached £26.8bn, making it the largest fund in the UK and abrdn’s showpiece. Today it has just £857m.

Performance of fund over 10yrs against sector and index

Source: FE Analytics

Abrdn’s head of multi-asset and alternative investment solutions Russell Barlow, who led a strategic review on the fund, made this decision to simplify the multi-asset offering.

“My focus during the strategic review was to clarify roles, reduce inefficiency and increase collaboration ensuring we deliver the best outcomes possible for our clients,” he said.

“The new structure simplifies our processes and facilitates a greater comparison of opportunities across asset classes rather than being focused on research within single asset classes and products. I'm confident this approach is best suited to the needs of our clients in delivering strong performance outcomes across a more relevant product range.”

He was echoed by Peter Branner, CIO of abrdn, who praised Russell’s “thorough job” of creating an offering “that will enable us to work together to bring the results our clients need today whilst being ready for the challenges of the future”.

The fund had been struggling for some time, particularly since its founder, Euan Munro abandoned left the firm (formerly Standard Life) to join Aviva Investors as chief executive in 2013.

Richard Batty, Dave Jubb and David Millar – also former managers of GARS – had also left the previous year to create Invesco’s multi-asset team.

Munro was replaced with his own hire Guy Stern, who stayed in charge until 2018, and later with Aymeric Forest, who took over before resigning earlier this year when the strategic review into the fund was announced.